South Korea: Joint venture investment 27 trillion won, EV production of 4 million units:

U.S. Automobile Big Three

3 Korean batteries

Joint Venture Investment:

A joint venture between GM, Ford, Stellantis and three Korean battery companies.

The total investment amount is 27 trillion won (2.57 trillion yen)

It is estimated to reach 30 trillion won including the independent investment by the Korean battery industry.

Joint production scale:

The annual production scale is 330GWh (GWh), and more than 4 million EVs can be produced.

EV share in the US market:

In the US automobile market of 14.9 million units last year, EV accounts for 3% (430,000 units).

The number of EVs is 4 million, which is 10 times that. It was

GM

LG Energy Solutions

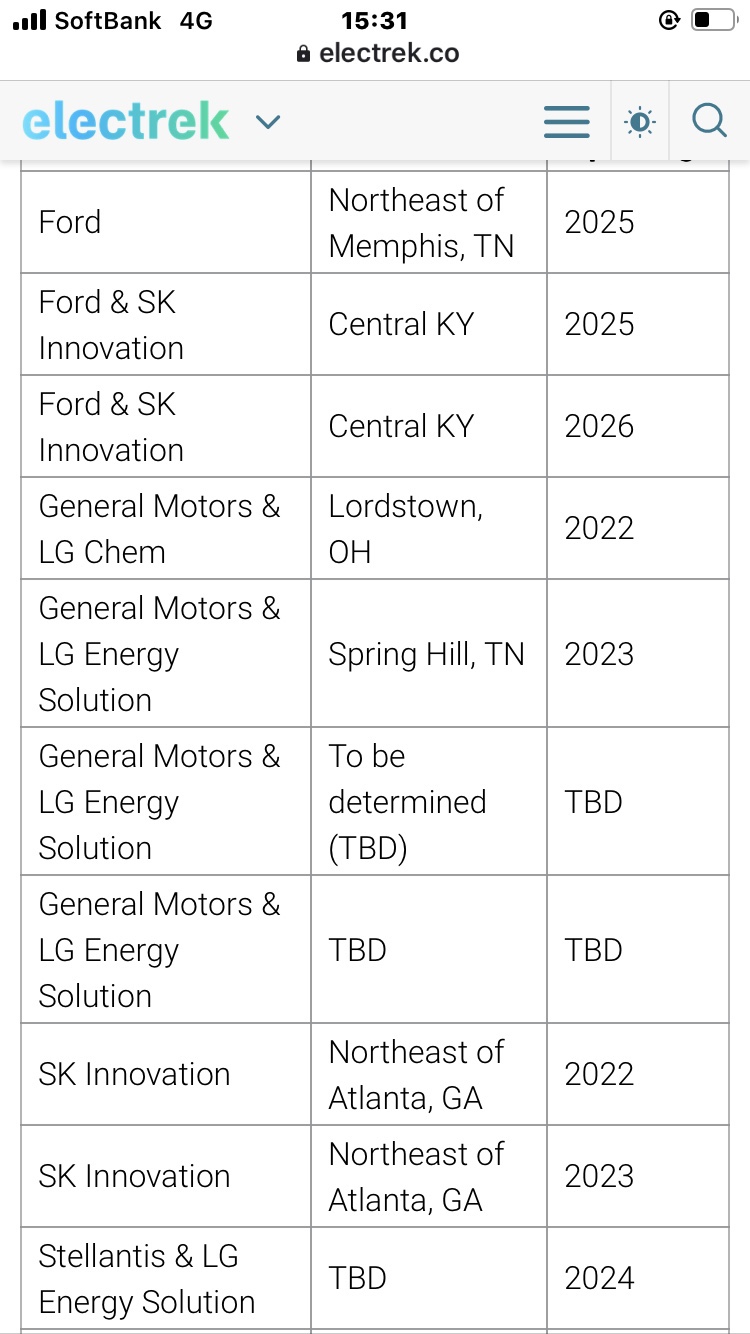

The leader is an alliance between GM and LG Energy Solutions, and the production scale at the four plants is expected to reach 140 GWh.

Ford

SK on

Ford and SK production scale is 129GWh,

Stellantis

LG, Samsung SDI

Stellantis will be produced at one plant each for LG and Samsung SDI, with a total scale of 63 GWh.

Tesla

Panasonic in Japan

Panasonic in Japan is reluctant to collaborate with other than Tesla.

Korean manufacturers have entered an era of opportunities with aggressive investment.

Big three

Hyundai Motor,

Honda,

It is likely to choose a Korean manufacturer to build a battery factory in the United States.

The fast-growing US EV industry will depend on South Korean batteries.

US Automotive Industry:

It is an important manufacturing industry that employs at least 1.8 million people directly and indirectly.

It accounts for 3% of US GDP.

The Biden administration has expressed a strong will to transform the US automobile industry into EVs.

Korean battery material manufacturer:

Currently, Korean battery material makers are being pushed by China’s low-price offensive.

A Korean material manufacturer has an opportunity to expand its business in the United States.

Korea POSCO Chemical

Korea Eco Pro BM

POSCO Chemical and EcoPro BM are positive electrode materials,

Enchem has an electrolyte production plant

Each decided to build in the United States.

Battery Supply Chain Alliance:

Batteries are led by Korean, Chinese and Japanese manufacturers.

US automakers will secure a stable supply through joint venture production in the United States.

Korean material makers depend on China:

The big problem is

Korean battery maker

The material is mostly dependent on China.

Imported two major materials from China:

Material of positive electrode material

Precursor used as a material for positive electrode material (powder mixed with NI, CO, MN)

Material of negative electrode material

Graphite, which produces negative electrode materials,

Korean manufacturers mostly procure the two major battery materials from China.

Battery industry insider:

US battery factories have no choice but to use materials imported from China.

In the future, the United States is likely to demand South Korea to diversify its supply chain.

Biden administration:

Last year, for major semiconductor manufacturers such as Samsung Electronics, which entered the United States

Requested supply chain information, including trade secrets.

Rui Yasuda University of South Korea

Professor Park Chulwan

This time, he advises that the “supply chain alliance” with the United States should expand the front line.

for example,

Korean semiconductors collaborate with US automobiles

Sign new supply contracts with the United States, Australia and Southeast Asia.

Of cobalt, lithium, nickel, graphite,

By entering the resource development business, the United States and South Korea can greatly reduce their dependence on China.

However, it is not easy for the United States and South Korea to do it.

Chosun Online | Chosun Ilbo

http://www.chosunonline.com/m/svc/article.html?contid=2022012880197

13 battery gigafactories coming to the US by 2025 – ushering new era of US battery production – Electrek

https://electrek.co/2021/12/27/13-battery-gigafactories-coming-us-2025-ushering-new-era/