COVID-19: EU Finance Minister Utilizes ESM: Credit Line Setting, Final Approval

[Brussels 8th Reuters]

Eurozone Finance Minister:

On May 8th, we will make use of the € 540 billion Euros Relief Fund “European Stability Mechanism (ESM)” to combat the new coronavirus.

The final approval was given to “establish a credit line equivalent to 2% of the gross domestic product (GDP) of each member country.”

European Stability Mechanism (ESM);

Credit facilities total up to € 240 billion ($ 260 billion).

Senteno Chair: Finance Minister of Portugal

“In response to the unusual situation of the New Corona Crisis, we have agreed on useful and appropriate financial terms,” he said.

It is unclear if Italy will have a high level of debt and can utilize its credit facilities.

The loan is expected to be available within a few weeks.

It will be implemented until the end of 2022.

The loan period is 10 years,

Interest rates are set at very low levels,

https://headlines.yahoo.co.jp/hl?a=20200509-00000018-reut-bus_all

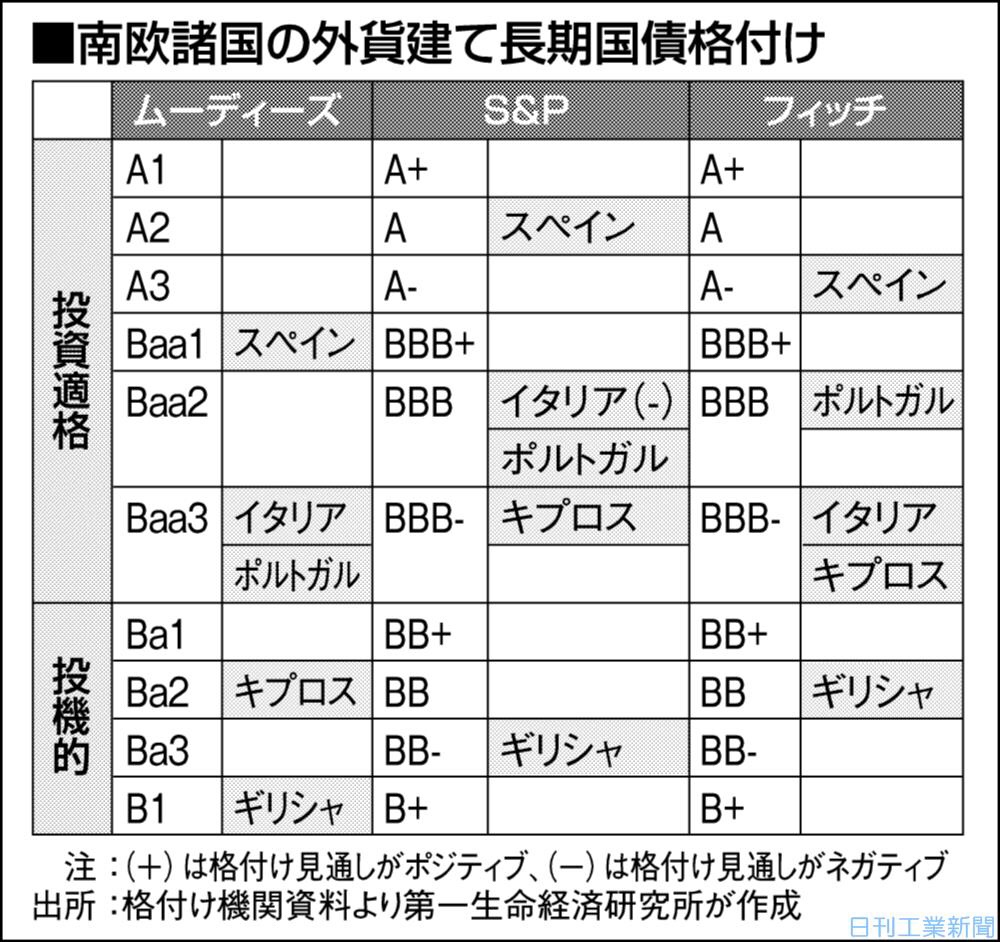

Italy’s rating trend down to “negative”

-Rating company: DBRS Morning Star

On May 8, Italy lowered the rating trend from “stable” to “negative”.

He added that there is growing uncertainty over the impact of the new coronavirus on the economy.

rating;

It was left at “BBB”, which is three levels above the junk (speculative) grade.

-Reuters

https://jp.reuters.com/article/italy-ratings-dbrs-idJPKBN22K2VJ

[European bonds] Italian government bonds and other peripheral government bonds plunge

March 13, 2020 4:43 JST

Italian bond yields hit record highs, selling to Spanish and French bonds

Bloomberg

https://www.bloomberg.co.jp/news/articles/2020-03-12/Q73EUUDWRGG001