Putin: Can’t rely on “Chinese yuan”: Gold reserves only

-Financial measures for the United States-

G7 Treasury Minister:

“If Russia invades the military, it will impose economic sanctions,” he said in a statement on February 14.

Biden administration:

“Exclude Russian banks from the international dollar fund settlement network.”

Banks with blocked dollar access will be unable to do international operations.

“In the past financial sanctions, the representative target countries are North Korea and Iran.”

Soviet Union dismantled in 1991

The Putin administration has a bitter lesson from the former Soviet era.

US Government of Reagan in 1980:

In the early 1980s, the Reagan administration took a high interest rate policy and plunged crude oil prices.

The Soviet economy was exhausted because it relied on dollar-denominated oil revenues.

Gorbachev administration in 1985:

The Gorbachev administration, which was inaugurated in 1985, has embarked on a reform path.

However, it proceeded to the fall of the Berlin Wall in 1989 and the dissolution of the Soviet Union in 1991.

Contents of the Russian economy:

Currently, “30% of the total revenue of the Russian government is oil and gas revenue.”

Of course, the world energy market is denominated in dollars.

Putin’s administration laid the groundwork for dollar-free dependence,

It has been accelerating the dollar away from several years ago.

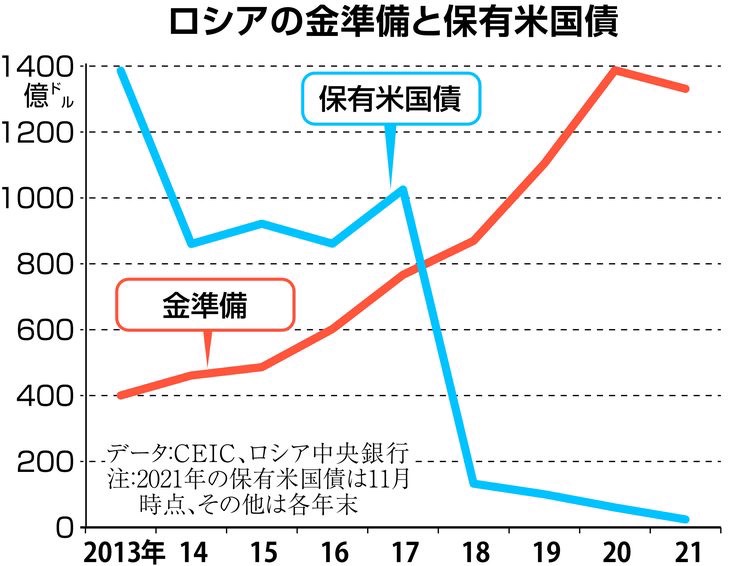

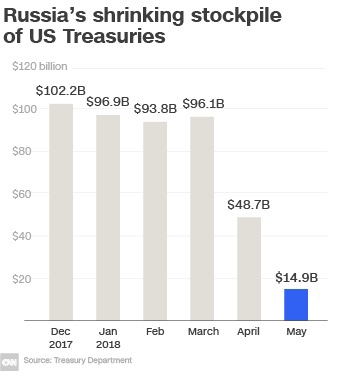

Russia’s US Treasury Decline:

2013

Russia held $ 140 billion (16,160 billion yen) US Treasuries in 2013.

2018

Russia drastically reduced US Treasuries to $ 13.2 billion in 2018.

2021

Russia’s holdings of US Treasuries fell to $ 2.4 billion (¥ 277 billion) in November last year.

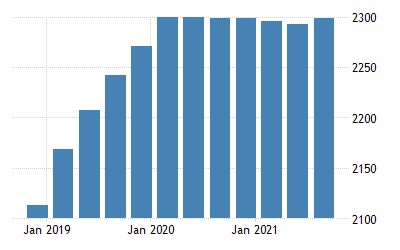

Increased Russian gold reserves:

Instead, it’s gold reserves that are skyrocketing.

Mr Putin, the foundation for gold reserves from 2018.

It was about $ 40 billion in 2013.

It increased by nearly $ 140 billion in 2020.

Russia and the dollar payment network:

Even if Russia’s is removed from the dollar settlement network

If the transaction currency is denominated in a currency other than the dollar, the impact on Russia will be lightened.

Russian yuan assets

National Welfare Fund

The National Welfare Fund, a Russian foreign investment fund.

The asset composition of the National Welfare Fund by currency is

In January 2009, the dollar denominated was 51.2 billion dollars, but in July 2009, the dollar denominated was set to zero.

Instead, it increased its RMB-denominated assets to $ 35 billion.

China-Russia Currency Union:

“For Russia, the current yuan is like a piece of paper.”

“Russia will supply natural gas with China at the start of the Beijing Winter Olympics”.

but,

“The currency of payment with China is the euro, and the yuan cannot be used,” he said.

Euro tightening:

The future focus will be on how far Germany, France and the United Kingdom will be in tune with the United States.

–zakzak: Yukan Fuji official website

https://www.zakzak.co.jp/article/20220218-A7Y5KKB36RJE5AK3XFABDE2544/