Samsung Electronics: Mass production of D1z process DRAM: EUV lithography

Samsung Electronics:

Finally, mass production of DRAM for the “D1z” process has started.

Introduced the long-awaited EUV lithography technology for the last few months.

EUV lithography technology:

Samsung has already started in early 2020

ArF immersion based D1z DRAM and

Both EUVL-applied D1z DRAM,

He announced that he would develop the product.

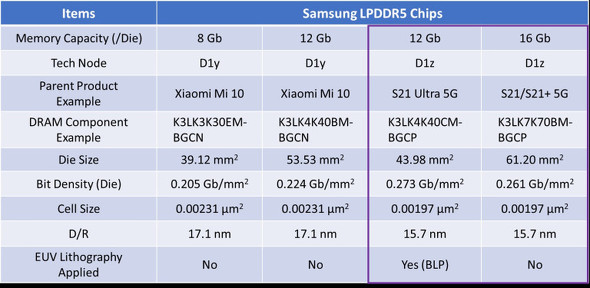

New product of D1z process:

D1z 8Gbit DDR4 DRAM and

D1z 12G Bit LPDDR5 DRAM,

Developed D1z 16Gbit LPDDR5 DRAM.

Both have achieved high performance.

“Galaxy S21 5G” series:

12Gbit and 16Gbit LPDDR5 is the latest smartphone in January 2021

“Galaxy S21 5G” series:

“S21 5G”

“S21 + 5G”

It is installed in the “S21 Ultra 5G”.

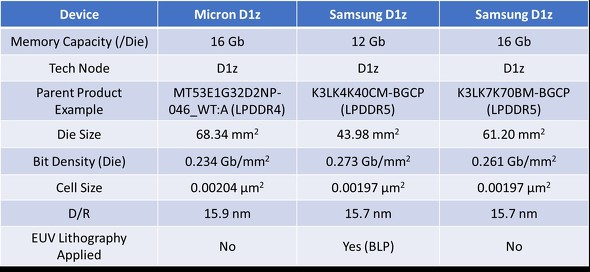

D1z LPDDR5 development method:

Initially based on ArF-i and EUV.

D1z LPDDR5 was developed by applying SNLP (Storage Node Landing Pad) / BLP (Bit Line Pad) lithography.

Currently, it is presumed that “EUV SNLP / BLP lithography has been applied to all D1z LPDDR5 products.”

D1z chip manufacturing plant:

In the latter half of 2019, 1 million “sample modules with D1x EUV lithography” were shipped.

It seems that the D1z chip will be manufactured at the second production line in Pyeongtaek (Pyeongtaek), Gyeonggi-do, South Korea.

Development of next-generation DRAM:

Samsung plans to develop next-generation DRAM in 2021

The company plans to continue increasing EUVL processes for next-generation DRAMs such as D1α and D1β in 2022.

TechInsights-EE Times Japan

https://eetimes.jp/ee/articles/2102/26/news142.html

Samsung D1z LPDDR5 DRAM with EUV Lithography (EUVL) – Memory TechStream Blog | TechInsights

https://www.techinsights.com/ja/node/33575

Samsung Electronics: All Eyes on Memory Semiconductors

In 2021, the company

is expected to secure operating profit ofKRW28.7tr (+52.7% YoY) from semiconductors,

KRW12.3tr (+7.3% YoY) from IM,

KRW4.1tr (+83.0% YoY) from displays,

KRW3.3tr (-8.0% YoY) from CE.

Time to focus on the flagship memory business

We believe the key driver behind the share price rally

is shifting from improvement in valuations to expectations for earnings growth.

During the steep rally at the end of last year and early this year, valuation multiples rose sharply on high expectations for non-memory semiconductors.

However, Samsung Electronics is unlikely to see significant earnings contribution from the non-memory business in the near term.

Nearly 60% of its profits come from memory semiconductors.

The key investment point

is that the focus is now turning from non-memory to memory.

Memory market conditions

should improve rapidly with the spike in DRAM prices and a market turnaround for NAND.

SK Hynix,

Micron Technology,

Western Digitalhave rallied recently on such expectations.

We see no reason for Samsung Electronics, the world’s largest memory chipmaker, to be left out.

Now is the time to focus on a turnaround in memory semiconductors.

Businesskore

http://www.businesskorea.co.kr/news/articleView.html?idxno=61307