China: Debt Levels of Listed Non-Financial Companies: Worst Ever

Reuters:

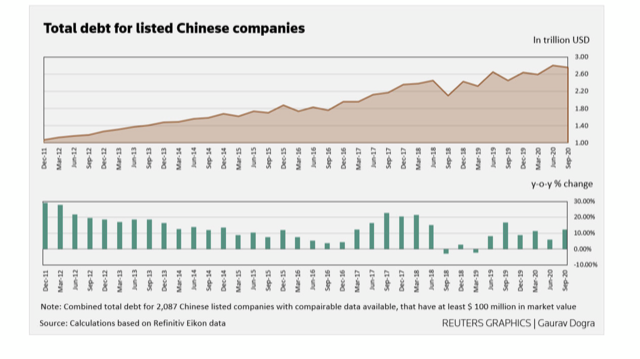

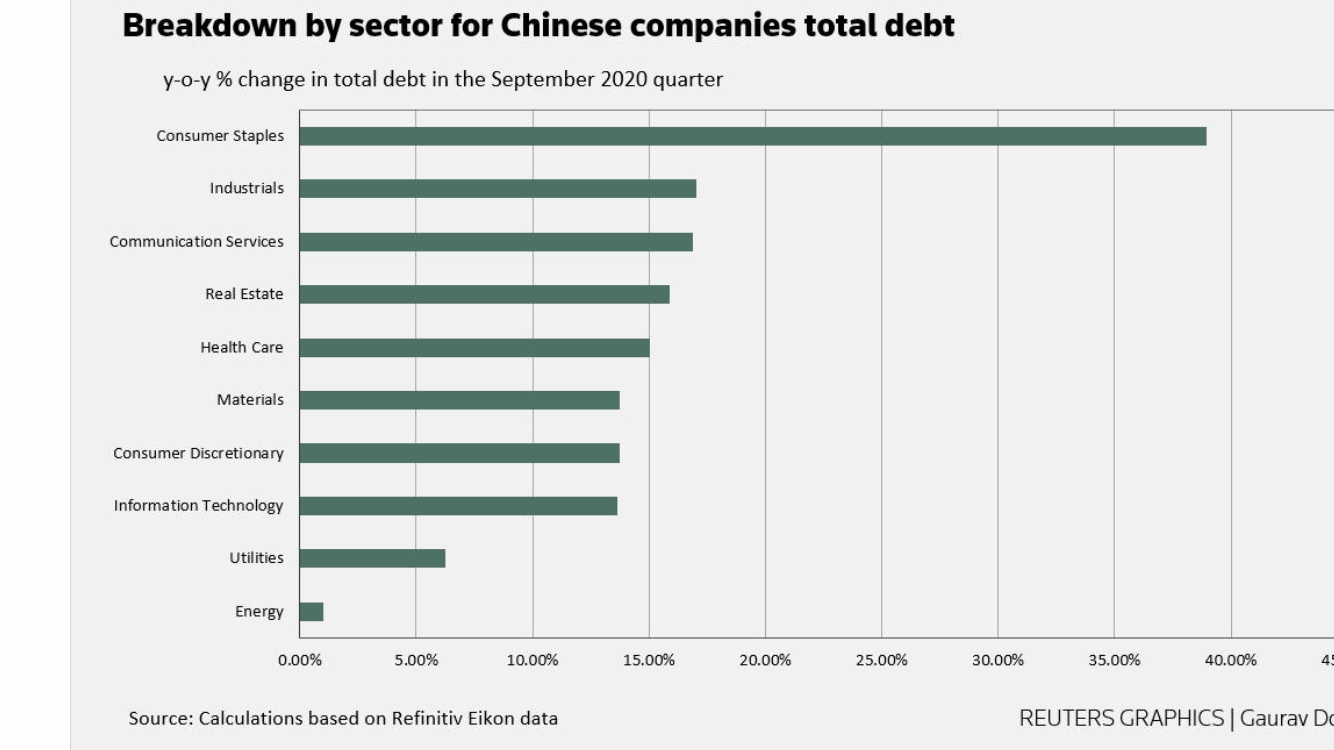

We analyzed 2087 listed non-financial companies in China with a market capitalization of more than $ 100 million.

As of the end of September 2020, the total debt was $ 2.76 trillion.

It increased by about 12.5% year-on-year, the largest increase in the past year.

It is slightly below the record low of $ 2.8 trillion at the end of June.

Institute of International Finance (IIF)

Global debt is expected to reach a record $ 277 trillion by the end of the year.

China’s debt-to-gross domestic product (GDP) ratio for the third quarter was 335%.

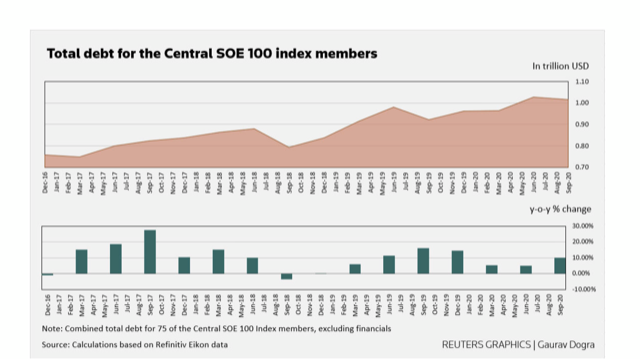

China State-owned Enterprise (SOE) Financing:

Aggressive financing by Chinese state-owned enterprises (SOEs) is also prominent this year.

CSI Central SOE100 Index:

The total debt of 75 constituent companies excluding finance increased 10.2% year-on-year in the quarter, the first increase in three quarters.

Frequent defaults in recent weeks:

Yongcheng Meiden Holding Group, a state-owned coal company

Brilliance Auto Group, the parent company of the German BMW joint venture,

State-owned semiconductor manufacturer Tsinghua Unigroup, etc.

It became the default one after another.

Debt repayment deadline:

Based on Refinitiv data,

By the end of next year, Chinese non-financial companies will have at least $ 815 billion worth of debt due.

Reuters

https://jp.reuters.com/article/china-corporate-borrowing-idJPKBN28504M

Why China’s Debt Defaults Are More Alarming This Time: QuickTake – Bloomberg

Major Chinese Chip Company Defaults on Debt

https://www.wsj.com/articles/major-chinese-chip-company-defaults-on-debt-11605607470