Third point: Mass sale of Sony stock: a 13F-HR form 2Q

August 19, 2020

Third point:

Sony shares fell for three consecutive business days following the announcement of the sale of Third Point.

It turns out that the hedge fund management company, Third Point, sold a large amount of its holdings.

US Securities and Exchange Commission (SEC):

According to “Form 13F” submitted on the 18th,

Third Point had 675,000 shares as of the end of March.

However, as of the end of June, there was no description.

According to the SEC rules, the description of minority shares can be omitted.

However, it is highly possible that all Sony shares were sold.

Third Point Claim: Spinoff Proposal

In June of last year, it announced that it would own Sony stock worth 1.5 billion dollars (about 163 billion yen).

It insisted that the semiconductor division should be separated and focused on the movie/entertainment business.

It requested the sale of its equity interest in Sony Financial Holdings and proposed a capital structure review.

Bloomberg

https://www.bloomberg.co.jp/news/articles/2020-08-19/QFA9T9DWRGG001

Third Point LLC closes position in SNE / Sony Corp. – 13F, 13D, 13G Filings

Third Point LLC closes position in SNE / Sony Corp.

August 17, 2020

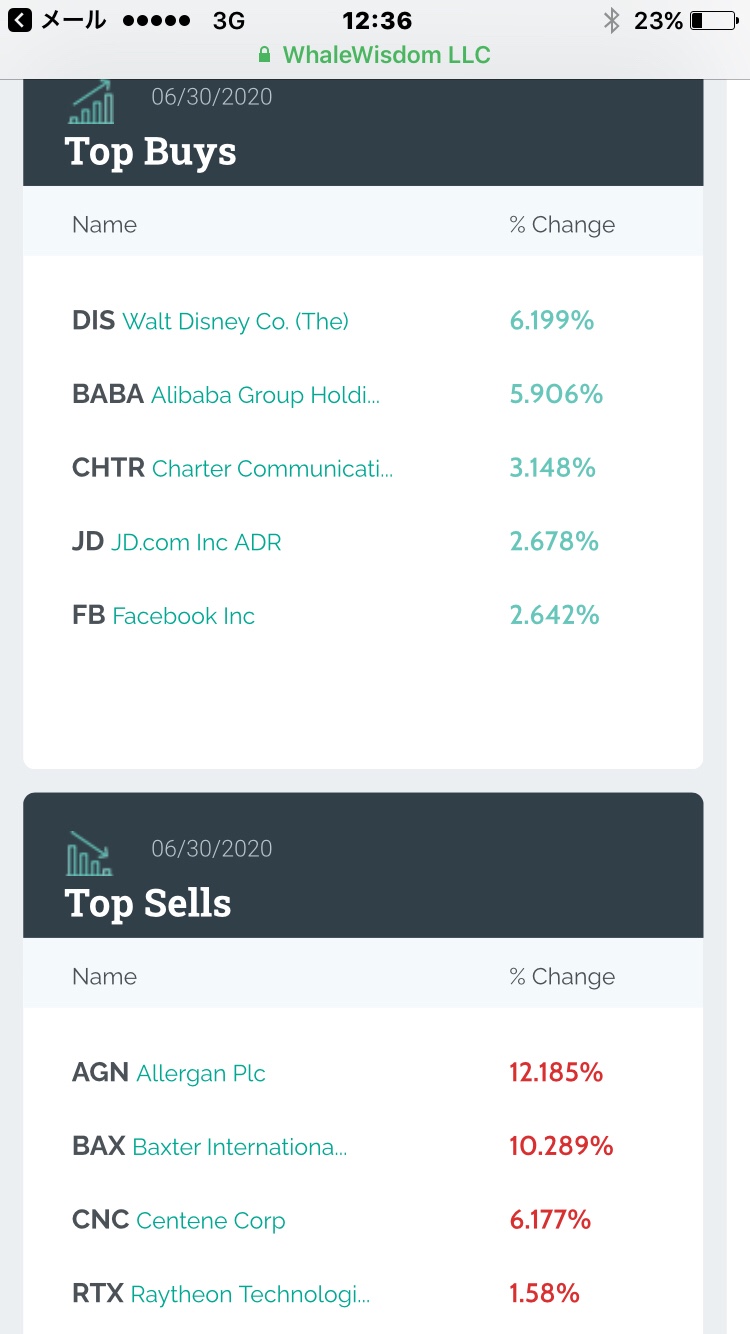

Third Point LLC has filed a 13F-HR form disclosing ownership of 0 shares of Sony Corp. (US:SNE) with total holdings valued at $0 USD as of June 30, 2020.

Third Point LLC had filed a previous 13F-HR on May 15, 2020 disclosing 675,000 shares of Sony Corp. at a value of $39,946,000 USD.

This represents a change in shares of -100.00 percent and a change in value of -100.00 percent during the quarter.

Fintel.io