Interbank International Trust: Unable to pay principal and interest

– Chinese real estate crisis and suspension of payments by non-banks –

-The Chubu Enterprise Group manages 20 trillion yen in assets-

We will deliver a summary from the article published in hisayoshi-katsumata-worldview.

Interbank International Trust Stops Payments:

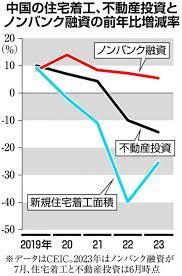

In China, the management crisis of real estate development companies overlapped with the suspension of payments by non-banks.

Wall Street Journal:

On August 20, the company published an article titled “Concerned about China’s reaming shock.”

The finances of Chinese asset management giants are under pressure.

Concerns about intermediary international trusts

China Bank International Trust has become a source of market concern.

At the end of 2022, it managed assets of $108 billion (15.7 trillion yen).

Failure to pay principal and interest:

China Yuan International Trust failed to pay the principal and interest of four trust products to three listed Chinese companies.

In stock exchange filings, the sum totaled $14 million.

There is no guarantee that inability to pay principal and interest will not occur in the future.

Most of the borrowers are construction projects of real estate developers.

What is Chuyu International Trust?

Under the umbrella of a financial conglomerate mid-plant company group.

Nakaplant owns multiple asset management companies.

If repayment problems and defaults escalate, there will be problems with investment products sold in China.

Social media:

A private investor posted that he had not received any payment from a company affiliated with Zhongzhou.

Complaints have been made to local authorities.

Neither company has made an official response to the matter.

Audited by KPMG

It has now stopped paying thousands of customers.

KPMG carried out a clarification of the assets of the Chubu Enterprise Group.

It is time to sell the assets and redeem the deposit.

It is unclear whether the redemption will go smoothly.

Chinese trust industry

It has long been a source of funding for real estate developers.

Industry-wide assets in trust totaled $2.9 trillion as of March.

Gavecal Research

Analyst Xiaoxi Zhang

The Sino-Plant Enterprise Group is a black box. Not disclosing information on a regular basis.

It’s a privately held company and I don’t know what assets it invests in.

Shadow banks and real estate in China:

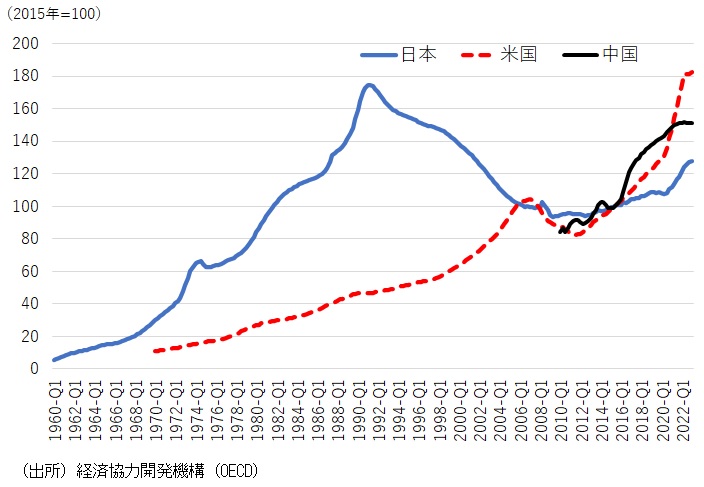

It is also involved in the management crisis of Hekkei-en Holding. There are concerns about a recurrence of the Lehman Shock.

Nonbanks other than medium planting:

This time, there are more serious things happening at the same time than non-bank payment suspensions.

Whether non-banks other than Nakatsutsu will also stop payments is also a focus.

Nomura Research Institute Report: 2023/08/08

Dozens of developers have already defaulted in China’s real estate industry.

Many mutual funds are clearing their holdings in the real estate sector.

Mutual fund real estate sector holdings:

Equivalent to approximately $155 billion as of the end of March (22.5 trillion yen)

This is now in great danger.

https://hisayoshi-katsumata-worldview.com/archives/33082778.html