Nippon Steel: Cuts off China’s Baoshan Steel and expands globally

– Establishes a tri-polar structure in the U.S., India, and Southeast Asia

– This summer, Mike Pompeo is appointed as an advisor for the acquisition

Summary from Katsumata Hisayoshi’s World View article.

Nikkei (August 10th)

An article titled “Nippon Steel to expand into growing markets with integrated production in the U.S., India, and Southeast Asia” was published.

Nippon Steel’s overseas strategy is reaching a historic turning point.

The company will effectively end its 47-year partnership with China’s Baoshan Steel, which it taught blast furnace technology to as part of Japan-China economic cooperation.

1. Reduce China’s Baoshan Steel’s production capacity by 70%.

2. Instead, concentrate management resources in the U.S., India, and Southeast Asia.

The company will take on the challenge of realizing “local production for local consumption” by integrated production from upstream processes such as blast furnaces in the three world poles.

WSJ Online (Opinion section, August 4)

An analysis of the acquisition of US Steel was published in the WSJ.

Mike Pompeo, former Secretary of State in the Trump administration, wrote the analysis.

1. This joint venture puts American workers and families first and strengthens American manufacturing.

2. President Biden mistakenly believes that it poses a national security risk to US steel manufacturing.

Strong demand for steel in the US:

The US is an exception among developed countries in that its population continues to grow.

The population will grow from 335 million in 2023 to 370 million in 2080.

Unlike China, the US has a growing population. It is the only developed country with a growing population. This is why we can expect great demand.

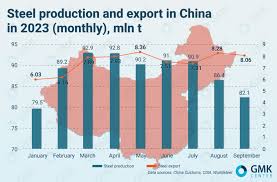

China’s real estate slump continues:

China’s recession has become prolonged, and steel demand has declined significantly.

Nippon Steel will end its joint venture with Baoshan Steel of China.

On August 29th, Nippon Steel will withdraw from its joint venture with Baoshan Iron and Steel, a subsidiary of the world’s leading Baowu Iron and Steel Group.

China’s steel industry is in a state of over-competition:

China is home to six of the world’s top 10 companies in terms of crude steel production.

1. China’s real estate slump is dragging on, and steel demand is sluggish.

2. Production remains high, and the steel market appears to be over-competitive.

China’s EV production is also over-competitive:

In China, the shift to EVs has progressed rapidly.

As a result, Japanese automakers, which are Nippon Steel’s customers, are struggling.

China’s rapid population decline:

1. China is a country whose population will decline rapidly from now on.

2. Six of the world’s top 10 companies are in such a market.

This will result in a classic case of over-competition, and China’s demand for steel will decline.

New overseas business model:

The new overseas target is a model of integrated production from the upstream process of blast furnaces and electric furnaces.

Concentrated production system in three global poles:

In the future, production will be concentrated in three poles: the United States, India, and ASEAN.

Nippon Steel’s crude steel production capacity is currently 66 million tons, but it plans to increase it to 100 million tons in the future.

Steel demand in India: Research company Steelmint

1. Steel demand in India is expected to be 120 million tons in 2023.

2. It is expected to increase to 190 million tons in 2030.

Joint venture with ArcelorMittal:

In India, infrastructure investment is thriving along with the population growth, and steel demand will continue to increase.

Nippon Steel is currently building two blast furnaces in western India through a joint venture with Europe’s ArcelorMittal.

1. With a view to operations from 2025 onwards, the total investment amount will exceed 1 trillion yen.

2. A joint venture between Nippon Steel and Mittal plans to build another steelworks in eastern India.

Posco’s activities:

Global rivals are also placing India at the core of their growth strategies.

In 2022, the company announced that it will move forward with plans to build an integrated steelworks in a joint venture with India’s Adani Group.

Japan’s JEE’s activities:

The company has invested in JSW Steel, India’s second largest steelmaker.

The company will launch a joint venture for steel sheets for transformers in anticipation of expanding energy demand.

Nippon Steel’s global strategy:

1. Lead the world in quality and decarbonization technology, and increase its global presence.

2. The acquisition of US Steel will propel Nippon Steel to become a global company.

Nippon Steel will lead the world in quality and decarbonization technology.

https://hisayoshi-katsumata-worldview.com/archives/36485212.html