China’s Foreign Exchange Reserve Shortage: Unable to Cover Foreign Debt!

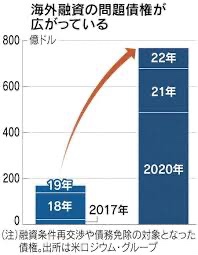

-Sudden expansion of non-performing loans of overseas assets-

– Current account deficit remains due to trade friction with US and Europe –

Report from the latest articles published in Fuji Evening Paper

China’s “One Belt, One Road”:

Invested $748.1 billion. There are 150 countries involved.

US think tank: American Enterprise (AEI)

China poured in $100 billion each year during the Great Leap Forward.

However, the corona misfortune has changed. One Belt, One Road is shrinking to $60 billion a year.

US research firm Rhodium Group:

One Belt, One Road bad debts had already reached $76.8 billion.

Non-performing loans in developing countries:

Sri Lanka, Pakistan, and Venezuela’s “repayment reduction” and “deferral” negotiations have hit a deadlock.

The Development Bank of China and the Export-Import Bank of China have turned to “credit crunch, credit stripping”.

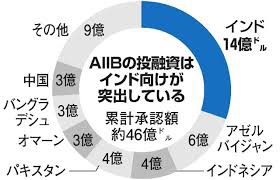

AIIB investment in India stands out China-led AIIB:

Several loans to India are “co-financing with ADB led by Japan”.

IMF (International Monetary Fund): Demanded China to draw debts from developing countries.

However, China has not agreed to the negotiations.

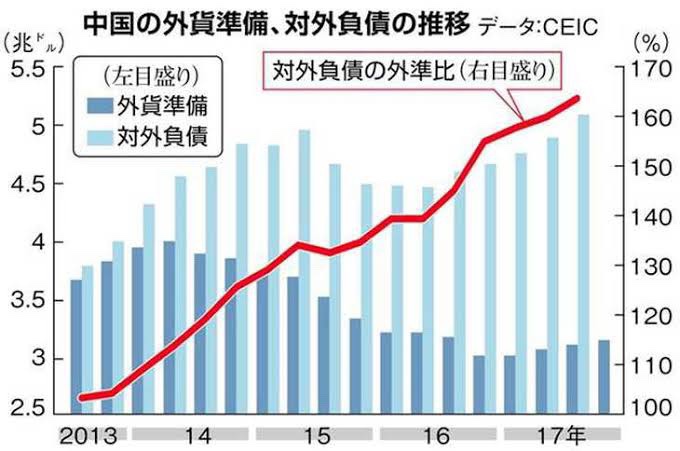

China’s foreign exchange reserves:

Boasting $3.2 trillion. However, it has sharply reduced its holdings of US Treasuries.

The actual situation is “borrowing dollars from foreign banks.” Many of China’s overseas assets have turned into non-performing loans.

High-speed rail in Southeast Asia:

Construction of the Indonesian Shinkansen is delayed. The scale of Malaysian high-speed rail has also been reduced.

Only the China-Laos Railway is open. Pakistan’s Gwadar port modernization project was also suspended.

China’s Foreign Exchange Reserve Shortage Serious:

It is exports that make a net increase in China’s foreign exchange reserves.

However, the current account deficit continues.

The trade surplus decreased due to trade friction with the United States and Europe.

The trade surplus cannot continue in the future.

According to Chinese statistics, “borrowing from foreign banks is included in foreign exchange reserves.” It’s all a hoax.

https://news.yahoo.co.jp/articles/3dcf7764462be0df69dd33fcde71654435c78737/images/000