Softbank G: 10 trillion yen Fund is in good shape: Unrealized gain of 2,084.2 billion yen

-Behind the good performance, there are also issues-

Softbank G:

SoftBank Group (SBG) financial results for the April-December period of 2020 announced on February 8.

SBG’s financial results interview:

It generated a net profit of 3,055.1 billion yen.

However. President Masayoshi Son of SBG seems to be still not satisfied even if he makes such a profit.

SoftBank Vision Fund:

Most of the huge profits were invested in more than 10 trillion yen for venture companies around the world.

The first fund to be managed from 2017,

No. 2 fund started in 2020,

In total, it posted a return on investment of 2,728.8 billion yen.

Unrealized gains on unlisted stocks:

Unrealized gains from rising prices of listed stocks held by most and rising fair value of unlisted stocks.

Unrealized gain amounted to 2,084.2 billion yen.

At the time of the announcement of financial results, due to the recent rise in stock prices, “there is a profit in the latter half of hundreds of billions” (President Son).

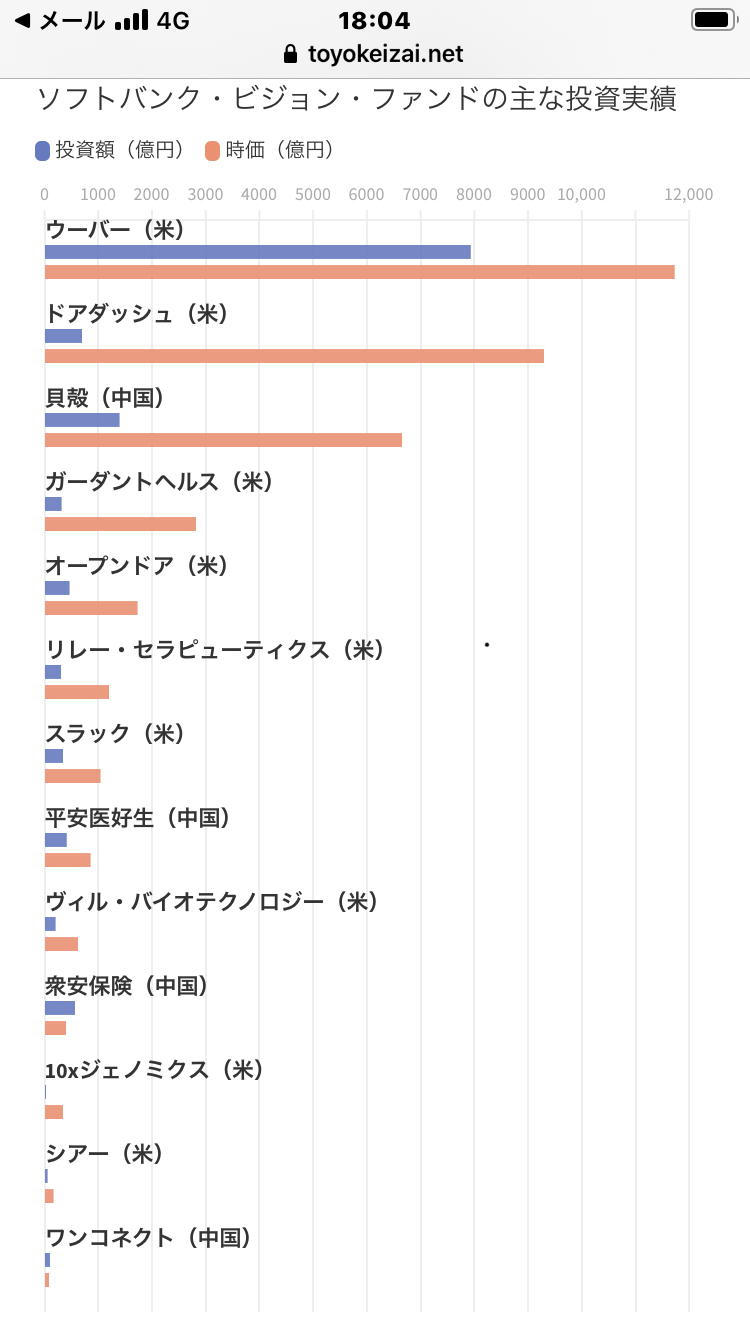

Main investment destinations:

Door dash:

Among them, the largest unrealized gain was brought by DoorDash, the largest food delivery service in the United States, which was listed in December 2020.

The Vision Fund has invested a total of approximately 70 billion yen four times since 2018.

As of the end of December after listing, the market value has risen to about 930 billion yen.

Uber Technologies:

In addition, Uber Technologies Inc., a major American ride-sharing company, was listed in May of the following year after investing about 790 billion yen in December 2018.

Although the stock market crashed temporarily, it picked up in the latter half of 2020, and the market value at the end of December was 1,170 billion yen.

This also generated a large unrealized gain.

Huge loss last year:

Vision Fund

In the fiscal year ended March 2020, a huge loss was spilled due to the “management problem of WeWork, a major US share office.”

However, at present, although it is an unrealized gain, it is showing a literal V-shaped recovery.

Alibaba stock plunge:

President Son emphasized the performance of the Vision Fund from beginning to end at this press conference.

On the other hand, there are some topics that did not take much time.

Whereabouts of Alibaba Group in China:

Alibaba shares account for half of the total value of SBG’s shares held, and the impact of the decline in Alibaba shares is significant.

Listed stock investment fund launched last summer:

Listed stock investment performance at the end of December was revealed in this financial result.

The situation of a deficit of over 100 billion yen.

This may be the reason why President Son is not satisfied with the net profit of 3 trillion yen.

Toyo Keizai Online