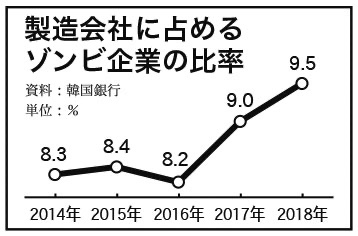

Listed companies in South Korea: 1 out of 5 companies are zombies!

-In Japan, 58% are “debt-free management”-

According to Chosun Ilbo (May 23),

20% of South Korean listed companies cannot pay interest on the money they earn. It published an article titled “Zombie companies double what they were 6 years ago.”

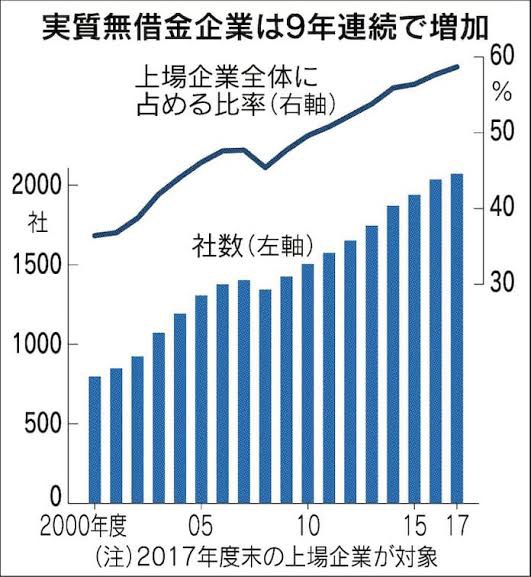

On the other hand, Japanese companies are practically debt-free (deposits exceed debts), accounting for 58% of the manufacturing industry.

The gap in financial power between Japan and South Korea has widened beyond imagination.

1 in 5 South Korean listed companies are zombie companies, twice as many as 6 years ago – chosunonline

https://www.chosunonline.com/site/data/html_dir/2023/05/23/2023052380012.html

Korean National Federation of Business Organizations:

On May 22, we analyzed the financial status of listed companies (2,347 companies) including those on the OTC market as of the end of 2022.

As a result, 17.5% (410 companies) were found to be zombie companies.

The ratio of zombie companies increased by 8.2 points from 9.3% (218 companies) in 2016.

Zombie companies are:

A company that has been unable to pay interest on loans for three years or more with its operating profits.

Majority of Japanese manufacturers are debt-free:

According to the Nihon Keizai Shimbun (May 24), Japanese manufacturers do not borrow funds from financial institutions.

58% of the manufacturing industry has “substantial debt-free management”.

Majority of Japan’s Manufacturing Industry Is “Virtually Debt-Free” – Financing, AI Opens the Way

https://www.nikkei.com/article/DGKKZO71266050T20C23A5EE9000/

Katsumata Jura’s World View comments,

Japan’s virtually debt-free situation is a problem for financial institutions. If lending does not increase, financial institutions will not be profitable.

Furthermore, in the era of zero interest rates, the profit margins of financial institutions have been squeezed.

For financial institutions, if lending does not increase, there is no profit.

Japanese financial institutions need to have a “positive attitude like venture capital”.

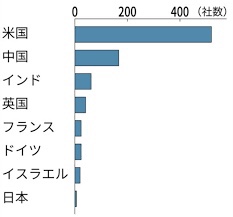

As of February 2022 (Source: Created from Keidanren materials)

Mitsubishi UFJ Bank

Mr. Hideo Iwano

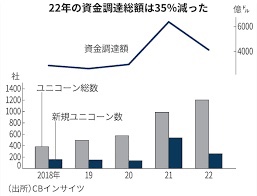

Japan lags behind Europe and the United States in creating unicorns. This is partly due to the lack of funding from financial institutions.

Even if the current business performance is not good, by buying the future potential of the company, it is possible to accept unsecured loans.

https://hisayoshi-katsumata-worldview.com/archives/32398154.html