TSMC: Insufficient stock of 300mm wafers: SUMCO, Shin-Etsu Chemical

-Another shadow that shakes semiconductors-

Taiwan TSMC Requests Increased Production:

The inventory of Taiwan TSMC is steadily decreasing.

Will you invest in increasing production as soon as possible?

Since February 2021, SUMCO has been increasingly requested by TSMC to increase production.

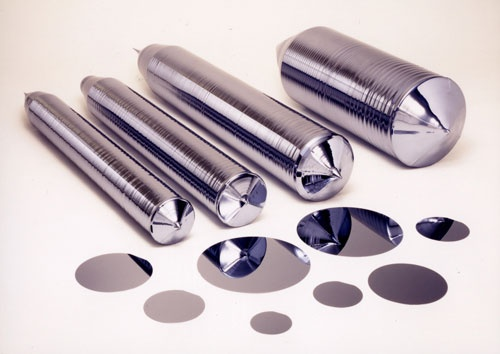

This is mainly because “the tightness of silicon wafers with a diameter of 300 mm used for manufacturing advanced products” is increasing.

SUMCO’s estimate:

On average, global semiconductor manufacturers had an inventory of 300mm wafers for 1.6 months in early 2020.

On the other hand, February has decreased to 1.3 months.

SUMCO: Masayuki Hashimoto, CEO

Supply of 300mm wafers:

-For CPU and device control logic semiconductors-

The supply of 300mm wafers cannot keep up with the demand.

10% shortage in 2023:

In particular, demand for 300mm wafers for smartphones will be replaced by 5G from 4G.

It is expected to increase by 30% in 2o24 compared to 2o20.

Wafer maker system:

If wafer makers do not invest to meet demand this year, they will be 10 to 20% short of the monthly demand of 7.5 million wafers for 300 mm in 2023.

TSMC and Intel’s frustration:

“If nothing is done, wafers will not be available in the near future.”

Semiconductor giants such as TSMC and Intel have begun to feel frustrated.

It takes about two years from the construction of the wafer factory to the start of stable mass production.

If construction is not started this year, there is a possibility that semiconductor materials will run short in two years.

SUMCO’s production :

On the other hand, SUMCO is calm.

CEO Hashimoto asserts, “If there is no prospect of a price increase, we will not build a new factory.”

There are two reasons:

One reason: the past curse that danced to the “Silicon Cycle”.

Demand plummeted due to the 2008 Lehman shock, and SUMCO suffered a large deficit due to overcapacity.

This is the reason why it doesn’t move to easy investment.

CEO Hashimoto:

“If the price of 300mm wafers does not rise by 60%, the break-even point will not be exceeded,” it is estimated.

While the power on the wafer supply side is strong,

Win the increase in wafer price,

SUMCO’s profits will steadily increase,

That, it is thought that investment from with a prospect.

According to market participants, Shin-Etsu Chemical is also in talks to raise prices.

Japan occupies 55% of the world market share.

Japan is confident in its wafer technology.

Second reason:

British Omdia Report:

Shinetsu, the leader, and SUMCO, the second, occupy 55% of the world wafer market share.

The more cutting-edge products, the clearer the oligopoly tendency of the two companies.

Semiconductor performance depends on the circuit line width.

However, these two companies are currently the only companies that can mass-produce cutting-edge 5 nanomaterials.

Global Wafers:

Taiwan’s ring-shaped crystal circle (Global Wafers), which is in third place, cannot catch up with the Japanese due to its technological capabilities.

Currently, Taiwan’s ring-shaped crystal circle, which is in third place, is in the process of acquiring Siltronic, Germany, which is in fourth place.

Wafers are directly linked to semiconductor quality

Wafers are directly linked to the quality of semiconductors.

TSMC says, “In advanced product development, we have no choice but to choose SUMCO and Shinetsu as partners.”

SUMCO and Shinetsu:

It takes a lot of time for wafer makers around the world to catch up with the two.

Therefore, SUMCO and Shinetsu can continue to be bullish on the repeated requests for increased production.

Advanced technology development capabilities of the two companies:

Due to the shortage of semiconductors, the shortage of wafers has begun to be revealed.

It is no exaggeration to say that the investment decisions of the two companies hold the fate of the semiconductor industry.

that is

If you continue to hone your overwhelming skills,

Even if you invest blindly and don’t pursue market share

It suggests that it can exert its presence.

Nikkei Business Electronic Edition