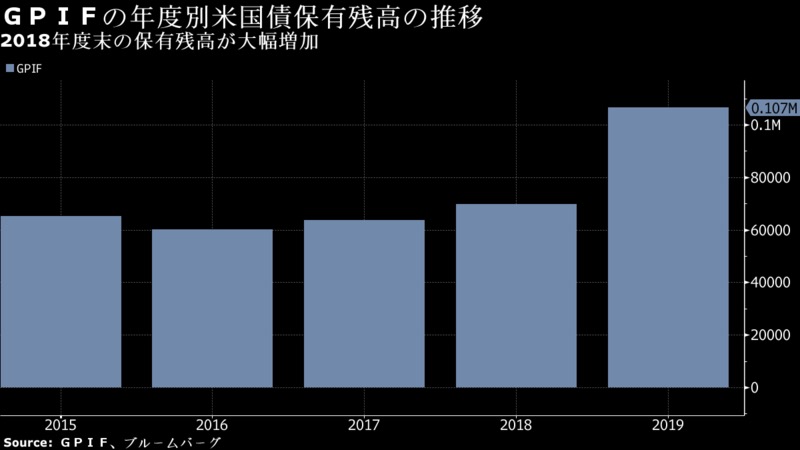

Japan GPIF: US Treasury increased by 50%: US Treasury ¥ 10,661.5 billion at the end of March

The world’s largest pension fund: (GPIF)

The foreign bond most owned by the Pension Reserve Investment Management Independent Administrative Agency (GPIF) was a US bond in 2018.

The balance is a surge of 53% from the previous flat.

GPIF: US Treasury Bond Holding Amount

10,661.5 billion yen as of the end of March.

From the 14th to the 17th, when the disclosure information goes back, it remained in the 6 trillion yen range.

In fiscal 2018, the Fund posted an increase of ¥ 3,677.8 billion in one year, including valuation gains from falling interest rates and foreign exchange gains from the weak yen and the strong dollar.

For example, life insurance companies are heading for European bonds, avoiding dollar-denominated bonds, which have high costs for avoiding foreign exchange losses (hedge).

This is in stark contrast to this.

Bloomberg

https://www.bloomberg.co.jp/news/articles/2019-07-11/PUGSBE6TTDSA01?srnd=cojp-v2

Japan’s GPIF Increased Argentinean Sovereign Debt Exposure by $400 Million

Posted on 07/12/2019

Government Pension Investment Fund Japan (GPIF) is a major institutional investor in foreign bonds.

Like its institutional Japanese peers, GPIF is forced to invest in foreign bonds in order to preserve capital.

On March 31, 2018, GPIF had 23,947,850,732 JPY exposed to sovereign debt from Argentina versus 71,157,839,759 JPY in March 31, 2019

SWFI