China Minsheng Bank: Large loan to China Evergrande: Stock price fell 31%

-Stock price performance The worst bank in the world-

January 12, 2022

China Minsheng Bank, one of the big creditors of Evergrande, fell 31% in stock price in one year

It has been pointed out that the exposure to the evergrande exceeds 29 billion yuan.

China Minsheng Bank:

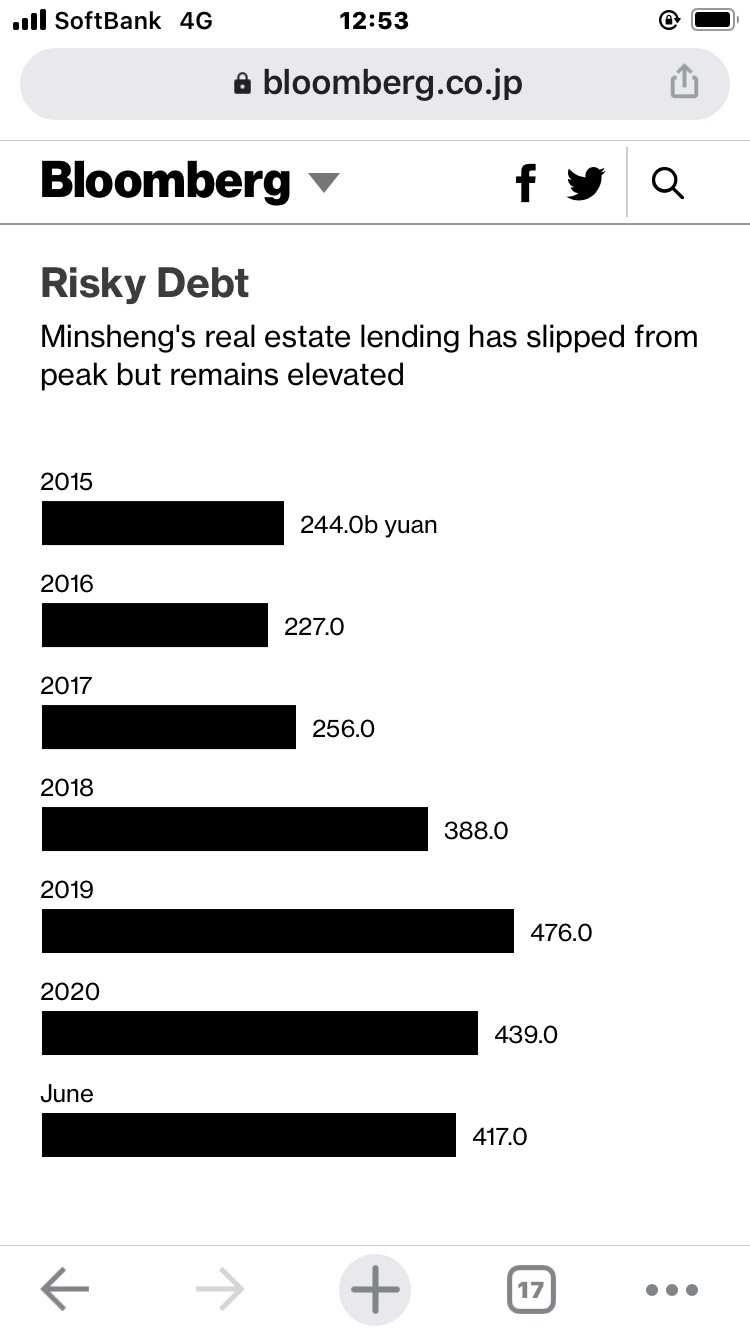

China Minsheng Bank is one of the most devastated financial institutions in China’s real estate debt crisis.

Losses associated with lending to major real estate developers, including the Evergrande Group of China, have increased.

China Minsheng Bank Stock Price:

It has fallen 31% in the year to last week.

“Of the 155 stocks that make up the Bloomberg World Bank Index,” it has the worst performance.

Investors such as hedge funds are more bearish on Minsheng Bank than any other bank stock.

China Minsheng Bank’s Predicament:

For the Chinese real estate industry, etc.

According to the Chinese Xi Jinping leadership

The effects of tightening are widespread.

“Warning to international financial institutions that are investing heavily in expanding their business in China.”

Citigroup

September 2021 Survey Report

China Minsheng Bank’s exposure to high-risk developers is 130 billion yuan (2.352 trillion yen)

Equivalent to 27% of “Tier 1” capital.

This is the highest among the major banks in China.

Beijing Incense Capital

Shen Moe Director

It will take several years to dispose of bad debts of China Minsheng Bank.

It is possible that a rival bank with a stronger management base will inject capital.

China Minsheng Bank’s Evergrande Exposure:

As of June 2020, it is about 29 billion yuan.

As of September 2021

China Minsheng Bank’s evergrande lending has declined by 15% since June 2008.

However, the specific level has not been clarified.

Considering indirect lending in trust products,

The exposure to the evergrande exceeds 29 billion yuan.

–Bloomberg

https://www.bloomberg.co.jp/news/articles/2022-01-11/R5KBH0T1UM0W01