Korean LNG carrier: Confused about huge license fee payment!

– Burden of heavy royalty payments –

French GTT:

France GTT is

We are collecting “a huge license fee from South Korea” for “technical licensing of LNG carriers and cargo holds”.

For LNG carriers built by Korean shipyards,

France’s GTT secured a “more than 20% profit increase in Q1 2023”.

French GTT achievements:

GTT announced on April 20 that it had 1Q sales of €79.89 million (116.9 billion won).

GTT’s profit increased by 17.2% compared to the same period last year.

Performance of South Korean shipbuilders:

In spite of receiving orders for large LNG carriers, with huge royalty payments,

“The 1st Q will continue to be in the red,” and there will be almost no profit.

Serious lack of technical skills:

Korean companies cannot develop their own technology for cargo holds, and it is undeniable that they lack technological capabilities.

GTT’s LNG and ethane division:

“LNG Cargo Hold Royalties” increased by 23% from last year,

Recorded “royalty income of 66.24 million euros (96.9 billion won)”.

“90% of all royalty income” is “collected from Korean shipyards.”

This means

that the three major Korean shipbuilders paid around 90 billion won in royalties to GTT in the first quarter alone.

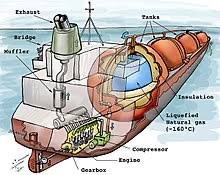

GTT has the original technology for membrane-type LNG cargo holds.

It is a technology that has become a de-facto standard around the world

as it can carry more LNG than the past spherical Moss-type LNG cargo hold and rarely causes safety problems.

Global ship owners

stick to the use of GTT membrane technology thanks to decades of its technological reliability.

As it monopolizes the LNG cargo hold market, it has enormous price negotiation power.

Korean shipbuilders

pay about 5 percent of a ship price as the GTT cargo hold technology license fee.

Korean shipbuilders

are barely making ends meet despite receiving large LNG carrier orders, paying huge royalties on top of rising raw material prices.

According to FnGuide, securities firms

expect Daewoo Shipbuilding & Marine Engineering (DSME) to record an operating loss of 41.7 billion won in the first quarter of 2023.

Since 2021, it has posted losses in every quarter.

In the first quarter,

HD Hyundai Heavy Industries (HHI) is expected to record a surplus in the 40 billion won range in the black.

As GTT’s market dominance grows,

the Korean Fair Trade Commission (FTC) puts on the brakes, and the Korean shipbuilding industry is also promoting the localization of cargo holds.

But the industry still has a long way to go in the localization of cargo holds.

The FTC came to the conclusion

that GTT was abusing its market dominating power, so it ordered GTT to stop tying technology licenses and technical support services.

The case went all the way to the Supreme Court and recently ended with GTT losing the case.

“Thanks to the court ruling, we are now able to purchase licenses and technical support separately, but GTT still has huge negotiating power, so there are no big practical benefits from the ruling yet,” an industry insider said.

In order to reduce royalties worth hundreds of billions of won each year,

Korean shipbuilders have started to develop in-house cargo holds, but they are in trouble.

KOGAS and the three shipbuilding companies delivered their first LNG carrier in 2018 equipped with Korea’s first LNG cargo hold, KC-1.

However,

as a cold spot phenomenon occurred and accordingly cold air from the cargo hold was transferred to the hull of the ship, the carrier had to repeatedly undergo repairs.

KOGAS, SK Shipping, and Samsung Heavy Industries, which built the ship,

are at loggerheads in court over this matter.

However, recently,

a technical judgment has been made that the cargo hold can run at six degrees or higher, expanding anticipation for cargo hold localization in the long term.

GTT, which has relied on Korean shipbuilders for 90 percent of its cargo hold license fees,

is also trying to expand its license sales to Chinese shipbuilders.

Last year, GTT decided to issue cargo hold licenses to them.

“GTT is pumping up its license sales pitch to Chinese shipyards while beginning cargo hold design for four LNG carriers for a Chinese shipbuilder in April.”

– Businesskorea

http://www.businesskorea.co.kr/news/articleView.html?idxno=113417

Méthanier coréen : Perplexe face au paiement des frais de licence énormes !

– Fardeau des lourds paiements de redevances –

GTT français :

France GTT est

Nous percevons “un énorme droit de licence de la Corée du Sud” pour “l’octroi de licences techniques aux transporteurs de GNL et aux soutes”.

Pour les méthaniers construits par les chantiers navals coréens,

Le français GTT a obtenu “une augmentation de plus de 20% de ses bénéfices au premier trimestre 2023”.

Réalisations GTT France :

GTT a annoncé le 20 avril avoir réalisé un chiffre d’affaires de 79,89 millions d’euros au premier trimestre (116,9 milliards de wons).

Le bénéfice de GTT a augmenté de 17,2 % par rapport à la même période l’an dernier.

Performance des constructeurs navals sud-coréens :

En dépit de commandes pour de grands méthaniers, avec d’énormes paiements de redevances,

“Le 1er Q continuera d’être dans le rouge”, et il n’y aura presque aucun profit.

Manque sérieux de compétences techniques :

Les entreprises coréennes ne peuvent pas développer leur propre technologie pour les soutes, et il est indéniable qu’elles manquent de capacités technologiques.

La branche GNL et éthane de GTT :

Les « Redevances de retenue de cargaison de GNL » ont augmenté de 23 % par rapport à l’année dernière,

A enregistré “des revenus de redevances de 66,24 millions d’euros (96,9 milliards de wons)”.

« 90 % de tous les revenus de redevances » sont « perçus auprès des chantiers navals coréens ».

Koreanischer LNG-Carrier: Verwirrt über riesige Lizenzgebührenzahlung!

– Belastung durch hohe Lizenzgebühren –

Französische GTT:

Frankreich GTT ist

Wir kassieren „eine riesige Lizenzgebühr von Südkorea“ für die „technische Lizenzierung von LNG-Tankern und Frachträumen“.

Für LNG-Tanker, die von koreanischen Werften gebaut werden,

Frankreichs GTT sicherte sich im ersten Quartal 2023 eine Gewinnsteigerung von mehr als 20 %.

Französische GTT-Erfolge:

GTT gab am 20. April bekannt, dass es im ersten Quartal einen Umsatz von 79,89 Millionen Euro (116,9 Milliarden Won) hatte.

Der Gewinn von GTT stieg im Vergleich zum Vorjahreszeitraum um 17,2 %.

Leistung der südkoreanischen Schiffbauer:

Trotz des Erhalts von Aufträgen für große LNG-Tanker mit enormen Lizenzgebührenzahlungen

„Das 1. Q wird weiterhin im Minus sein“, und es wird fast keinen Gewinn geben.

Schwerwiegender Mangel an technischen Fähigkeiten:

Koreanische Unternehmen können keine eigene Technologie für Frachträume entwickeln, und es ist unbestreitbar, dass ihnen technologische Fähigkeiten fehlen.

LNG- und Ethan-Sparte von GTT:

Die „LNG Cargo Hold Royalties“ sind gegenüber dem Vorjahr um 23 % gestiegen,

Verzeichnete „Lizenzeinnahmen von 66,24 Millionen Euro (96,9 Milliarden Won)“.

„90 % aller Lizenzeinnahmen“ werden „von koreanischen Werften eingezogen“.