Russia: Default chain, nightmare of 17.7 trillion yen

-March 16 If interest payment is not possible, it is a serious situation-

March 16, 2022

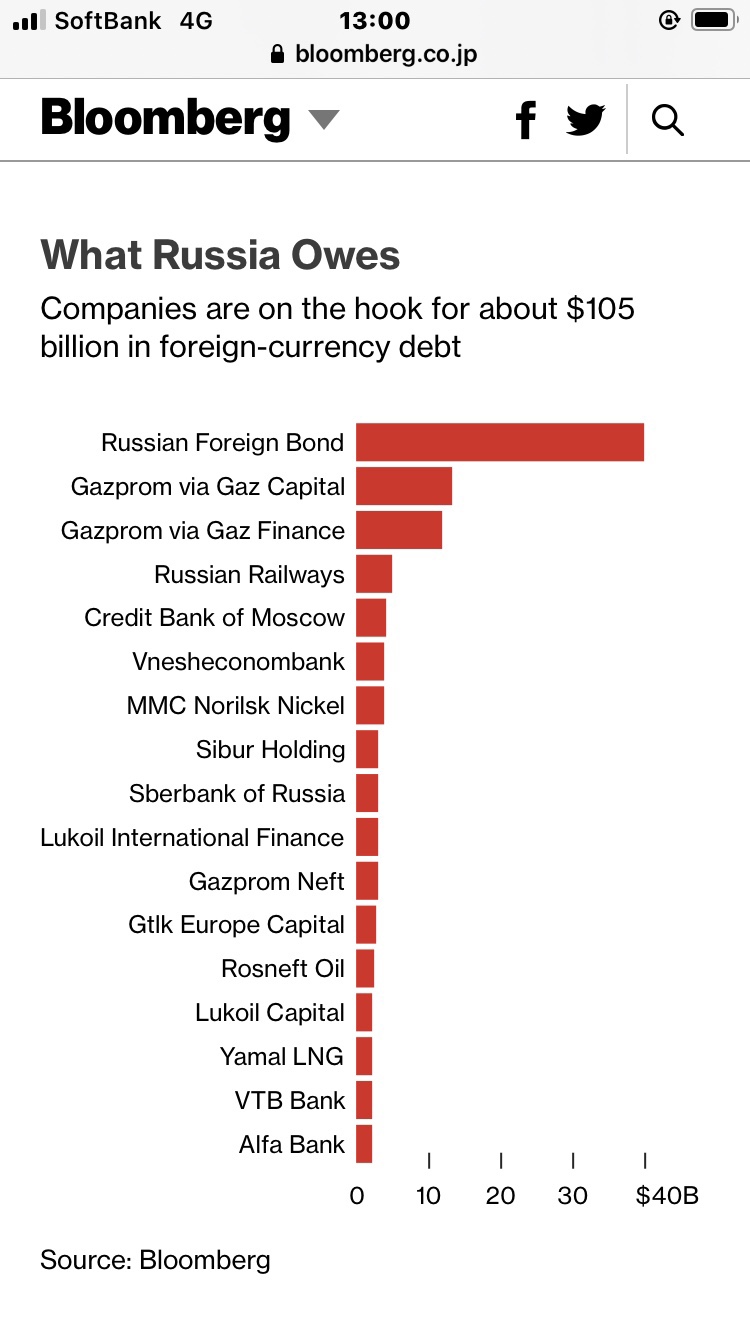

Russian Foreign Currency Debt:

“Foreign currency-denominated debt, including government bonds, Gazprom and Sberbank corporate bonds,” is $ 150 billion.

It may affect not only major managers but also pensions and donation funds.

Russian government bonds are junk-class:

The Russian economy was exhausted, the currency ruble plunged, and government bonds were downgraded to the junk level (speculative rating).

The next time default becomes a reality, investors will incur huge losses.

Two Russian dollar-denominated government bonds:

The interest payment deadline for a total of 117 million dollars (about 13.8 billion yen) will come on the 16th.

Government payment procedures should begin.

However, the warning light is blinking and

Since the Russian invasion of Ukraine

The value of investment has plummeted, and bondholders have reached a critical stage.

Dollar-denominated gov bond interest payment due date arrives on the 16th:

If interest payment is not possible or ruble payment is made,

The nightmare of chain defaults becomes a reality.

Chained default nightmare:

It’s not just government bonds.

Natural gas Gazprom,

Oil company Lukoil,

It also involves the corporate bonds of Sberbank, the largest bank.

A chain default of “foreign currency-denominated debt (total of 150 billion dollars = 17.75 trillion yen)” will occur.

–Bloomberg

https://www.bloomberg.co.jp/news/articles/2022-03-16/R8RUNUT1UM0W01