Bank of Korea Head Office (Seoul) with currency swap agreement with the United States © ︎iStock.com

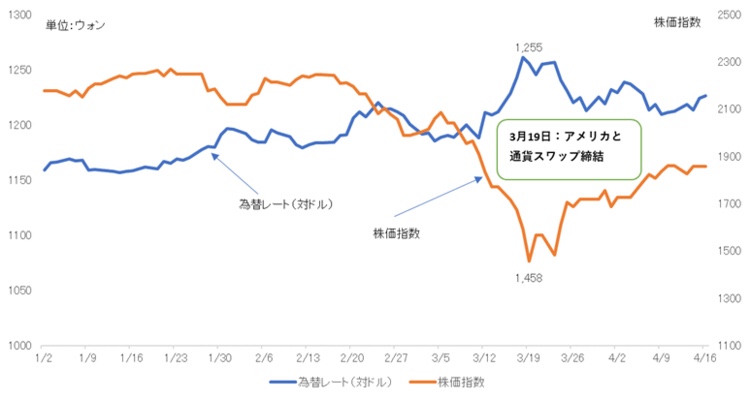

South Korea: Stock index / exchange rate before and after the outbreak of new coronavirus (vs. US dollar Korea Exchange )

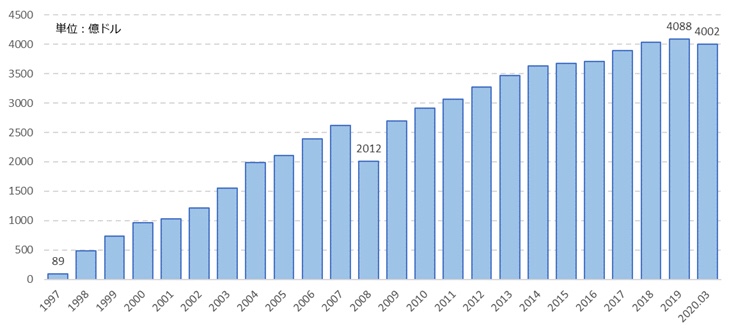

Changes in Korean foreign currency reserves (Bank of Korea “ECOS Economic Statistics System”)

COVID-19: South Korea’s biggest weakness: foreign exchange reserves / currency swaps

COVID-19:

-“Weaknesses” of currency problem-

Central Bank of Korea: Bank of Korea

On March 19, it announced that it has signed a US $ 60 billion currency swap with the US Federal Reserve.

This is the second time the Korean government has signed a currency swap with the United States.

The first was in October 2008, when there was a global financial crisis due to the Lehman shock, amounting to $ 30 billion.

This time South Korea started to move into a “currency swap” due to the influence of the new coronavirus

Won depreciation against the dollar,

Financial market unrest due to stock price crash

To eliminate the tightness of dollar funds and prevent outflow of money / fall of currency.

New Coronavirus: Financial Market Movements

For the first time in Korea, a person infected with the new coronavirus was confirmed.

January 20:

The exchange rate was 1160 won per dollar.

March 18: US $ Korean currency swap The dollar dropped to 1261 won on March 18, the day before.

March 19: Until February, the 2000pt stock index (KOSPI) crashed to 1458pt on March 19.

March 19: Signed currency swap with US,

The financial market began to stabilize as the financial market instability disappeared, stock prices rose little by little, and the weakening of the won stopped.

Foreign currency reserves:

End of 1997: Foreign exchange reserves were $ 8.9 billion at the time of the Asian crisis.

End of March 2020: Time increased to $ 400.2 billion.

Currently, the total dollar and foreign currency reserves secured by currency swaps amounted to approximately $ 600 billion.

Thus, a big improvement was seen.

Japan / Korea: Currency swap

It started on a scale of 2 billion dollars in July 2001 and expanded to 70 billion dollars in 2011.

However, in 2012, the relationship between Japan and South Korea deteriorated and ended in February 2015.

Foreign Currency Reserves in South Korea: Why we Should Increase

After that, the Korean government is continuing its policy of increasing foreign exchange reserves.

First reason:

This is because “Korean currency is not a base currency like the dollar or yen.”

For US / Japan:

If you run out of foreign currency, you can solve the problem of foreign currency shortage by “quantifying easing and issuing currency.”

For Korea:

However, South Korea, whose home currency is not the core currency, must “borrow from other countries when it runs out of foreign currency.”

If korea cannot borrow foreign currency, korea will face a currency crisis.

1997: Asian currency crisis

At that time, in Korea, the debt that had been borrowed in foreign currencies swelled due to the sudden fall of the won.

Foreign currency reserves are only $ 3.94 billion.

Eventually, South Korea had to call the IMF for emergency assistance.

Second reason:

The Korean government has judged that “the current foreign currency reserve is not sufficient”.

Recently, in Korean Society / presentation papers,

The appropriate level of foreign exchange reserves in South Korea is

IMF: $ 681 billion when the standard is applied,

BIS: $ 830 billion by applying the standard

Compared with this estimation result, “Korean foreign exchange reserves are now well below the appropriate level.”

IMF and BIS standards include short-term external debt and foreign investors / shareholdings.

South Korea: Short-term external debt

You need to repay in a short time.

Foreign investors / equity holdings are likely to be sold immediately and capital outflowed when the Korean economy is bad.

Korean Government:

“The Korean government still has no choice but to rely on currency swaps.”

South Korea’s short-term external debt ratio to foreign currency reserves is declining.

However, it accounts for more than 30% (32.9% in 2019).

Bunshun online