McDermott: Bankruptcy Law Article 11, Applicant Application Announcement: $ 2.8 Billion, DIP Finance

McDermott: Bankruptcy Law Article 11 Filing

McDermott International (Houston, Texas), a major US energy engineering company,

On January 21, it was announced that it would file a petition for reconstruction under Article 11 of the Bankruptcy Law.

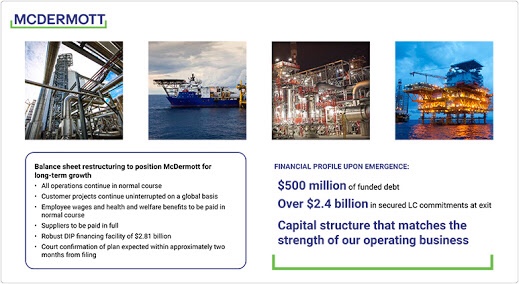

The company will resolve and restructure more than $ 4.6 billion of debt through the following restructuring procedures:

Reconstruction Procedure: Eliminate $ 4.6 Billion Debt

“Two-thirds of fixed liabilities / creditors” will support financial reconstruction.

Leveling almost all non-current liabilities with letters of credit and $ 500 million in non-current liabilities.

Restructuring with $ 2.81 billion in DIP financing (Debtor-in Possession Finance), a new banking financing method that will take over management from former management through Article 11 of the Bankruptcy Code, which will begin on January 21. Implement.

Contracted projects / all operations continue seamlessly as normal.

Full payment to all suppliers is stipulated in the reconstruction plan.

Sold Lummus Technology (a division of CB & I) to Chattery Group / Rhone Group for $ 2.725 billion.

Chiyoda Corporation: Impact on Joint Projects

Most notably,

It clearly states “continuous implementation of projects already received” and “payment in full to suppliers”.

The company has built natural gas liquefaction facilities, including Freeport and Golden Pass in Texas and Cameron in Louisiana, with a U.S. subsidiary of Chiyoda Corporation (see article August 22, 2019).

McDermott: Recent Stock Price

Until the first half of March 2018, the company’s stock price was stable in the $ 20 range.

In December 2017, we acquired US engineering giant CB & I (acquisition value of approximately $ 6 billion).

In September 2018, the stock price dropped sharply, and since November it has fallen below $ 10.

After November 2019, it is below $ 1.

The reason is believed to be “accounting for losses in acquisitions and large projects such as Cameron.”

It is expected that the New York Stock Exchange / Delisting will be delisted within 10 days following this reorganization petition.

The details since the announcement of the company’s acquisition of CB & I are shown in the attached materials.

-JETRO

https://www.jetro.go.jp/biznews/2020/01/20b9449329b95e07.html

McDermott – McDermott International, Inc. Announces Comprehensive Prepackaged Restructuring Transaction to De-Lever Balance Sheet and Immediately Position Company for Long-Term Growth

McDermott files for Chapter 11 – Splash 247

https://splash247.com/mcdermott-files-for-chapter-11/

McDermott negotiates loan before Bankruptcy Law Article 11 filing-sources-Bloomberg

https://www.bloomberg.co.jp/news/articles/2019-12-31/Q3CQB4T1UM0Y01