Chinese Real Estate: Deficit Widening from Private to State-Owned

– Chinese Government “Emergency Investigation of 10 Provinces in Financial Crisis”-

– 18 out of 38 state-owned developers are in the red in the first half –

We will deliver a summary from the hisayoshi-katsumata-worldview article.

China’s real estate crisis:

The economic slump is getting worse.

Real estate companies are expanding deficits from private sector to state-owned.

The central government was forced to conduct an emergency investigation into the financial crisis of 10 provinces.

Bloomberg (August 18)

We published an article titled China’s real estate crisis spreads from the private sector to the government.

China’s state-owned property developer warns of widespread losses.

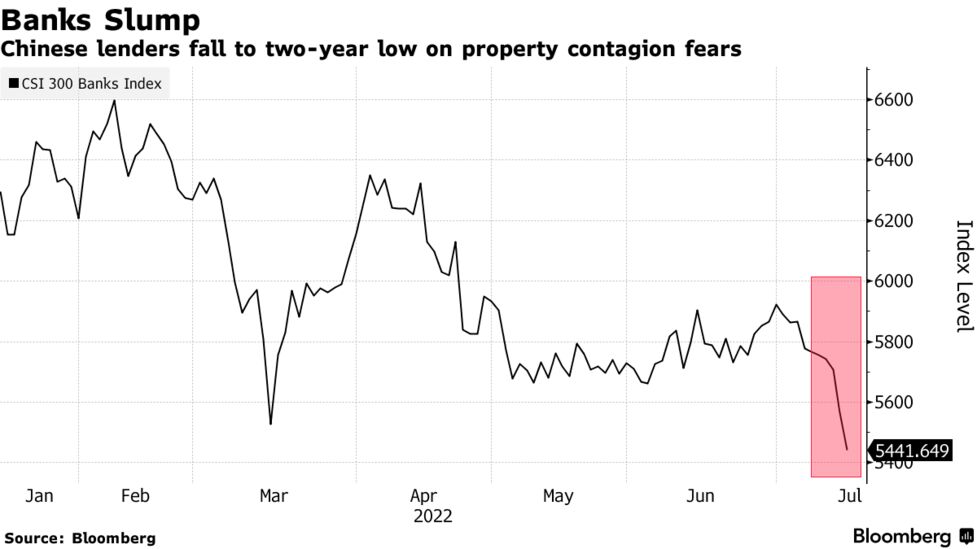

The housing crisis spread from the private sector to government-backed businesses.

Bloomberg research

Aggregate filings of real estate developers.

38 state-owned developers listed in Hong Kong and mainland China.

18 companies tentatively reported losses in the first half (January to June).

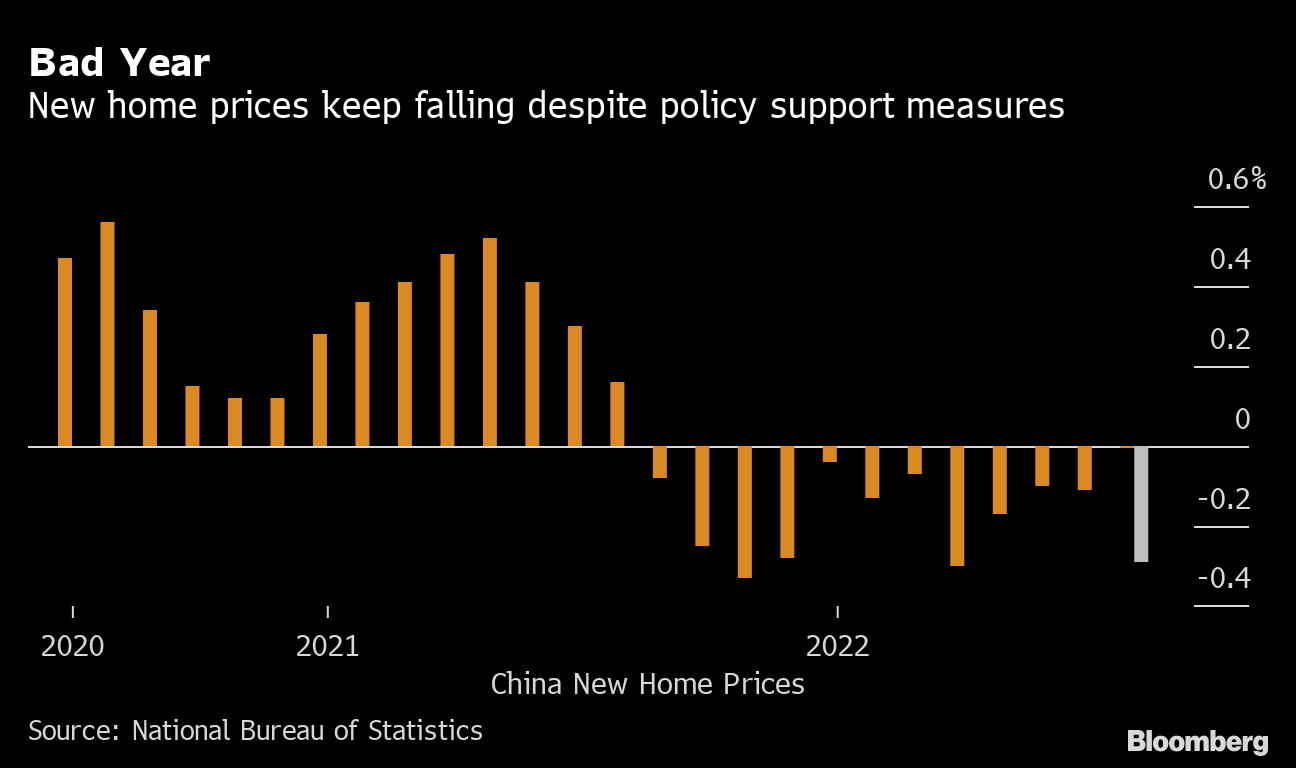

Two years of housing recession

In 2022, the number will increase from 11 companies for the full year.

Of the 38 listed state-owned developers, 18 are in the red in the first half of this year.

Two years ago, only four companies were in the red. The number of companies in the red is increasing rapidly.

inancial times

On August 12, the State Council of China dispatched a “Debt Settlement Investigation Team” to 10 provinces suffering from financial deterioration.

Debt Settlement Research Team

The investigation team includes the Ministry of Finance, the central bank and the China Securities Regulatory Commission.

This is the result of the rapid decline in funds for selling land due to the bursting of the real estate bubble.

All because of the collapse of the land standard.

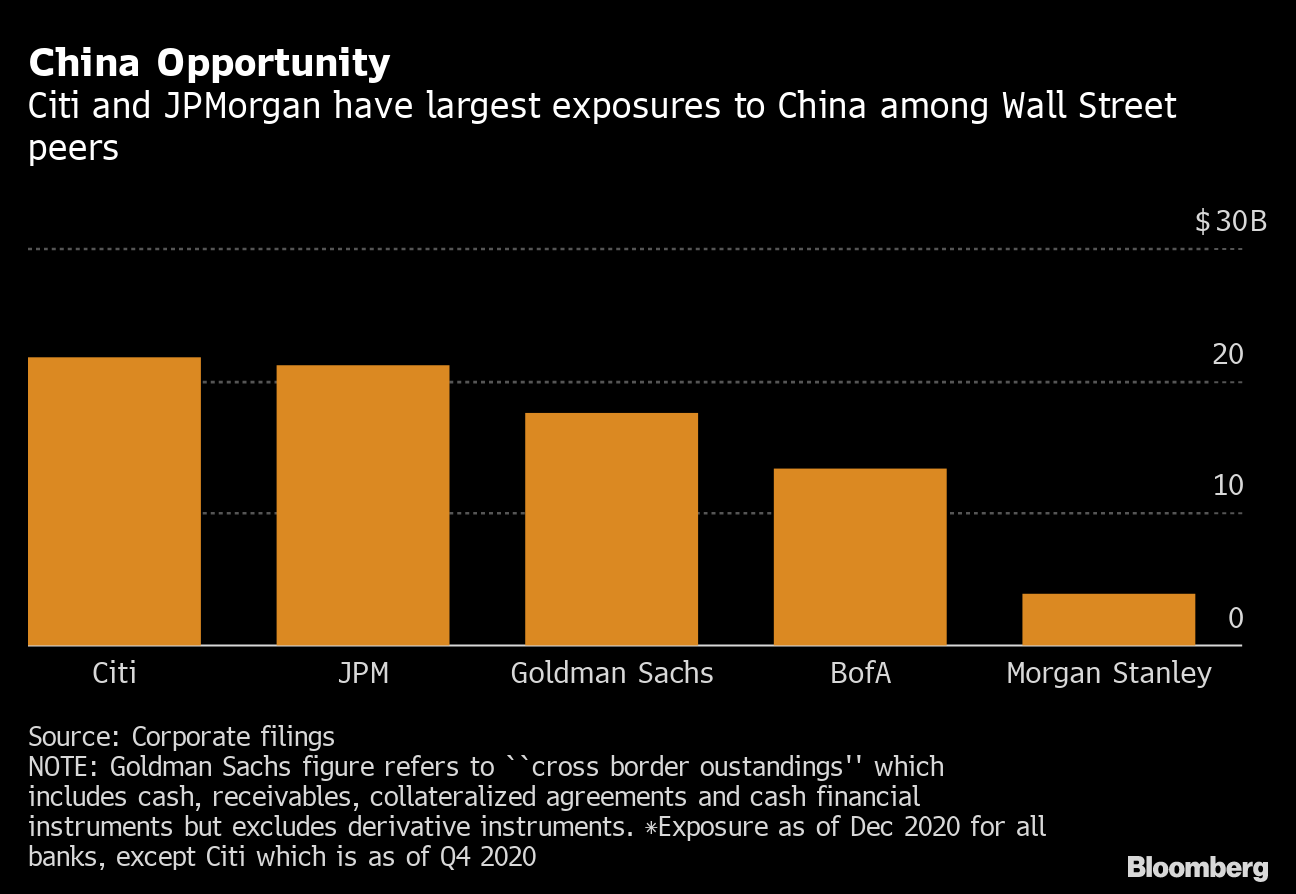

Large investment bank: Goldman Sachs

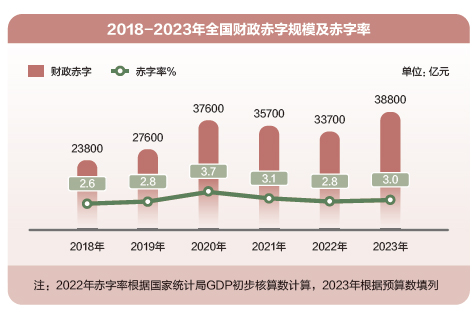

On August 12, it was estimated that the debt scale of local governments in China would reach 94 trillion yuan (1,880 trillion yen).

Local government debt in China’s GDP rose from 62.2% in 2019 to 76% last year.

local government anxiety

The construction of condominiums in small and medium-sized cities was suspended all at once due to the Hekkeien problem. Residents’ anger explodes.

homebuyers backlash

In Zhengzhou, Henan province, last year, home buyers protested against the suspension of construction, sparking demonstrations.

In a hurry, the local government allocated a budget of 5 billion yuan to resolve the situation.

Such incidents will occur frequently in the future.

![中国最大の不動産デベロッパー碧桂園のデフォルトが近い: Shuli Ren[ブルームバーグ・オピニオン]](https://www.axion.zone/content/images/2023/08/400786855.png)

f Hekkeien is the default

When the construction of Hekkei-en’s condominium is suspended, residents start protesting.

China, which had been enjoying the benefits of the real estate bubble, turned into hell.

https://hisayoshi-katsumata-worldview.com/archives/33066143.html