COVID-19:South Korean Currency Crisis: “Won Selling” Worries

“Won Selling”:

March 23:

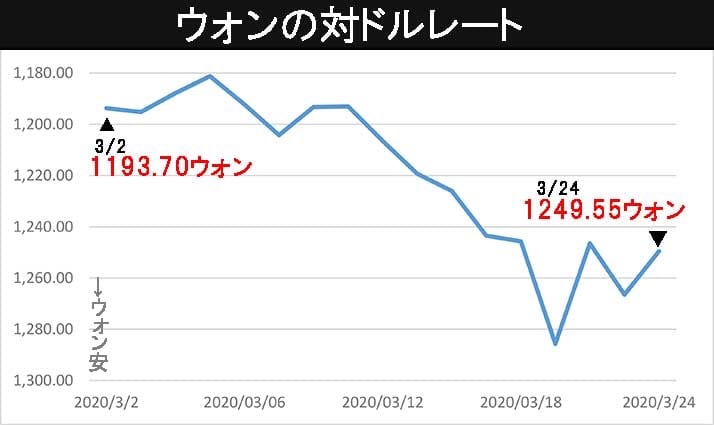

The Seoul foreign exchange market closed at 1266.50 won per dollar, down 20.00 won from the previous weekend.

March 19:

The US Federal Reserve has announced a foreign exchange swap agreement with nine central banks, including South Korea.

As a result, on March 20, 39.20 won was raised by one won a day.

New type pneumonia:

Concerned about economic deterioration due to new types of pneumonia, etc., the violent “won selling” started.

Six months in the US, a $ 60 billion swap couldn’t be stopped.

March 24

It closed at 1,249.55 won, an increase of 16.95 won, but the “won selling” air was not dispelled from the market.

Fed Site: SWAP Definition

The Fed refers to this swap as “liquidity arrangements (swap lines)“.

South Korea Website: SWAP Definition

On the other hand, the Korean side wrote “bilateral currency swap arrangement“.

If it is a currency swap, it can also be used to buy Won of the Bank of Korea.

However, the use of foreign exchange swaps is limited to “only for supplying dollars to the Korean city banks.”

South Korea swap countries:

South Korea has already entered into swaps between various countries and the two countries.

However, both are contracts denominated in the currency of the partner country.

In the event of an emergency, it is very likely that the debt will not be repaid in time.

Other than the United States, the country that issued the dollar, “the only country with enough foreign currency reserves to swap in US dollars is Japan.”

Daily Shincho

https://www.dailyshincho.jp/article/2020/03241730/?all=1&page=1