Rapidus: Successfully produced 2nm semiconductor

・A big step towards mass production of 2nm semiconductors

・Automated process to start in the second half of 2027

Summary from Katsumata Hisayoshi’s World View.

Rapidus (Tokyo): President Koike:

Successfully produced prototype of 2nm semiconductor “IIM-1”.

On July 18th, at a factory in Chitose City, we succeeded in prototyping a semiconductor with a circuit width of 2nm.

2nm performance confirmed:

On July 10th, he revealed that “the operation of a 2nm transistor (semiconductor element) was confirmed.”

He said, “We were able to confirm the performance that will fully satisfy potential customers.”

Successfully produced prototype of IIM-1:

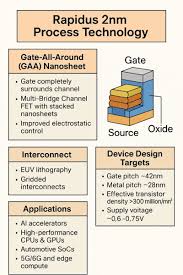

The prototype is a cutting-edge component called a “transistor” that controls electric current.

1. The latest technology is the gate-all-around (GAA) structure.

2. On July 10, the normal operation of the gate-all-around was confirmed and verified.

They announced that they are making good progress toward their mass production goal by 2027.

The world’s major foundries: Progress of 2nm development:

Taiwan’s TSMC:

TSMC will begin mass production of 2nm in the second half of 2025.

TSMC will begin mass production of the next-generation 1.4nm in 2028.

Korea’s Samsung:

Samsung plans to mass-produce 2nm within 2025, but Samsung’s 2nm commercialization will be impossible.

Currently, even the yield rate of “5nm” is “stagnating in the red zone of 20-30%.”

USA’s Intel:

Intel plans to mass-produce 1.8nm within 2025, but like Samsung, Intel’s commercialization will be impossible.

Currently, they are far behind, with Japanese companies being asked to automate the post-processing.

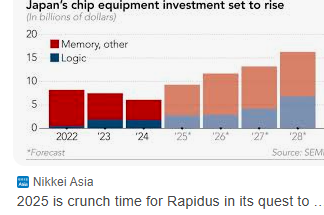

Estimates by US research firm Omdia:

Rapidus’ production capacity:

About 7,000 12-inch wafers per month. This will increase to 25,000-30,000 during mass production.

TSMC’s production capacity:

TSMC’s main factory produces 100,000 12-inch wafers. Rapidus cannot compete with TSMC in terms of production scale.

Rapidus prototype: Developed in 2 years:

At a press conference, President Koike proudly stated that it was “unthinkable speed.”

1. Construction began on the Chitose factory in Hokkaido in September 2011.

2. On December 25, 2012, EUV (extreme ultraviolet) exposure equipment was delivered.

3. On April 1, 2013, a 2nm semiconductor prototype line was launched.

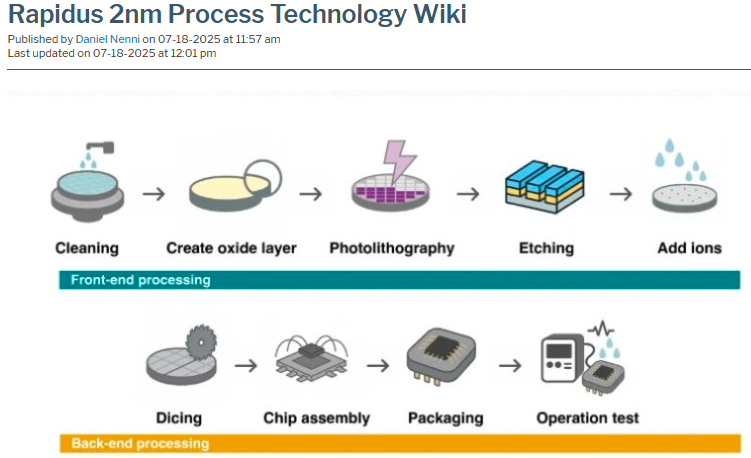

Future plans: Improving front-end and mass production:

1. By the end of this year, we will distribute the latest version of the PDK (Process Design Kit) required for chip design to potential customers.

2. Potential customers will be able to evaluate Rapidus’ technology based on the PDK.

We have made clear our plans and policies for presenting the PDK to customers by the end of March next year.

Full automation of front-end and back-end processes:

Rapidus has become the first in the world to successfully achieve “full automation of front-end and back-end processes.”

We will utilize the adjacent Seiko Epson Chitose facility for back-end processes.

1. We will proceed with “preparing a pilot line” as a base for full automation of semiconductor back-end processes.

2. We will start “integrated front-end and back-end processes” in the second half of 2027.

Rapidus: President Koike says:

Rapidus has no intention of “competing with TSMC on mass production scale.”

The company aims for “flexible management that delivers small lots in a short time.”

1. US customers are aware of the US-China divide and need a second vendor (alternative supplier).

2. Rapidus’ sales target is “developing giant tech companies” such as “GAFA.”

Mass production of Rapidus will enable AI/data center and autonomous driving vendors to procure the latest semiconductors at all times.

TSMC: Rushing to build overseas factories:

TSMC sees “Rapidus as a powerful rival.”

Previously, TSMC was not very enthusiastic about building US factories.

However, after the news that “Rapidus succeeded in developing 2nm” spread, the company shifted gears to rapid construction.

The reason TSMC is so desperate overseas is “the very existence of Rapidus.”

https://hisayoshi-katsumata-worldview.com/archives/38969831.html