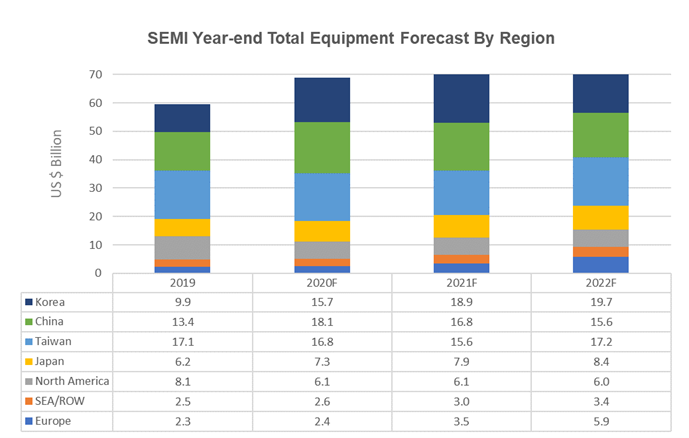

资料来源:SEMI 2020年12月,设备市场数据订阅

新设备包括晶圆厂,测试和A&P。总设备不包括晶圆制造设备。由于四舍五入,总数可能不增加。

当前的SEMI预测基于顶级设备供应商SEMI的Worldwide Semiconductor的集体投入

中国:半导体和制造设备进口激增:SEMI十二月报告

-在美国制裁之前购买-

2021年2月3日

2020年中国将成为全球最大的半导体制造设备市场

台湾最大赢家30年以来首次超过中国经济增长率

美国禁运对中国的影响:

去年,由于美国对中国的禁运,中国的半导体和半导体制造设备进口大幅增加。

加强回应,说:“让我们保护我们的国家免受美国对中国的技术禁运的扩大。”

从中国进口半导体制造设备:

2020年,它从日本,韩国,台湾等地购买了价值320亿美元的半导体制造设备。

它比2019年增长了20%。

彭博社分析:

根据中国贸易的官方统计数据进行了分析。

在美国制裁生效之前,华为和其他公司急于购买半导体并增加了库存。

2020年半导体进口量:

2020年半导体进口额将接近3800亿美元。

它增长了14%,约占中国进口总量的18%。

Gabcal Dragonomics:王丹先生

他说:“短期内,中国将依靠进口来制造半导体。”

中国还没有能力制造先进的半导体制造设备。

“我们正在投入大量资金,但要成功需要十多年的时间。”

国际半导体制造设备材料协会:(SEMI)

半导体制造国际公司(SMIC):

中芯国际等中国半导体制造商正在迅速扩大对半导体制造设备的购买。

根据SEMI报告,中国已成为2020年全球最大的半导体制造设备市场。

美国半导体工业协会(SIA):

预计今年需求将继续增长。

去年12月,“预计2021年全球半导体销售将增长8.4%”。

彭博社

https://www.bloomberg.co.jp/news/articles/2021-02-03/QNX984DWLU6P01

China Demand Lifts Japan’s Exports to First Gain Since 2018

Japanese exports gained in December for the first time in just over two years,

with shipments to China climbing even as the pandemic resurged in other key markets.

The value of overseas shipments rose 2% compared with a year earlier,

snapping a 24-month losing streak that came amid trade wars and the coronavirus, the finance ministry reported Thursday.

Economists had predicted a 2.4% increase.

Exports to China rose 10.2% from a year earlier, while shipments to the U.S. fell 0.7% and those to the EU dropped 1.6%

Exports of semiconductor equipment increased about 10%, accounting for a fifth of the overall advance.

Vehicle shipments dropped 4.2%.

The trade balance

was 751 billion yen ($7.3 billion) in the black compared with a consensus forecast for a 930.5 billion yen surplus.

Semiconductor Equipment Consensus Forecast

Dec 14, 2020 TOKYO

December 15, 2020

Global sales of semiconductor manufacturing equipment by original equipment manufacturers

are projected to increase 16% compared to $59.6 billion in 2019 and register a new industry record of $68.9 billion in 2020,

SEMI announced today in releasing its Year-end Total Semiconductor Equipment Forecast – OEM Perspective at SEMICON Japan.

The growth

is expected to continue with the global semiconductor manufacturing equipment market reaching $ 71.9 billion in 2021 and $76.1 billion in 2022.

semi logo Both the front end and the back end semiconductor equipment segments

are expected to power the expansion.

The wafer fab equipment segment – which includes

wafer processing,

fab facilities,

mask/reticle equipment

is projected to rise 15% to reach $59.4 billion in 2020, followed by 4% and 6% growth in 2021 and 2022, respectively.

The foundry and logic segments, which account for about half of total wafer fab equipment sales, will see a mid-teens Record Growth Ahead,

SEMI Reports | SEMI