Chinese EVs: Confronting European brands

– Challenges of BYD, NIO and SAIC –

ーRising transportation costs in China, weak brand powerー

We will deliver a summary from the article published in hisayoshi-katsumata-worldview.

Chinese EV wall:

China-made EVs are hitting a high wall in Europe.

Reality is never so sweet.

“High transportation costs from China and weak brand power.”

Popularity of EVs made in China:

The name recognition of Chinese EVs is extremely low.

Even when Chinese EVs entered Europe, they were rebounded by consumer pride.

In terms of “quality” in terms of ride comfort, European manufacturers are by far the winner.

Reuters (August 22):

An article titled “Chinese EV makers facing cost increases and brand power barriers in Europe” was published.

Chinese EV manufacturers:

We are facing new challenges in the European market.

BYD,

Shanghai Nii Automobile (NIO),

SAIC MG Motor,

Many challenges were faced.

automotive consulting

Innovev data

A promising start:

Chinese brands account for 8% of all new EVs sold in Europe so far this year

It has risen steadily from 6% in 2022 and 4% in 2021.

However, the European side also released new products to defend itself.

Western companies counterattack immediately:

We plan to introduce new EVs one after another and reduce costs and prices.

In the future, Chinese companies will be forced to compete with all their might.

China Association of Automobile Manufacturers (CAAM): Deputy Secretary General Chen Shihua

Last week, he pointed out, “If things continue as they are, Chinese manufacturers’ exports to Europe will fail.”

The global expansion of Chinese manufacturers is not going well.

Right now, it’s too open. It is necessary to pay attention to the risks.

Chinese EV advances into Europe

It is expanding into all regions without being focused.

Chinese EVs thought it would be easy to enter Europe.

It’s already showing a dead end.

Biggest strengths of Chinese EVs:

The biggest advantage of Chinese manufacturers is their price.

The average selling price of an EV last year was 32,000 euros ($35,000).

Much cheaper than Europe’s €56,000.

Average selling price of EV in China:

32,000 euros (5,090,000 yen) in the first half of last year

Europe 56,000 euros (8.9 million yen)

Chinese EVs are roughly 40% cheaper.

However, logistics, customs duties, and the cost of achieving European certification standards are high.

As a result, it cannot be said that China has the upper hand.

Geely Zeeker: CEO Spiros Photinos

Chinese brands cannot set the same prices in Europe as they do in China.

Factors such as logistics, sales taxes, import duties and compliance with European certification standards all contribute to higher costs.

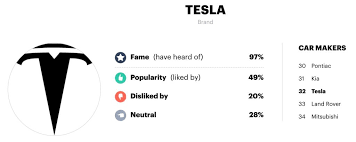

YouGov Recognition Rate Survey

A survey conducted last year among 1,629 German consumers.

Even BYD had a recognition rate of only 14%.

17% said they heard the name of NIO

Xpeng’s recognition rate was 8%.

Chinese EVs have a bumpy road ahead:

Tesla is 95% familiar, 10% likely to buy

That is, 9.5% is the potential purchase rate.

Awareness of Chinese brands is 8-17%

The maximum potential purchase rate is only 0.17%.

In this situation, Chinese EVs have a difficult future ahead of them.

https://hisayoshi-katsumata-worldview.com/archives/33098068.html

Europe: BEV sales and market share update

[From November 2022 to April 2023]

The PHEV market share in major countries is growing dramatically and steadily.

In major EU countries, the market share has consistently exceeded 20%.

We are watching the sales share of PHEV in Europe from 2020 onwards.

This is the latest information for the fiscal year ending April 2023.

April 2023

Country

EV

PHEV

EV+PHEV

Actual EV+PHEV sales

Vehicle sales volume

United Kingdom 15.4% 6.5% 21.9% 29,117 132,990

France 12.9% 8.2% 21.1% 27,990 132,509

Germany 14.7% 5.8% 20.5% 41,527 202,947

Sweden 33.7% 22.1% 55.7% 11,477 20,588

Norway 83.3% 7.8% 91.1% 8,174 8,976

https://blog.evsmart.net/ev-news/electric-vehicle-sales-in-europe/