China’s finances: Debt ratio rankings by city revealed

-’Official debt’ is 35 trillion yuan (5 trillion dollars, 700 trillion yen)

-’Hidden debt’ is 56 trillion yuan (8 trillion dollars, 1,100 trillion yen)

– 87 out of 205 cities in China have crossed the red line

We bring you a summary of NHK broadcast articles.

Chinese real estate management crisis:

Companies such as Evergrande Group and Biguien have fallen into financial crisis one after another.

Local government debt risk:

China’s economy was slowing down, and the risk of financial collapse leading to long-term stagnation was hidden.

That is more than 1,800 trillion yen in local government debt.

NHK’s reporting team sheds light on the financial collapse of local governments in China.

(From NHK Special: The Truth about China’s Economic Stall)

Guizhou Province is unable to make repayments:

In February of this year, the government of Guizhou Province in China issued an emergency statement.

Guizhou Province’s debt problem should be resolved urgently.

However, Guizhou Province cannot solve the problem alone.

Guizhou province’s poverty alleviation policy:

Guizhou Province is one of the poorest regions in China.

Since 2000, the central government has promoted development with the aim of escaping poverty.

Over the past 20 years, GDP has grown by more than 10% per year.

Existence of a ‘special investment company’:

Why did I fall into a situation where I could not repay the loan?

Guizhou Province promoted ‘infrastructure development such as roads and bridges using debt.’

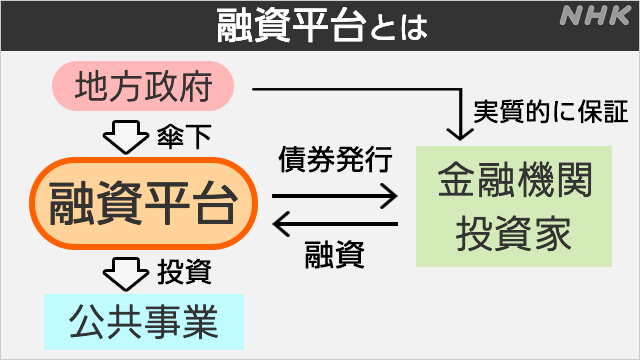

Establishment of ‘Local Loan Platform’:

However, financial resources for infrastructure development are limited.

Therefore, the local government invested and created Loan Pingdai (a special investment company).

Funding rules for Chinese local governments:

Local governments in China are generally prohibited from raising funds other than through local bonds.

However, local governments circumvented the ban rules. In fact, the funds were raised through a loan platform.

Local governments raised funds through bank loans and promoted infrastructure development.

Loan flat scheme:

Currently, local governments across China are using the loan platform.

There are more than 10,000 loan platforms across China.

However, development profits have not increased recently. A series of loan flats occur one after another due to worsening cash flow.

Guizhou loan platform:

In Guizhou province’s loan platform, it has become difficult to repay loans from banks.

Some loan companies have announced that repayments will be deferred for 20 years.

Deterioration of financing level for loan companies:

If the funding situation of the loan center worsens, local governments will be affected.

China’s official statistics trick:

The debts of Chinese local governments do not include debts owed by flat loans.

In reality, it is considered that “local governments independently guarantee repayments.”

Therefore, the loan debt is a ‘hidden debt’ of local governments.

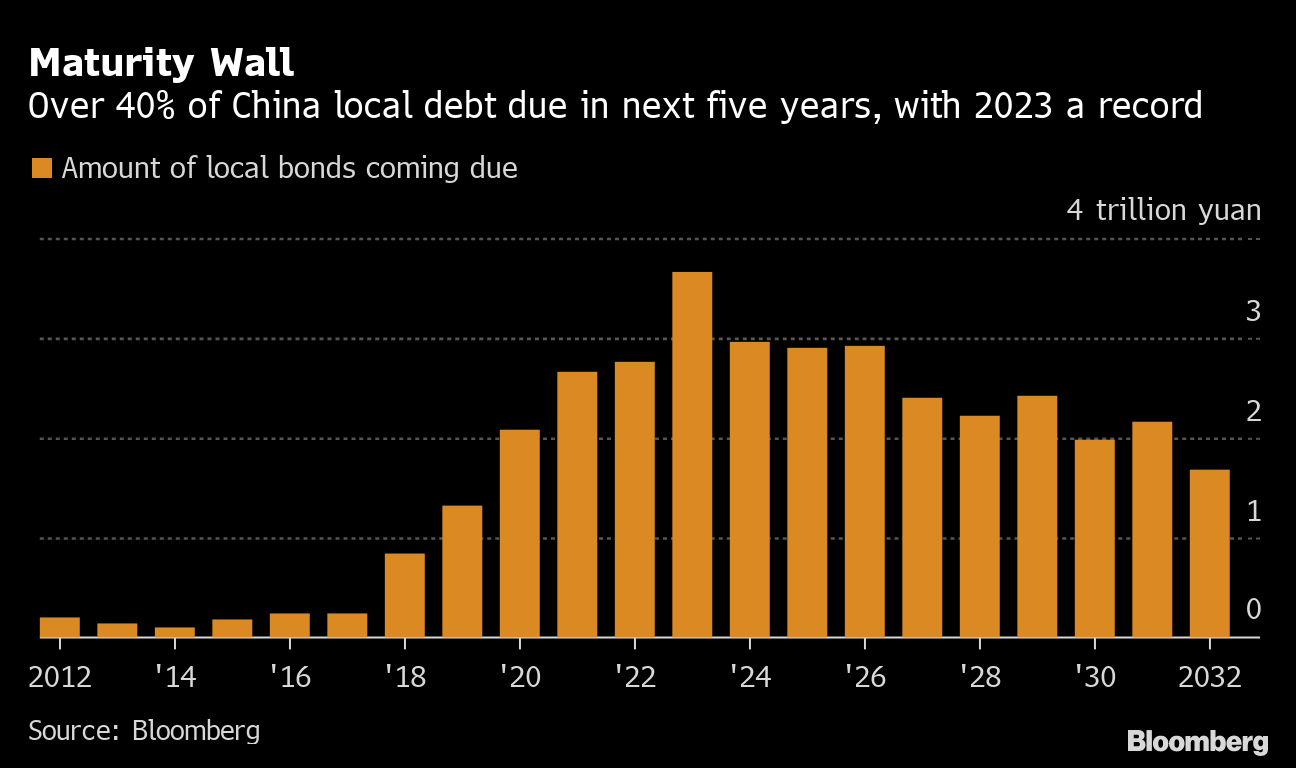

How much debt do Chinese local governments have?

Calculated by the International Monetary Fund (IMF).

Official debt is 35 trillion yuan: 5 trillion dollars, 700 trillion yen

Hidden debt is 56 trillion yuan: 8 trillion dollars, 1,100 trillion yen

Total debt is 91 trillion yen: 13 trillion dollars, 1,800 trillion yen

Impact on local government:

What impact does this amount have on local governments?

Currently, individual debt data for local governments is not disclosed.

How can I obtain debt data for Loan Hiradai?

Get Loan Pingdai debt data:

NHK visited and interviewed Chinese think tanks, researchers, and experts.

I learned that a Chinese private company owns a database.

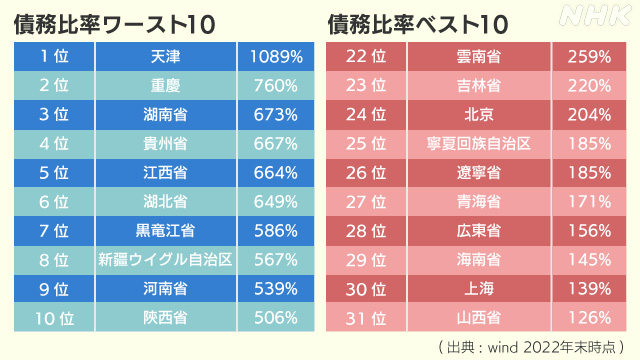

“Debt ratio” by local government:

We investigated the “debt ratio” of each local government.

Debt ratio refers to the ratio of outstanding debt to local government revenue.

This will give you a detailed picture of the deteriorating financial situation.

Debt ratio ranking survey:

Of China’s 31 provinces and municipalities,

1. Debt ratio is the worst/worst 10,

2. Illustrating the top 10 with the best debt ratios.

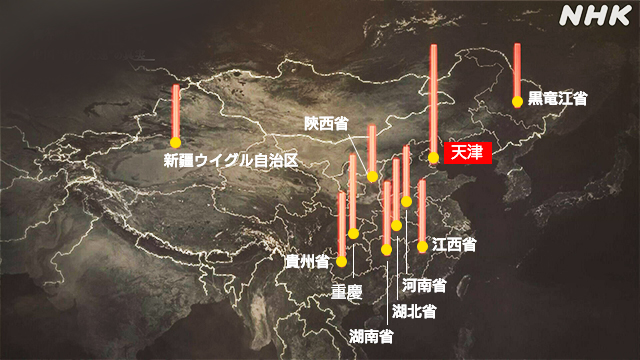

The worst place is the coastal city of Tianjin:

Local governments with poor debt ratios are concentrated in the central and western inland areas.

There are large differences in local government income between coastal and inland areas.

Guangdong Province, located on the coast of China:

There is Shenzhen, which has developed in the IT industry.

It ranks 6th in the country in terms of total debt, but local government revenue is high.

In fact, it ranks 28th in the nation in terms of debt ratio.

Guizhou province ranks 4th worst:

On the other hand, the inland province of Guizhou ranks fourth worst.

Total debt is 55 trillion yen. The debt ratio is 667%.

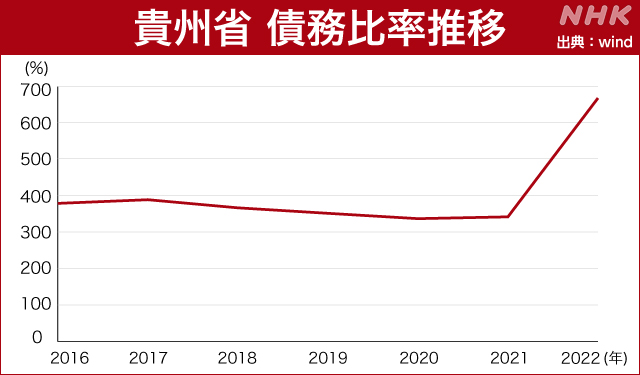

Trends in debt ratio of Guizhou Province:

Guizhou Province’s debt ratio deteriorated rapidly from 2021 to 2022.

Revenues for many local governments also plummeted from 2021 to 2022.

Why did the debt ratio deteriorate so rapidly?

A major factor is the “decrease in land revenue” on which local governments depend.

Deterioration of real estate company performance:

In China, the state owns the land.

Local governments ‘sell land use rights to real estate companies and use the sales proceeds to finance infrastructure development.’

However, due to the deterioration in the performance of real estate companies, income from the sale of land use rights fell.

This is a major blow to local governments that depend on the real estate industry.

Fiscal deterioration warning line = Cities above 80:

The central government is becoming increasingly concerned about the worsening financial situation of local governments.

Emergency response by China’s State Council:

Published a document called “Emergency Response Plan for Local Government Debt Risk”.

Local governments were told to “submit financial reconstruction plans if their debts are in crisis.”

Security lines at the Chinese city level:

The standard is “if interest payments on debt exceed 10% of government expenditures”.

This standard is a “warning line for fiscal deterioration” that could lead to financial collapse.

Which cities are above the alert line?

American think tank: Rhodium Group

We asked Logan Wright, an expert in analyzing China’s debt problems, to assist us.

We received data on interest payments and attempted to analyze them.

87 cities that crossed the red line:

The amount of interest paid for analysis also includes interest on “hidden debt.”

We analyzed 205 cities in China for which data was available.

‘Above the red line requiring fiscal restructuring’

It was revealed that 87 out of 205 cities in China.

Logan Wright warns that ‘we need to plan for the worst-case scenario’.

Financial deterioration of Chinese local governments:

In recent years, researchers around the world have continued to point this out.

However, in particular, ‘data regarding the detailed status of hidden debts’ has not been made public.

NHK’s data analysis revealed that local governments are in a critical situation.

For Japan, which has strong economic ties with China, this is not someone else’s problem.

NHK will continue to cover economic trends in China.

(Broadcast on “NHK Special” on November 5th)

https://www3.nhk.or.jp/news/html/20231115/k10014256361000.html