EU regulations: a barrier to China’s EV expansion

-Chinese EV batteries cannot comply with EU regulations

– EU compliance and business risks weigh on China

We bring you a summary of articles published in Toyo Keizai.

China has excess LIB production capacity

In China’s domestic market, there is excess production capacity for EVs and LIBs.

For this reason, Chinese battery manufacturers have newly entered the EU market.

Europe is the largest export destination for Chinese-made batteries.

Barriers to decarbonization have begun to prevent Chinese companies from developing markets.

European union:

On August 17th, the EU enforced the “European Battery Regulation.”

It stipulates the entire life cycle of batteries, from procurement of raw materials to manufacturing, usage, and recycling.

Enforcement of the “European Battery Regulation”

New rules have been enforced for battery manufacturers.

1. Obligation to declare your own products and carbon footprint’

2. Obligation to report CO2 emissions of own products and their entire life cycle

We are calling for the introduction of a battery passport.

Composition of battery raw materials,

recycling rate,

carbon footprint etc.

It is a system for registering information as electronic data.

Battery products that are not compatible with this will be prohibited from being sold in the EU market in the future.

Start of operation of “Border Carbon Tax”

The EU began operating Carbon Border Adjustment Measures (CBAM) on October 1st.

Effectively impose tariffs on imported products that do not sufficiently reduce CO2 emissions.

Note: There is a transition period until the end of December. Full-scale operation will begin in January 2024

Operation of Carbon Border Adjustment Measures (CBAM)

This is a measure taken when EU companies import products subject to CBAM from abroad.

1. CO2 emissions directly and indirectly generated in the product production process,

2. Carbon charges paid outside the EU must be reported.

Urgent issues emerging in China:

From January to August 2023, the ratio of China’s total LIB exports to the EU also exceeded 40%.

Responding to the EU’s decarbonization is an urgent issue for Chinese manufacturers.

China Electric Vehicle Hundred Association: Ma Weili Deputy Secretary-General

-Reducing CO2 emissions is a major global trend

The statement was made at an EV-related industry forum held on November 1st.

China’s battery-related industry is

Decarbonization, environmental consideration, carbon footprint, etc.

China needs to work towards decarbonization as soon as possible.

China Automobile Strategy and Policy Research Center: Mr. Shihong

The EU’s decarbonization legislation and carbon border adjustment measures are favorable to protecting EU industries.

EU regulations will quickly undermine the competitiveness of Chinese manufacturers.

Calculating carbon footprint:

The EU calculation method needs to cover the entire LIB cycle.

1. In addition to the manufacturing stage of our own products,

2. mining and transportation of raw materials;

3. Recycling after disposal, etc.

Calculation method disadvantageous to China:

For Chinese battery manufacturers, legal compliance costs and business risks are significant. .

Shi points out that the EU’s new regulations are “unfair to Chinese companies.”

4. When making calculations, battery manufacturers use parameters established by the EU.

5. Its contents are a black box.

6. An unfavorable CO2 emission factor has been set for China.

https://toyokeizai.net/articles/-/715091?page=2

Chinese automotive battery “CATL”: Expanding into the EU market

We bring you a summary of articles published on Toyo Keizai Online.

CATL financial results briefing:

CATL’s development of the EU market is proceeding smoothly.

Minutes of the financial results briefing for institutional investors disclosed by CATL on October 20th

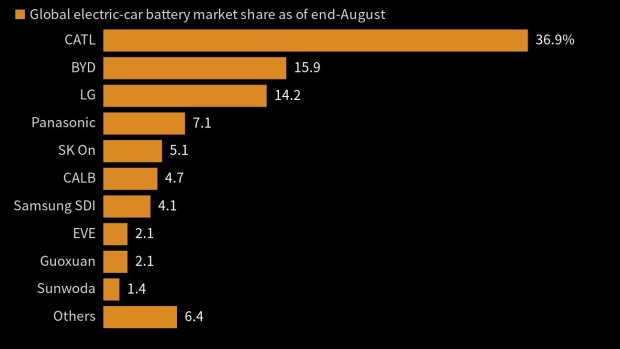

Rapid increase in EU market share:

The share from January to August 2023 was 34.9%, an increase of 8.1 points compared to the same period last year.

Building a battery factory in the EU:

CATL is currently building battery factories in Germany and Hungary.

In particular, the scale of the Hungarian factory is huge.

The planned production capacity is 100GWh per year.

Obtained approval from the Hungarian government:

Regarding the construction work for 34GWh in the first phase of the project,

Approval has been obtained from the Hungarian government. CATL will be completed in two years.