China’s finances: Local government debt deteriorates rapidly

・General municipal bond balance exceeds 40 trillion yuan (840 trillion yen)

・Is it possible to refinance hidden debts (=LGFVs)?

We bring you a summary of articles published on Toyo Keizai Online.

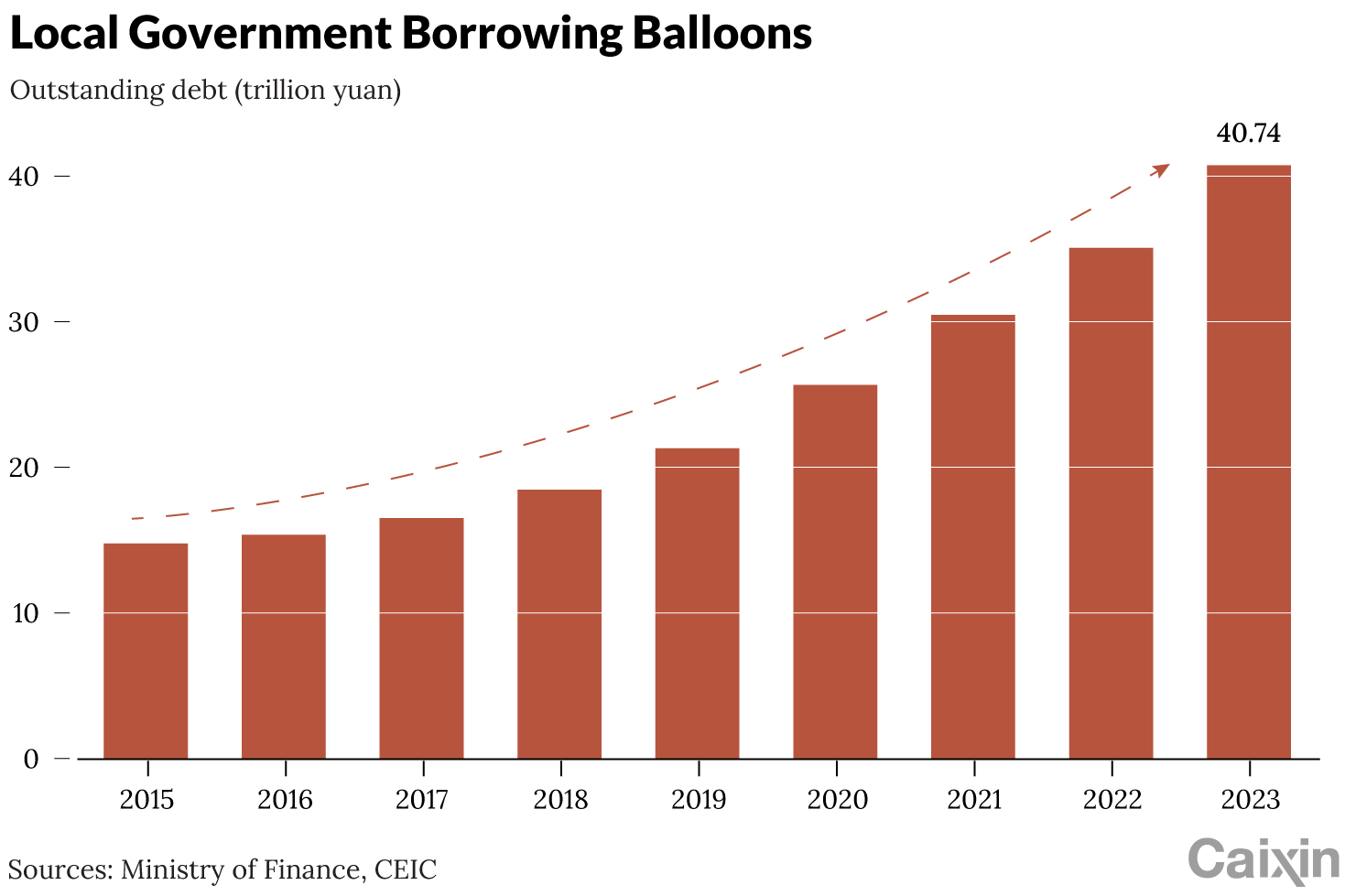

Debt scale of Chinese local governments:

The debt scale of Chinese local governments is rapidly expanding.

At the end of 2023, China’s local government bond balance will exceed 40 trillion yuan (825 trillion 452 billion yen).

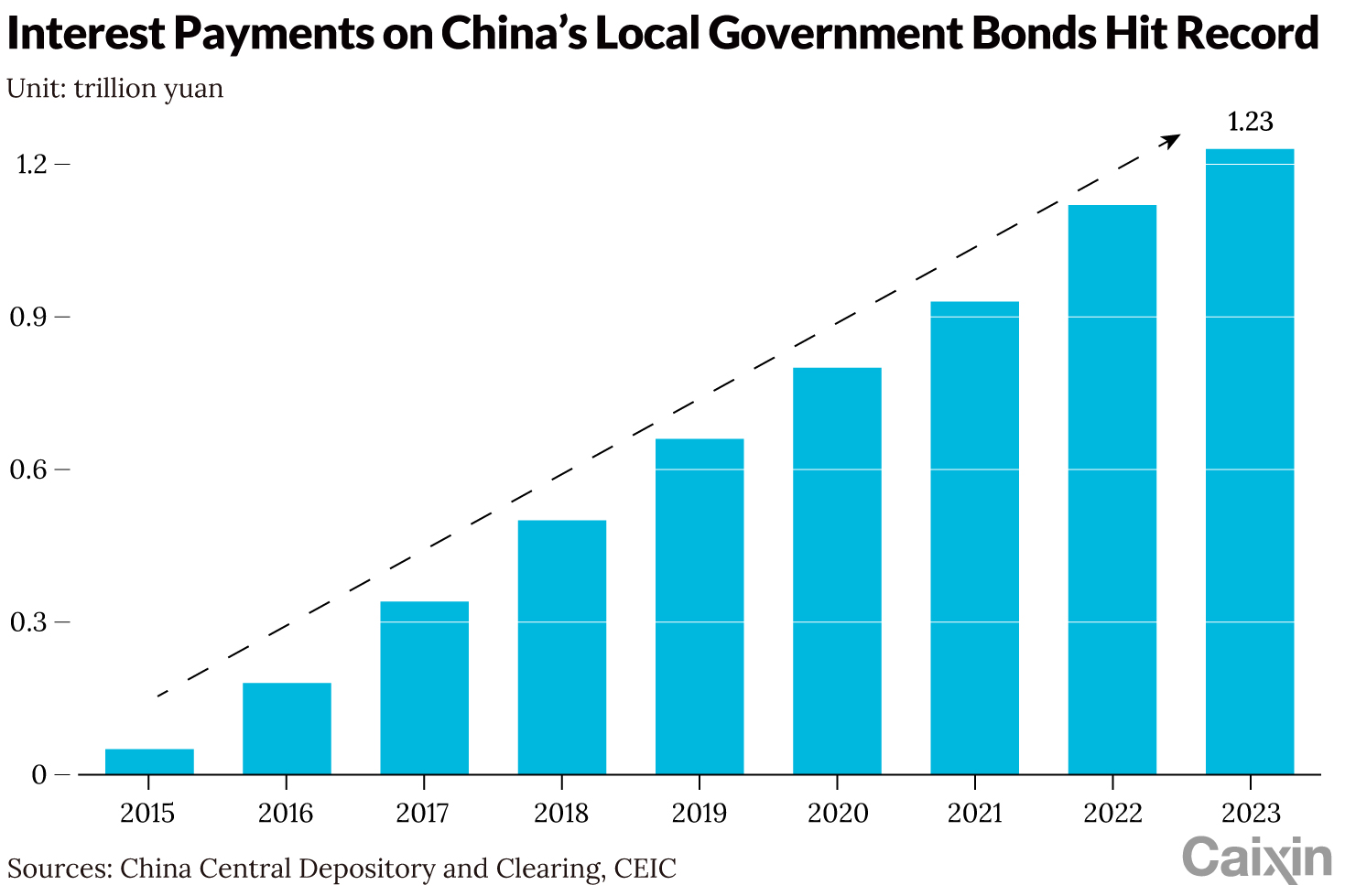

Annual interest expense exceeded 1.2 trillion yuan (24,763.6 billion yen).

Latest statistics from the Chinese Ministry of Finance:

On January 30th, the Ministry of Finance announced the local bond issuance status and debt balance for December.

Outstanding amount of local bonds issued:

The total outstanding local bonds at the end of December was 40,737.3 billion yuan (840,667.1 billion yen)

Breakdown of local bonds by type:

1. General debt: 15,868.8 billion yuan (327,473.3 billion yen),

2. Special debt, 24,868.5 billion yuan (513,193.8 billion yen),

Local bond interest payment status:

New bond issuance in 2023:

Newly issued local bonds in 2023 will be 4,657.1 billion yuan (96,105.3 billion yen)

1. General debt: 701.6 billion yuan (14,478.4 billion yen)

2. Special debt is 3,955.5 billion yuan (81,626.9 billion yen)

The scale of debt is expanding, and interest payments are also increasing.

Total interest payments in 2023:

The total interest payment on local bonds in 2023 will be 1.2288 trillion yuan (25.3579 trillion yen)

Reporter Caixin analyzes past data:

The situation of local government bonds in 2023 was compared with past data.

The outstanding amount outstanding and interest payments reached the highest amount since 2015.

Compared to 2022, it increased by 9.6%.

Issuance rules for Chinese local bonds:

Principal of local bonds and sources of redemption:

Even if there is insufficient financial resources to redeem the loan, it is possible to refinance the loan by issuing a ‘refinancing bond.’

Interest payments and securing financial resources for local bonds:

Interest payments on local bonds are a burden that local governments cannot postpone.

1. Fiscal funds must be used to pay interest on local bonds.

2. It is necessary to secure tax revenue for local governments and revenue from land sales.

Actual status of principal redemption in 2023:

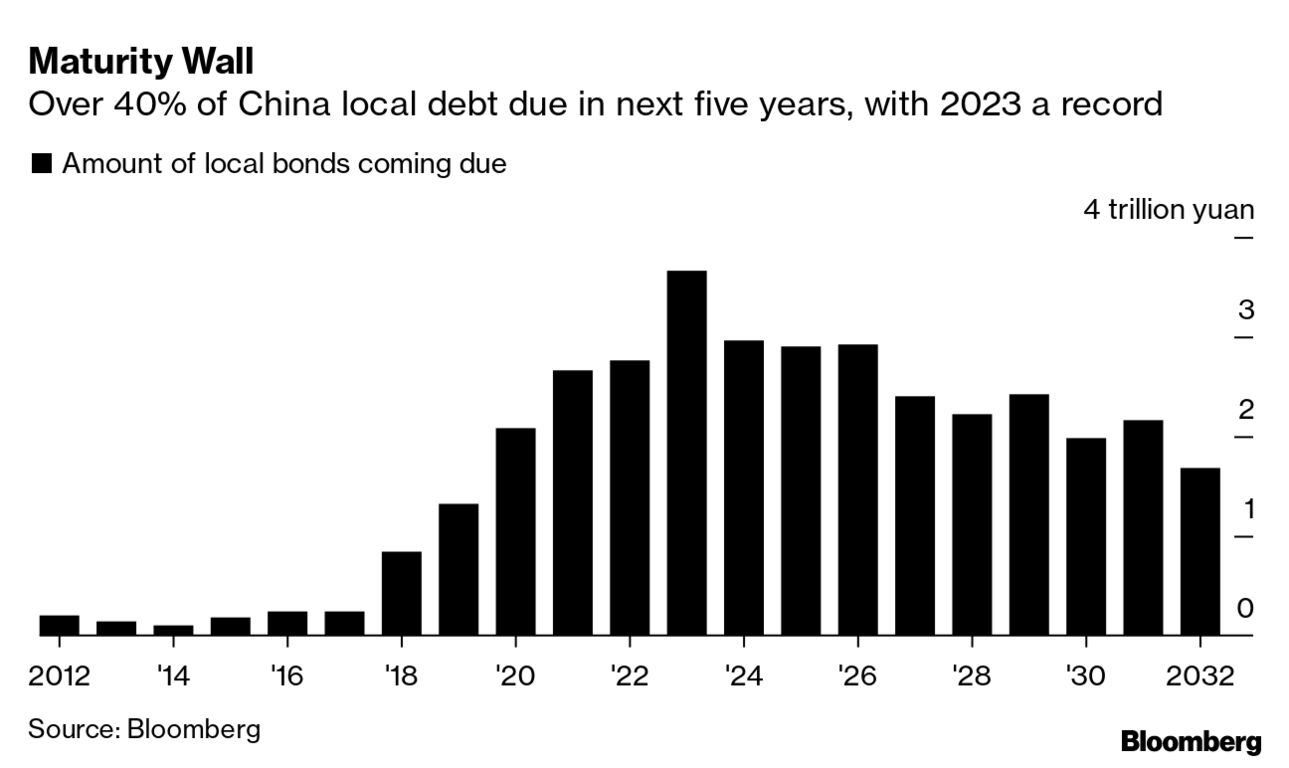

Municipal bonds that mature in 2023.

The principal redemption amount is 3,665.8 billion yuan (75,648.5 billion yen)

1. 90% of the principal redemption amount will be repaid through the issuance of refinancing bonds.

2. The deferred amount is 3,291.8 billion yuan (67,930.6 billion yen).

Only the remaining 374 billion yuan (7,718 billion yen) was covered by fiscal funds.

Take note of LGFVs:

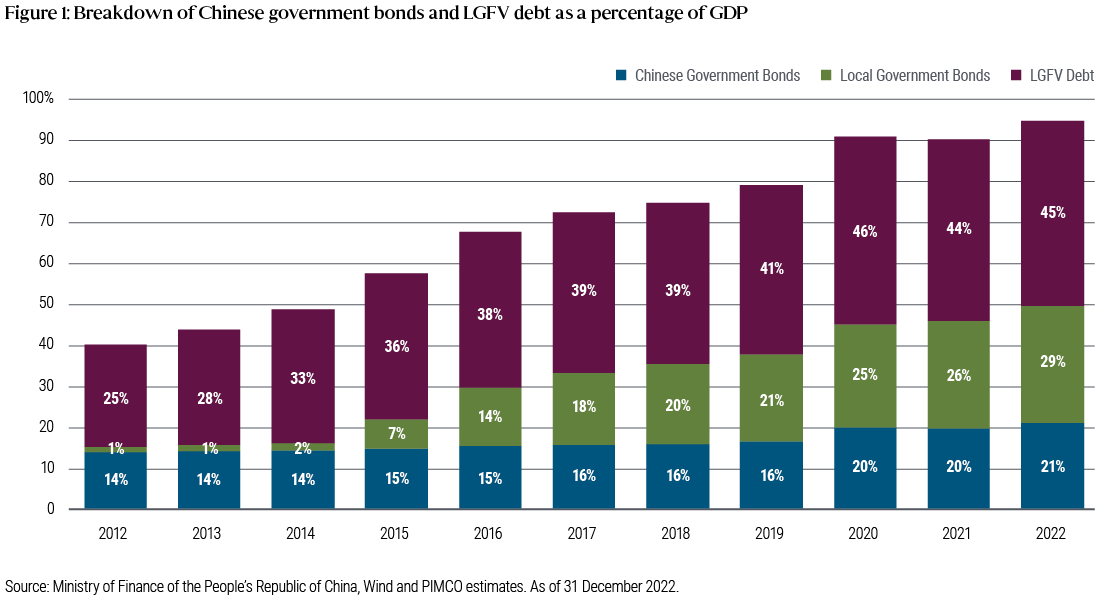

The above figures are only for general local bonds.

Local government hidden debt/LGFV is not included at all.

Focus on continuation of special refinancing bonds:

In July 2023, the Beijing central government approved the issuance of special refinancing bonds by local governments.

Local governments can ‘defer hidden debt/LGFV with special refinancing bonds.’

Will special refinancing bonds continue in 2024?

Issuance limit for special refinancing bonds:

The issuance limit is the amount obtained by subtracting the issued outstanding amount from the local bond issuance limit.

There is only 1.4301 trillion yuan (29.512 trillion yen) left to issue special refinancing bonds.

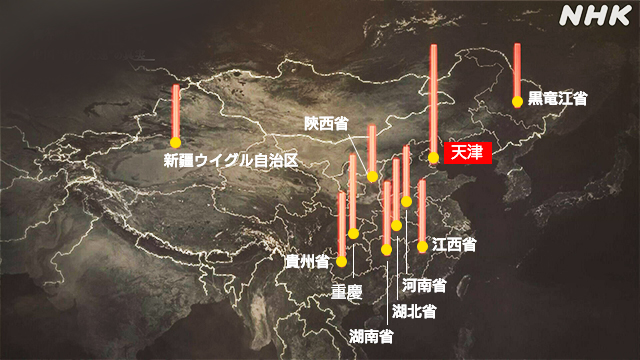

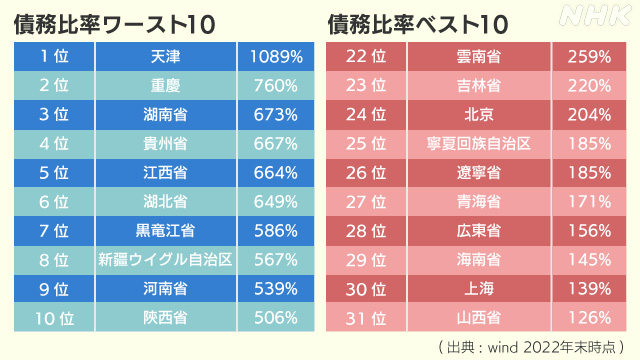

Hidden debts of Chinese local governments:

Chinese local governments have investment companies called LGFVs under their umbrella.

LGFVs debt provides an ‘implicit guarantee’ to local governments.

That is why they are called hidden debts or LGFVs.

This is a debt that does not appear in China’s official statistics.

IMF’s LGFVs calculation:

The IMF estimates that the total amount of LGFVs in 2023 will be 66 trillion yuan (1,362 trillion yen).

https://news.yahoo.co.jp/articles/0bd36aa6e12fb83eb4eaa8e52d25bc6a578c1f99