米McDermott:破産法11条、適用申請発表:28億ドル、DIPファイナンス(動画):

McDermott:Bankruptcy Law Article 11:$2.8Billion、DIP Finance:

McDermott:《破产法》第11条,申请人申请公告:28亿美元,DIP Finance

McDermott:破産法11条申請

米国エネルギー関連エンジニアリング大手のマクダーモット・インターナショナル(テキサス州ヒューストン市)が、

1月21日、破産法11条に基づく再建手続き申し立てを行うと発表しました。

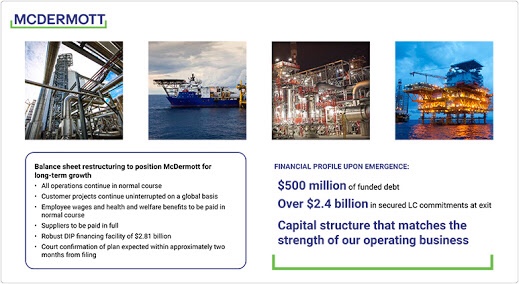

同社は、以下の再建手続きを通じて、46億ドル以上の債務を解消し再建を行います。

再建手続き:46億ドル債務の解消

- 「固定負債/債権者の内、3分の2」が、財務再建を支援します。

- 信用状および5億ドルの固定負債によるほぼ全ての固定負債の平準化。

1月21日から開始される破産法11条を通じ、28億1,000万ドルのDIPファイナンス(Debtor-in Possession Finance:旧経営陣に経営を任せつつ、新たな資金を提供する金融手法)により再建を実施します。

- 請負プロジェクト/全オペレーションは、シームレスに通常どおり続行。

- 全てのサプライヤーへの全額支払いを再建計画に規定。

- Lummus Technology(CB&Iの1部門)をチャテジー・グループ/ローヌ・グループに、27億2,500万ドルで売却。

千代田化工建設:共同プロジェクトへの影響

とりわけ注目されるのは、

「既に受注したプロジェクトの継続的実施」と、「サプライヤーへの全額支払い」の旨が明記されていることです。

同社はテキサス州のフリーポートやゴールデンパス、ルイジアナ州のキャメロンなどの天然ガス液化施設を千代田化工建設の米国法人とともに建設している(2019年8月22日記事参照)。

McDermott:直近の株価

同社の株価は、2018年3月前半までは20ドル台で安定していました。

2017年12月、米国エンジニアリング大手CB&Iを、買収(買収額は約60億ドル)しました。

2018年9月、急激に株価が下落、11月以降株価が、10ドルを下回り。

2019年11月以降は、1ドルを下回る状態。

この原因は、「買収およびキャメロンなどの大型プロジェクトにおける損失計上にある」とみられる。

今回の再建手続き申し立てに伴い、10日以内にニューヨーク証券取引所/上場廃止の見込み。

なお、同社のCB&I買収発表以降の経緯は添付資料のとおり。

– ジェトロ

https://www.jetro.go.jp/biznews/2020/01/20b9449329b95e07.html

McDermott – McDermott International, Inc. Announces Comprehensive Prepackaged Restructuring Transaction to De-Lever Balance Sheet and Immediately Position Company for Long-Term Growth

McDermott files for Chapter 11 – Splash 247

https://splash247.com/mcdermott-files-for-chapter-11/

マクダーモット、破産法11条申請前に融資交渉-関係者 – Bloomberg

https://www.bloomberg.co.jp/news/articles/2019-12-31/Q3CQB4T1UM0Y01