米国:レアアースの80%を中国に依存:Warrior Maven(動画):

USA: 80% of rare earths depend on China: Warrior Maven:

美国:80%的稀土依赖中国:Warrior Maven

2022年1月30日、

米華字メディア

多維新聞米国は中国に対するレアアース依存を減らすべきだ。

米メディアの紹介する記事を掲載した。

米ウェブメディア

Warrior Maven1月19日、グラント・アンダーソン氏による

「レアアース―米国の国防と宇宙の大きな要素」と題した文章掲載された。

中国で昨年12月、「新たにレアアース大型国有企業が生まれる」との情報が流れた。

- 中国がレアアース企業間競争を減らし、

- 国際市場における価格決定権を獲得し、

- 世界のレアアースサプライ掌握権を一層強化する。

レアアースを中国に依存:

かつてレアアース生産大国だった米国。

今や80%のレアアースを中国に依存している。

31種類を中国に依存:

米国政府が国の安全に不可欠な鉱産資源。

35種類の鉱産資源のうち、31種類を中国に極度に依存していると米国政府が発表した。

https://www.recordchina.co.jp/b888816-s25-c20-d0193.html

Rare Earths – Key Elements to American Defense and Space

Warrior Maven: Center for Military Modernization

Guest Post: Grant Anderson P.E. is the President & CEO of Paragon Space Development Corporation,

a recognized leader in life support and thermal control in extreme environments.

He holds a B.S. in Mechanical Engineering and an M.S. in Aeronautical & Astronautical Engineering from Stanford University.

In early December of 2021,

news brokeindicating that

China is set to create a new State-owned mega-company focused on the rare earth element (REE) market space– an industry that is already dominated by the Chinese.

This company will be

formed through the consolidation of several other existing rare earth companies in China.Based in Jiangxi,

it will be called China Rare Earth Group.Such a move would reportedly

help China further strengthen its hold on the global REE supply chain by reducing discrepancies between Chinese firms and establishing pricing leverage over global competition.This is a dynamic that should be highly concerning to policy-makers in Washington DC,

particularly in the wake of ongoing supply chain issues across an array of goods and materials

– especially those directly tied to China – and the importance of REE’s to national security.At the same time and for the same reasons, the private sector should also be increasingly concerned about this issue. And as the U.S.

seeks to expand our presence in space, and as we develop new technologies to advance that effort, this news should be of interest to companies in the new space economy as well.

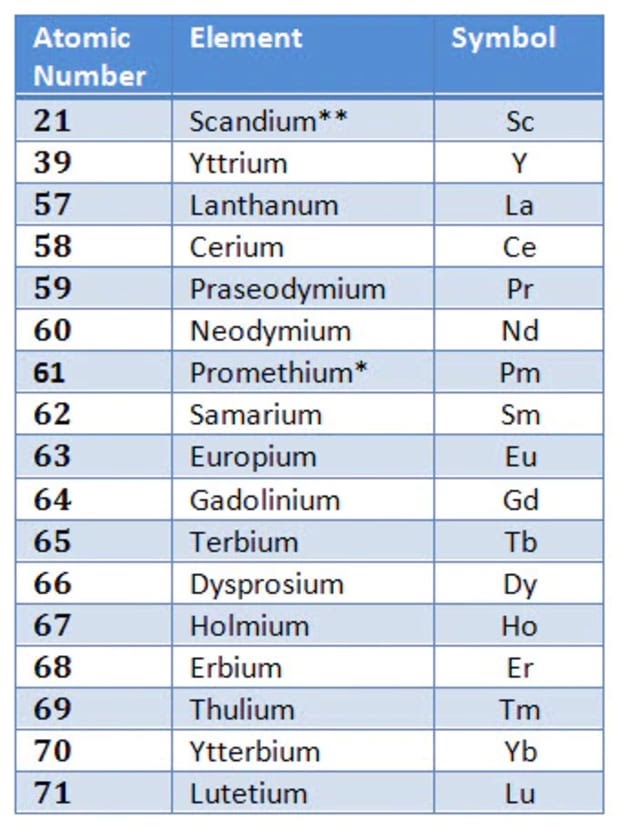

REE’s consist of 17 specific elements and are used for a wide variety of applications

– everything from

batteries,

cell phones,

semiconductors,

computers, and cameras, to petroleum refining and steel production.[1] REEs are also critical to the manufacture of national defense and space technologies as well; REEs are used in

magnets on aircraft,

for missile guidance control systems,

lasers,

satellite communications,

and radar and sonar systems.[2] They are also used in night-vision systems and stealth technology.

[3] And while REEs may not actually be that rare, they are disparately located and difficult to extract for both technical and regulatory (at least in the west) reasons.

Disconcertingly,

the U.S. is now dependent on China for 80% of our REE uses and needs[4] – even though like many other industries, we once led the world’s production of rare earth minerals.

[5] In fact, according to a recent Congressional Research Service (CRS) report, in 2019, “the United States imported 100% of rare earth metals and compounds it consumed, even though it exported some domestically mined rare earth element concentrate for further processing (due in part to a lack of domestic processing facilities).”

[6]Moreover, the U.S. relies on China for a great portion of 31 of 35 REEs that have been declared by the U.S. government to be indispensable to national security

– and – sources indicate that 14 of those specific elements are not found in the U.S.

China’s Monopoly

There is some variance regarding just how much the Chinese dominate the global REE trade

– but regardless of estimation or source, the plain fact is that China is the heavyweight player in this space.

And with this latest news about Chinese industry consolidation,

it would appear that China doesn’t seem interested in relinquishing their control over the REE market.

The fears about China’s monopoly on REEs often focus on continued supply chain access

in case of hostilities, or the potential for China to deliberately restrict rare earth mineral supply to the U.S.,

either as a provocative, retaliatory, or competitive action.

Given the problems of our overdependence on China for other key products that have emerged in the ongoing COVID-19 pandemic,

enduring concerns about Chinese dominance of REEs are not unfounded.

Warrior Maven