Korea: Revision of alcohol tax law /conversion to pay-as-you-go tax: Bridging the gap between domestic/ imported beer

Soul

January 14, 2020

National Revenue Service of Korea: “Revised alcohol Tax Law”

On January 5, the taxation system for beer /makgeolli will be changed from “export price base / export tax” to “export volume per liter / export tax”,

announced the enforcement of the revised alcohol Tax Law (effective January 1).

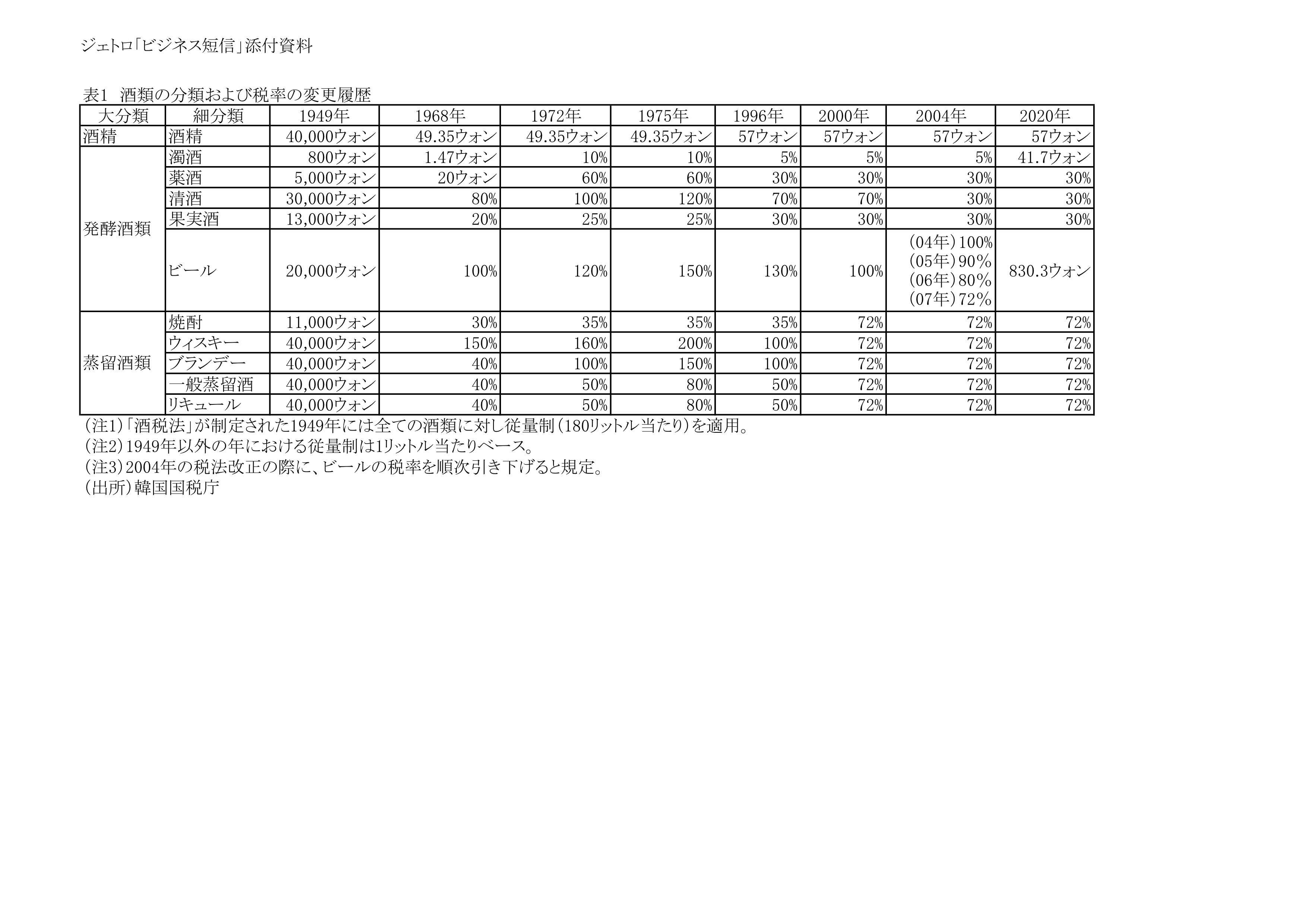

Beer / makgeolli: Price-linked system: (Attached document: see Table 1)

Implement an inflation-linked system that adjusts the tax rate in proportion to the inflation rate.

This maintains fairness with liquor to which VAT is applied.

Domestic / Imported Beer: Eliminating Unfairness

The Korean National Tax Service has stated that

Promotion of the development of high quality liquor,

Elimination of inequities in domestic and imported beers,

Of the two points.

Until now, “Domestic beers have been disadvantaged over imported beers due to differences at the time of taxation.”

For domestic beer:

The price at the time of issue is taxed.

Therefore, production costs, SG & A expenses, and profits were included in the tax standard.

For imported beer:

They will be taxed at the time of import declaration.

Only import value and customs duties are included in the tax base.

SG & A expenses and profits were excluded from the tax base.

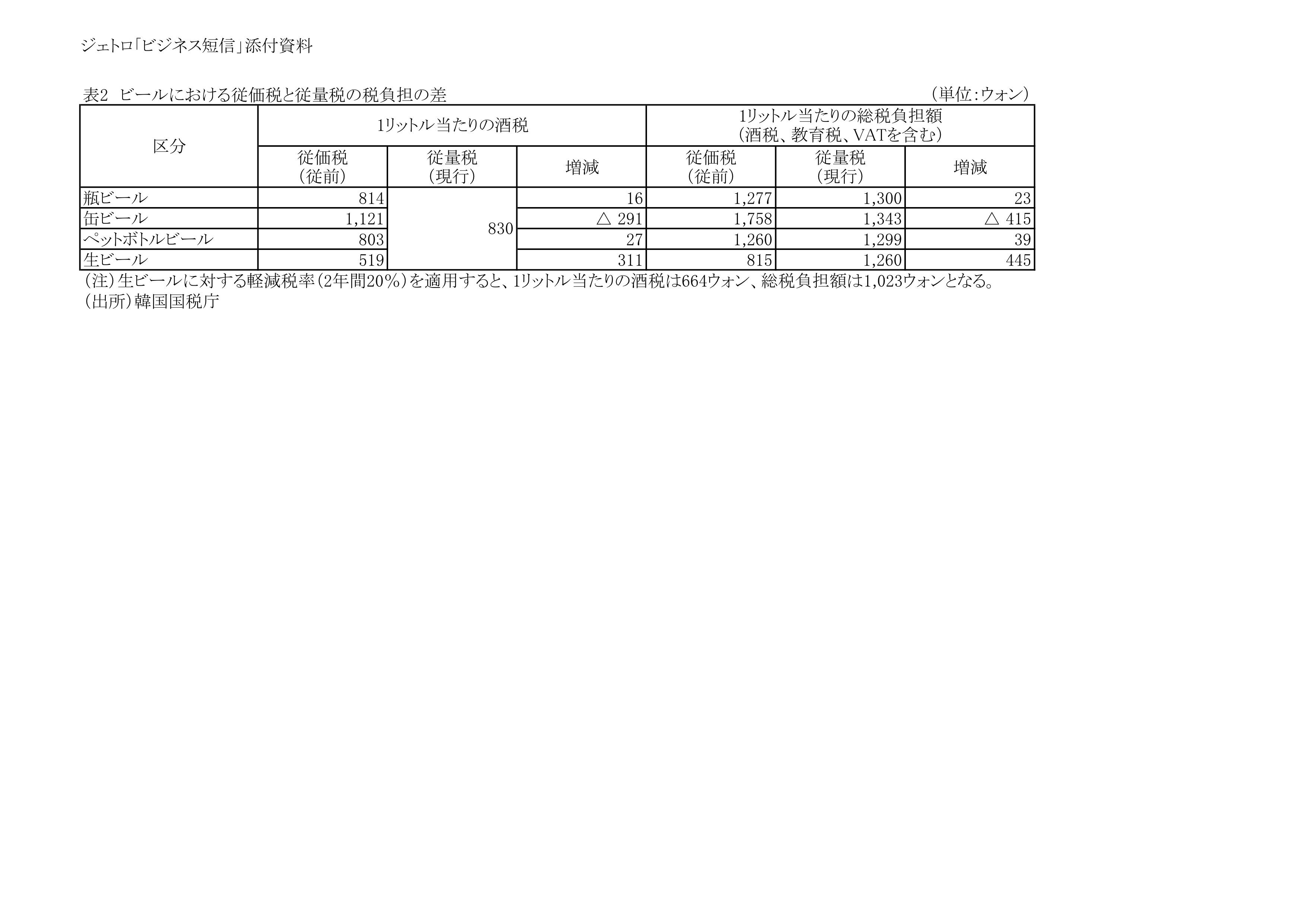

Introduction of pay-per-use tax: (Attached document: See Table 2)

Domestic beer makers can produce high quality beer without additional tax burden.

Bottled beer/PET bottled beer: The liquor tax amount will increase only slightly and will not affect consumer prices.

Canned beer: “Can manufacturing costs are excluded from the tax standard, liquor tax burden / shipping price is reduced,” so there is room for price adjustment.

Draft beer: Originally, the production cost is low and the selling price is lower than other beers. With the introduction of pay-as-you-go tax, liquor tax burden increased.

Therefore, draft beer will be subject to a reduced tax rate of 20% over the next two years (see Table 2 in the Appendix).

-JETRO

https://www.jetro.go.jp/biznews/2020/01/3ea752e0e442ffbb.html