China Country Garden: Signs of Default

– A shock that is greater than the everlasting group –

ーUnable to fulfill interest paymentー

We will deliver a summary from the latest article of hankyoreh japan.

China’s largest green garden:

An incident occurred in which the company could not pay the interest on the bonds.

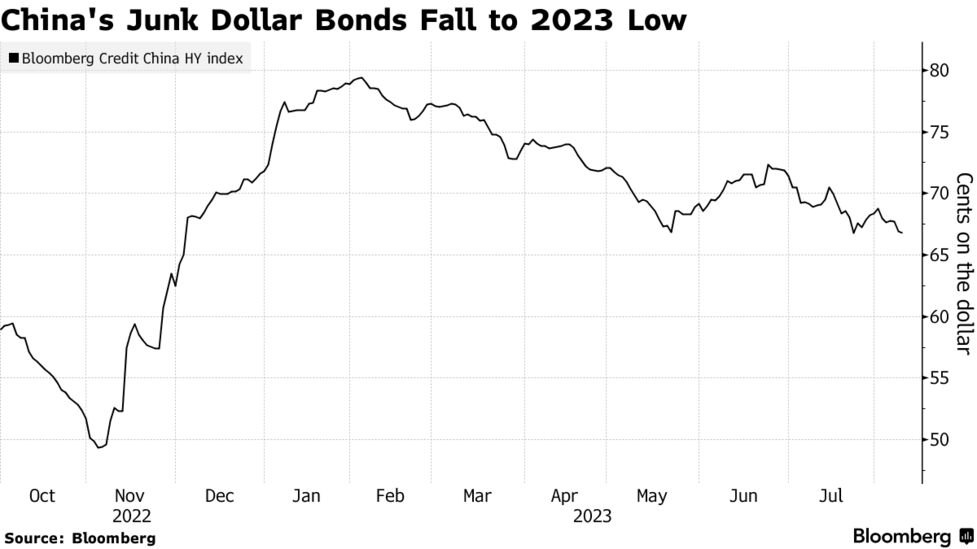

China’s real estate crisis is heating up again.

There are fears that the Chinese economy will be further shaken.

Hekkeien (country garden):

On August 7, Hekkeien failed to pay interest on its $22.5 million bond.

The company has not disclosed any future redemption plans.

If the interest is not paid within 30 days, it will be defaulted.

Evergrande Group and Hekkeien:

In 2021, Evergrande Group failed to repay its debt principal and interest and defaulted.

Hekkeien has 3,000 projects underway at the end of last year.

It has 1.4 trillion yuan ($199 billion) in debt.

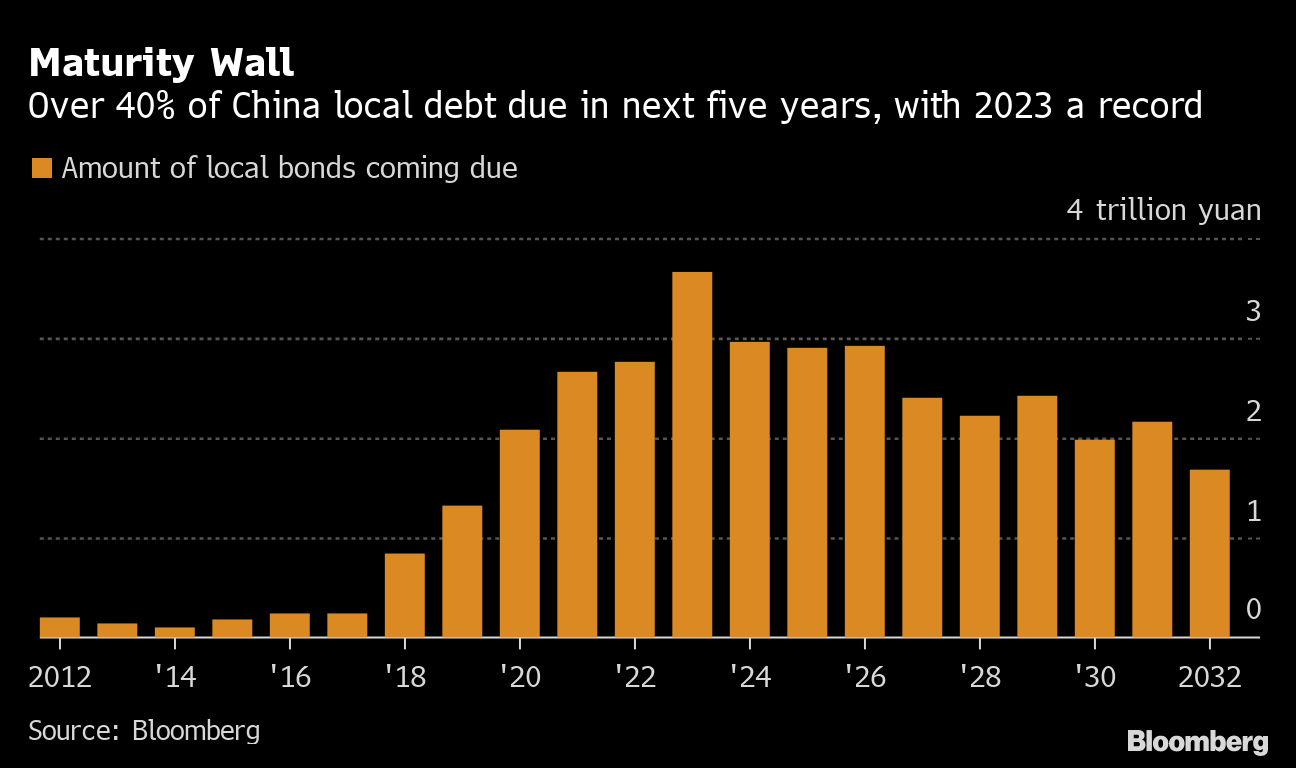

Bonds maturing:

Next month, 5.8 billion yuan of debt will mature.

You have to pay interest of 48 million yuan.

By the end of 2024, the Garden will generate $2.4 billion in China,

$2 billion must be repaid overseas.

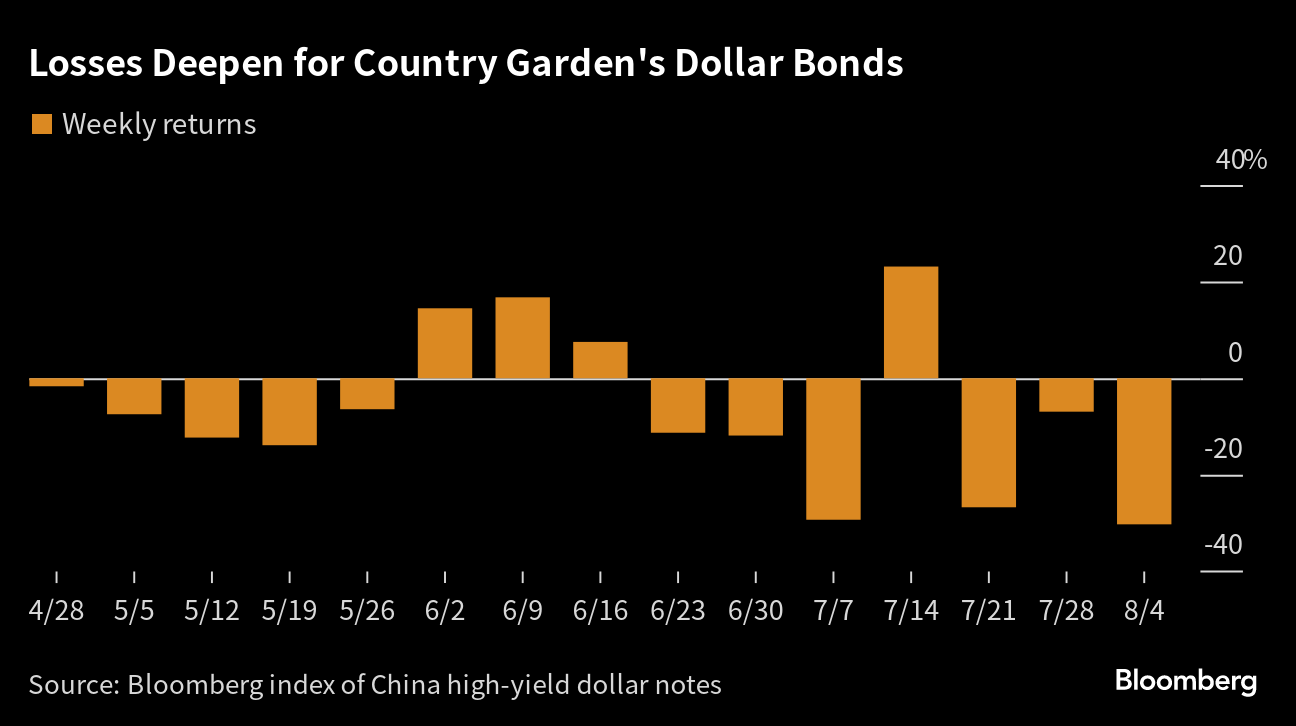

Corporate Bond Prices Crash:

In the market, the bond price of Hekkeiyuan plummeted.

Hong Kong stocks also plunged 14.4% from the previous trading day on the 8th.

Compared to the end of last year, the stock price has fallen by 70%.

Bloomberg Intelligence

On the 9th, Pekkeiyuan has four times more projects than Evergrande Group.

It will have a bigger impact on the Chinese housing market than the Evergrande collapse.

Bakueiyuan has condominium projects underway in all provinces of China.

60% are in progress in 3rd and 4th grade small and medium-sized cities.

https://japan.hani.co.kr/arti/international/cn_tw/47517.html

China’s Ministry of Finance: Helping LGFVs pay off debt

– LGTV Refinancing Bonds: $140 Billion Issuance –

Bloomberg reported on the 11th, citing sources familiar with the matter.

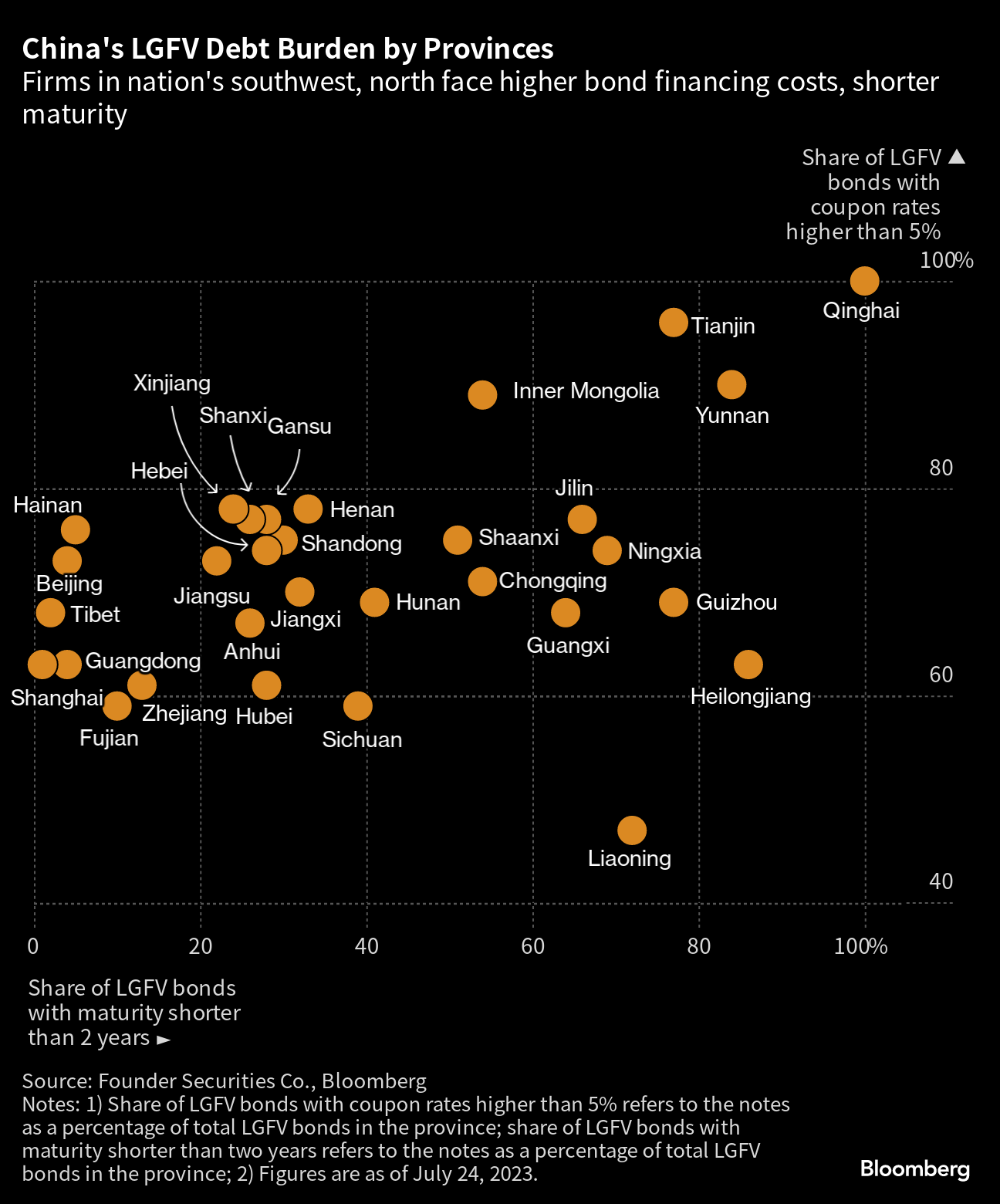

Local Government LGTV:

The Ministry of Finance notified the relevant authorities.

Approved to raise 1 trillion yuan ($140 billion) at LGTV.

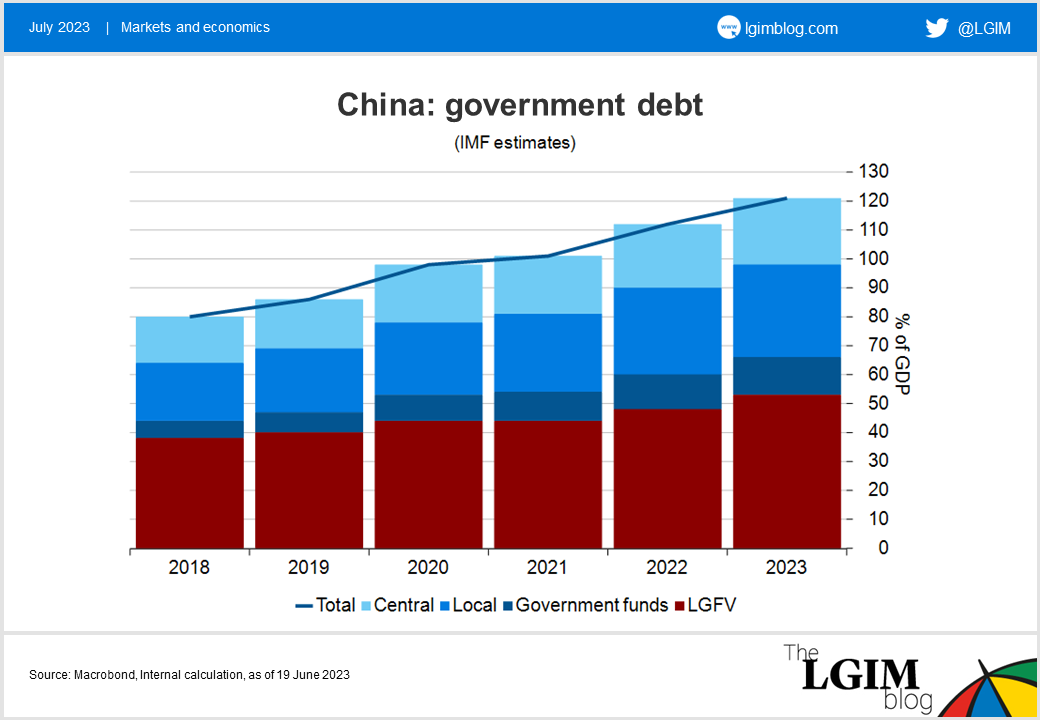

LGFV is off-balance sheet debt of local governments.

It is the repayment of debt that is not recorded on the balance sheet.

IMF estimate

LGFV has total debt of 66 trillion yuan ($9.1 trillion)

China’s leadership did not give details.

Local government defaults lead to destabilization of the financial sector.

This scheme:

The local government issues bonds with an interest rate of 3%. It replaces LGFV’s high-interest debt.

Some local governments pay 7-10% interest on LGFV.

LGTV Remedy This Time:

All provinces except Beijing, Shanghai, Guangdong and Tibet.

Use bond issuance to repay hidden off-balance sheet debt.

However, commercial banks bear the debt costs of local governments.

High-risk provinces are:

Guizhou, Hunan, Jilin, Anhui and Tianjin are at high risk.

The policy is to provide a lot of support for these.

https://news.yahoo.co.jp/articles/df5169bb50a6b07e198b0cc932e123a1947047b0