Bank of Japan is the Biggest User of Fed U.S. Dollar Liquidity Swap

Posted on 04/11/2020

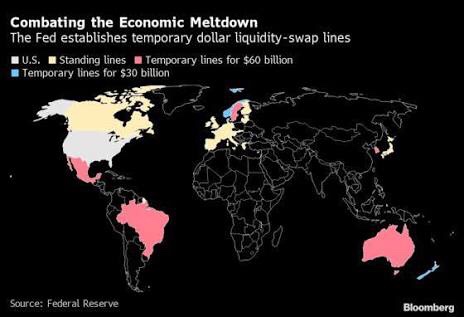

The Federal Reserve on March 19, 2020,

revealed the establishment of temporary U.S. dollar swap lines with an larger list of central banks.

The Bank of Japan has been the biggest user of the Federal Reserve U.S. dollar liquidity swap.

Bank of Japan leads the central bank group with the European

Central Bank in second place.

Japan, South Korea, and Singapore account for just over half of all foreign exchange swaps outstanding.

U.S. Dollar Liquidity Swap – Operation Results

From March 4, 2020 to April 9, 2020

Central Bank Name

Amount in USD

Bank of Japan

301,464,000,000

European Central Bank

221,607,200,000

Bank of England

59,180,000,000

Swiss National Bank

22,440,000,000

Bank of Korea

13,135,000,000

Monetary Authority of Singapore

9,450,000,000

Banco de Mexico

6,590,000,000

Danmarks Nationalbank

4,275,000,000

Norges Bank

1,575,000,000

Reserve Bank of Australia

1,150,000,000

Total

640,866,200,000

Source: New York Fed (FRBNY).

The swap lines were first created in December 2017 during the onset of the global financial crisis. The swap lines were reauthorized in May 2020 during the European debt crisis and then turned into standing arrangements in October 2013.