Source: SEMI December 2020, Equipment Market Data Subscription

New equipment includes wafer fab, test, and A&P. Total equipment does NOT include wafer manufacturing equipment. Totals may not add due to rounding.

The current SEMI forecast is based on collective input from top equipment suppliers, SEMI’s Worldwide Semiconductor

China: Imports of semiconductors and manufacturing equipment surged: SEMI December report

-Buy before US sanctions-

February 3, 2021

China grows into world’s largest semiconductor manufacturing equipment market in 2020-SEMI

Taiwan’s largest winner surpasses China’s economic growth rate for the first time in 30 yearsImpact of US embargo on China:

China’s imports of semiconductors and semiconductor manufacturing equipment increased significantly last year due to the US embargo on China.

Strengthen the response, saying, “Let’s protect our country from the expansion of the US technology embargo on China.”

Import of semiconductor manufacturing equipment from China:

In 2020, it purchased semiconductor manufacturing equipment from Japan, South Korea, Taiwan, etc. worth $ 32 billion.

It increased by 20% from 2019.

Bloomberg Analysis:

It was analyzed from the official statistics of Chinese trade.

Before the US sanctions came into effect, Huawei and others rushed to purchase semiconductors and increased their inventories.

Semiconductor imports in 2020:

Semiconductor imports in 2020 will be nearly $ 380 billion.

It increased by 14%, accounting for about 18% of all Chinese imports.

Gabcal Dragonomics: Mr. Dan Wang

“In the short term, China will rely on imports to manufacture semiconductors,” he said.

China does not yet have the ability to make advanced semiconductor manufacturing equipment.

“We are investing a lot, but it takes more than 10 years to succeed.”

International Semiconductor Manufacturing Equipment Materials Association: (SEMI)

Semiconductor Manufacturing International Corporation (SMIC):

Chinese semiconductor manufacturers such as SMIC are rapidly expanding their purchases of semiconductor manufacturing equipment.

According to the SEMI report, China became the world’s largest semiconductor manufacturing equipment market in 2020.

American Semiconductor Industry Association (SIA):

Demand is expected to continue increasing this year.

“Global semiconductor sales are projected to increase by 8.4% in 2021” in December last year.

Bloomberg

https://www.bloomberg.co.jp/news/articles/2021-02-03/QNX984DWLU6P01

China Demand Lifts Japan’s Exports to First Gain Since 2018

Japanese exports gained in December for the first time in just over two years,

with shipments to China climbing even as the pandemic resurged in other key markets.

The value of overseas shipments rose 2% compared with a year earlier,

snapping a 24-month losing streak that came amid trade wars and the coronavirus, the finance ministry reported Thursday.

Economists had predicted a 2.4% increase.

Exports to China rose 10.2% from a year earlier, while shipments to the U.S. fell 0.7% and those to the EU dropped 1.6%

Exports of semiconductor equipment increased about 10%, accounting for a fifth of the overall advance.

Vehicle shipments dropped 4.2%.

The trade balance

was 751 billion yen ($7.3 billion) in the black compared with a consensus forecast for a 930.5 billion yen surplus.

Semiconductor Equipment Consensus Forecast

Dec 14, 2020 TOKYO

December 15, 2020

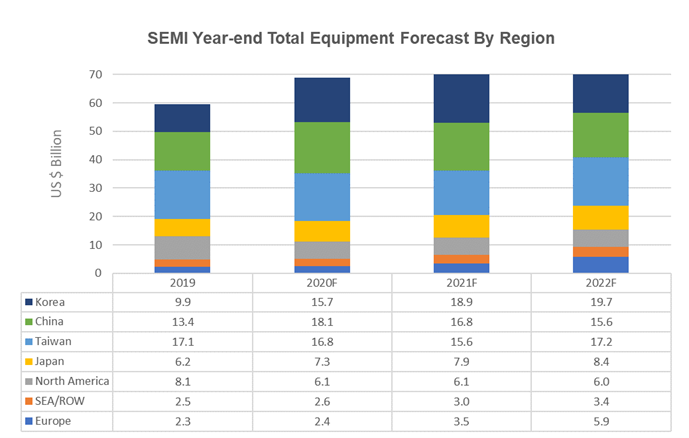

Global sales of semiconductor manufacturing equipment by original equipment manufacturers

are projected to increase 16% compared to $59.6 billion in 2019 and register a new industry record of $68.9 billion in 2020,

SEMI announced today in releasing its Year-end Total Semiconductor Equipment Forecast – OEM Perspective at SEMICON Japan.

The growth

is expected to continue with the global semiconductor manufacturing equipment market reaching $ 71.9 billion in 2021 and $76.1 billion in 2022.

semi logo Both the front end and the back end semiconductor equipment segments

are expected to power the expansion.

The wafer fab equipment segment – which includes

wafer processing,

fab facilities,

mask/reticle equipment

is projected to rise 15% to reach $59.4 billion in 2020, followed by 4% and 6% growth in 2021 and 2022, respectively.

The foundry and logic segments, which account for about half of total wafer fab equipment sales, will see a mid-teens Record Growth Ahead,

SEMI Reports | SEMI