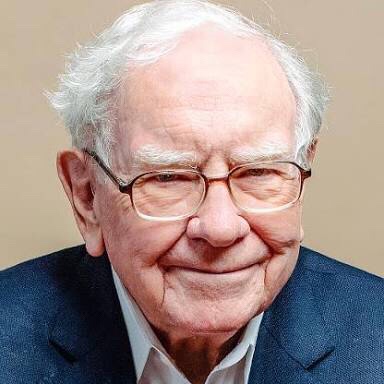

Here are Warren Buffett’s top 13 favorite stocks

Warren Buffett,

the leader of Berkshire Hathaway,

is a long-time value investor who looks to invest in companies that are undervalued by the market.

This year, however, Berkshire’s

used some of its record $128 billion cash pile to expand equity holdings instead of buy companies.

That’s because “prices are sky-high for businesses possessing decent long-term prospects,” Buffett wrote in his 2018 annual shareholder letter. It’s made it difficult for Buffett to finalize any acquisitions.

Here are his top 13 stock holdings according to SEC filings.

13. Southwest Airlines

Ticker:LUV

Berkshire holdings: 53,649,213 shares

Value: $3 billion

Southwest Airlin

Ticker:LUV

Berkshire holdings: 53,649,213 shares

Value: $3 billion

Source: SEC filings

10. Delta Air Lines

Ticker:DAL

Berkshire holdings: 70,910,456 shares

Value: $4 billion

Source: SEC filingsら

11. Goldman Sachs

Ticker:GS

Berkshire holdings: 18,353,635 shares

Value: $4 billion

Source: SEC filings

12. Bank of New York Mellon

Ticker: BK

Berkshire holdings: 80,937,250 shares

Value: $4 billion

Source: SEC filings

9. Moody’s Corporation

Ticker:MCO

Berkshire holdings: 24,669,778 shares

Value: $6 billion

Source: SEC filings

8. US Bancorp

Ticker:USB

Berkshire holdings: 132,459,618 shares

Value: $8 billion

Source: SEC filings

7. JPMorgan Chase & Co

Ticker: JPM

Berkshire holdings: 59,514,932 shares

Value: $8 billion

Source: SEC filings

6. Kraft Heinz Co

Ticker:KHC

Berkshire holdings: 325,634,818 shares

Value: $10 billion

Source: SEC filings

5. American Express Company

Ticker:AXP

Berkshire holdings: 151,610,700 shares

Value: $18 billion

Source: SEC filings

4. Wells Fargo & Co

Ticker:WFC

Berkshire holdings: 378,369,018 shares

Value: $20 billion

Source: SEC filings

3. Coca-Cola Co

Ticker:KO

Berkshire holdings: 400,000,000 shares

Value: $22 billion

2. Bank of America

Ticker:BAC

Berkshire holdings: 947,760,000 shares

Value: $31 billion

Source: SEC filings

1. Apple Inc.

Ticker:AAPL

Berkshire holdings: 248,838,679 shares

Value: $65 billion

Source: SEC filings

Markets Insider