One Belt, One Road: A debtor country in distress

– Swap extension for Mongolia, Egypt, Pakistan, Sri Lanka, and Türkiye

– Additional financing for Oman, Angola, and Venezuela

We bring you a summary of articles published in Forbes JAPAN.

Greedy One Belt One Road:

In mid-October, China celebrated the 10th anniversary of the One Belt, One Road initiative.

China-led program of high-level infrastructure development and international development assistance.

However, China is greedy and has caused controversy with the Fog Country.

Kiel Institute for the World Economy:

Now with the Belt and Road project. ‘Additional loans to countries with difficulty in repayments’ increased significantly.

‘China’s loan conditions and opaque practices’ drew criticism from researchers.

Liquidity swap deadline extension:

against Mongolia, Egypt, Pakistan, Sri Lanka, Turkey, etc.

China has extended the deadlines for a large number of liquidity swaps from 2015 to 2021.

Additional financing for countries in arrears:

Countries such as Oman, Angola, and Venezuela have fallen into arrears.

Repayments have been deferred and additional loans have been increased continuously.

During the same period, it received at least $1 billion (150 billion yen) in medium-term loans to improve its balance of payments.

Mongolia:

It has a large amount of debt to China.

After the commodity boom of the 2000s, it fell on hard times.

Mongolia’s debt to China:

In 2021, it is equivalent to 24% of gross national income (GNI), the highest level in the world.

Pakistan and Egypt:

It received a large amount of financing from the Belt and Road project.

Due to the slump in the domestic economy, Japan accepted a relief loan proposed by China.

![China's Belt And Road Rescue Lending Soars [Infographic]](https://imageio.forbes.com/specials-images/imageserve/65323e4952ea8e6204735684/20231020-ChinaRescueLanding/960x0.jpg?height=711&width=711&fit=bounds)

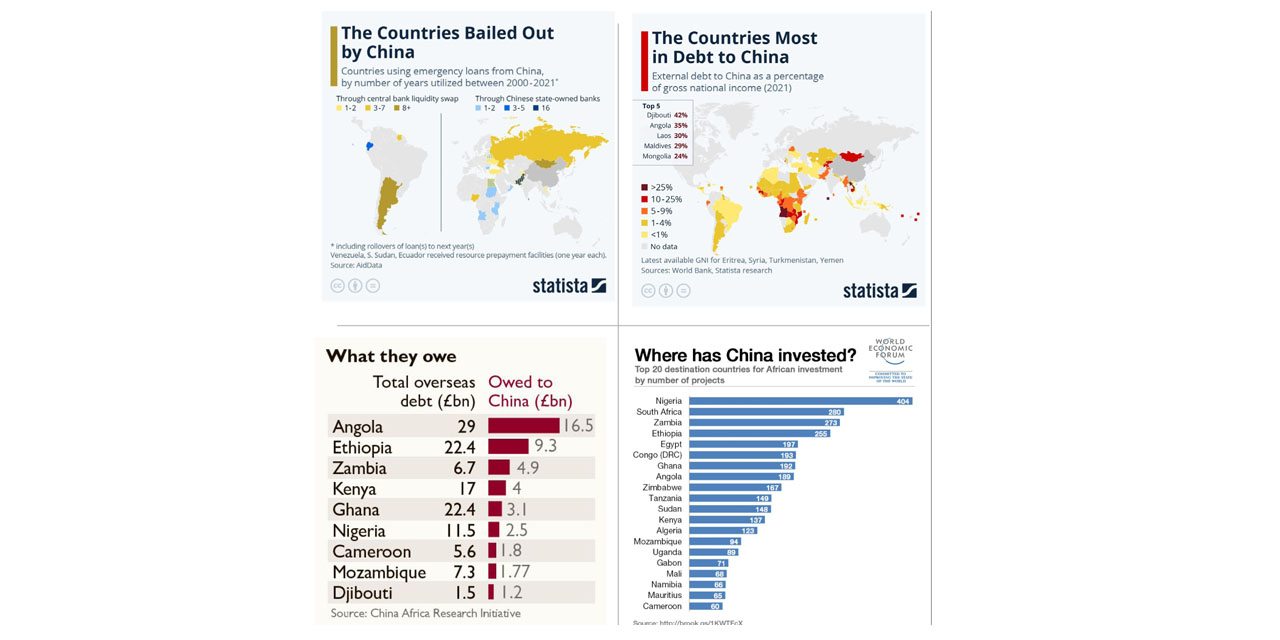

Percentage of countries with repayment difficulties:

In 2010, only 5% of countries were in difficulty repaying their Belt and Road loans.

In 2022, the proportion of countries in the Belt and Road portfolio that are in difficulty in repayment will dramatically increase to 60%.

China’s relief loan amount:

In 2014, the amount of relief loans was $11 billion (1.65 trillion yen).

In 2015, it had rapidly increased in recent years to reach $30 billion (4.5 trillion yen).

Relief loan to Argentina:

Due to Argentina’s economic crisis, relief loans have been increased by $8 billion (1.2 trillion yen).

Argentina’s borrowings from China:

In 2022, Argentina will join China’s Belt and Road Initiative.

In fact, the company had received Chinese loans even before that.

Venezuela’s borrowings from China:

In 2022, China will loan Venezuela $10 billion (1.5 trillion yen) to improve its international balance of payments.

Unfair financing conditions of the Belt and Road:

-Chinese loan repayment terms are on par with high-interest loans-

However, the conditions for development assistance loans provided by China are extremely poor.

This is extremely bad compared to the International Monetary Fund (IMF), World Bank, and Paris Club member countries.

High interest rate and short repayment period:

These pose particular challenges for developing countries. Of course, the same goes for China’s relief loans.

Kiel Institute for the World Economy:

China’s loan interest rate is 5%:

The interest rate on IMF relief loans is typically 2%. However, the interest rate in China is 5%.

In addition, China’s liquidity swap deadlines continue to be pushed back for years.

Loan terms are not disclosed:

It becomes a hidden long-term debt for the repaying country and lacks transparency.

No debt forgiveness provisions:

In the 2000s, the IMF began seriously working on debt cancellation.

However, the Belt and Road Initiative does not specify any debt forgiveness provisions.

Stock transfer issues in infrastructure projects:

Currently, the handling of stock transfers under the Belt and Road Initiative is being viewed as a problem.

China allows share transfers in Belt and Road projects as a means of repaying loans.

This will be used to further increase the repaying country’s dependence on China.

There are concerns that China will use the assets acquired through stock transfers to further increase its dominance.

https://news.yahoo.co.jp/articles/6055b66b425839c7529afe8cebbbe1d3937571da

China’s Belt and Road: Top 5 countries with huge debts

We bring you a summary of articles published in Forbes JAPAN.

World Bank data:

Most of the countries in Africa have large debts to China.

Central Asia, Southeast Asia and the Pacific region follow.

Low income countries of the world:

Thirty-seven percent of all these countries borrowed from other countries this year came from China.

Ranking of debt to China: (out of 97 countries, end of 2020)

1. Pakistan ($77.3 billion);

2. Angola ($36.3 billion);

3. Ethiopia ($7.9 billion);

4. Kenya ($7.4 billion);

5. Sri Lanka ($6.8 billion);

Djibouti and Angola:

Debts owed to China account for a large proportion of gross national income (GNI).

The ratio in Djibouti and Angola exceeded 40%.

GNI is close to gross domestic product (GDP). This index also includes income earned by residents abroad.

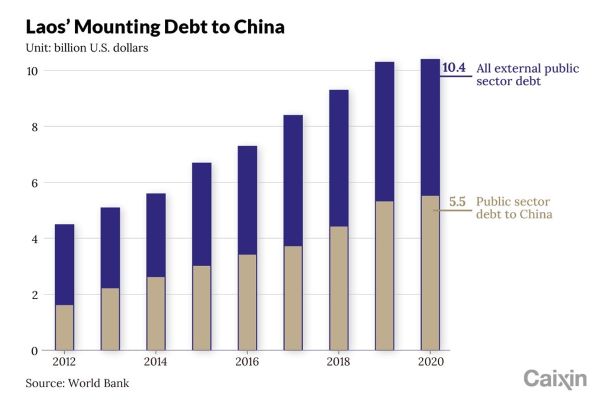

Laos’ debt to China:

In addition, a railway linking Laos with China just opened last year.

Debt to China exceeds 30% of GNI, and the debt burden is already a major problem.

Top 5 countries with large debt to China as a GNI ratio:

Djibouti – 43%

Angola – 41%

Maldives – 38%

Laos─30%

Democratic Republic of the Congo – 29%

Source: World Bank, Statista Research

Is debt forgiveness possible by China?

China lends to low-income countries:

In 2010, the amount of loans was $40 billion (5.48 trillion yen).

In 2020, lending amounted to $170 billion.

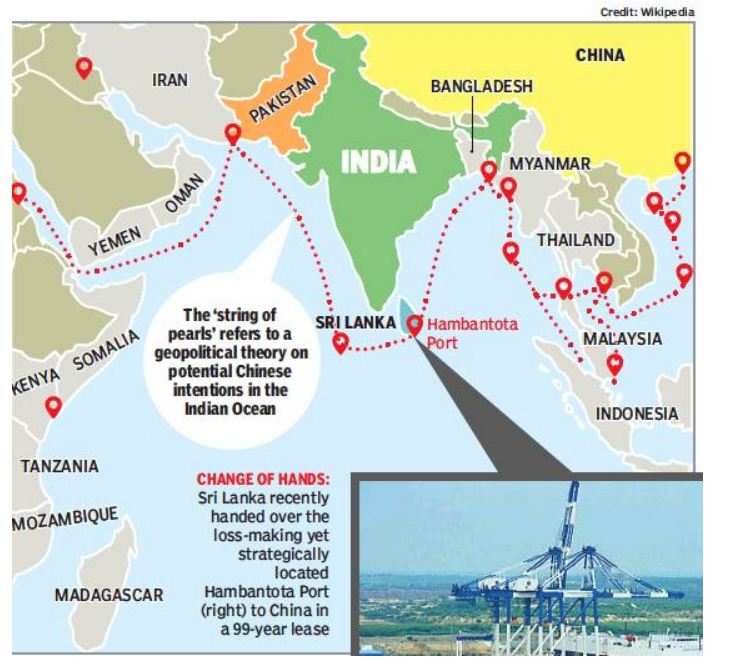

Tragedy of Sri Lankan port transfer:

If problems arise in debt repayments, China will have significant influence over the country’s infrastructure.

Sri Lankan ports are a well-known example.

It was built with loans from China, but they were unable to repay it.

Surprisingly, 70% of the management company’s shares were transferred to the Chinese side.

Royal Institute of International Affairs (Chatham House):

He warned that Sri Lanka’s ports could become an advantage for China in the future.