![]()

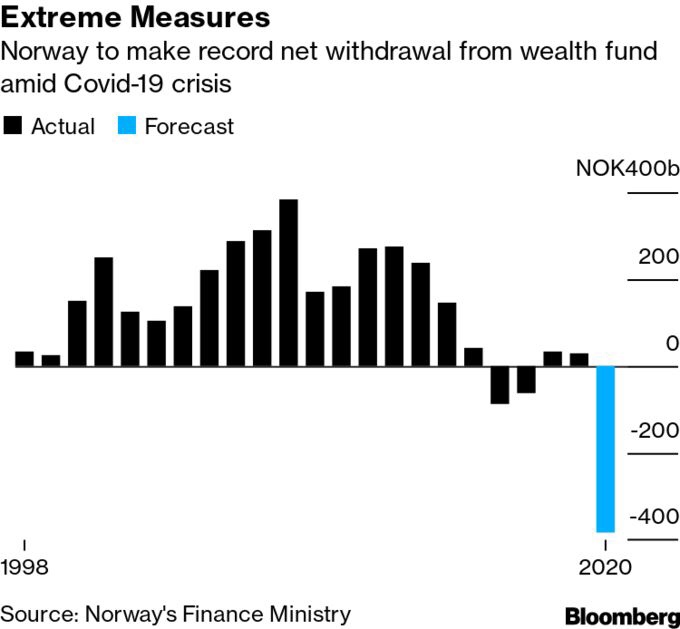

COVID-19: Withdrawal of 4 trillion yen from SWF, Norway-4 trillion yen, 4 times the highest number in the past

COVID-19:

Norway: SWF

Norway plans to draw Skr 382 billion (4 trillion yen) from SWF.

The world’s largest SWF has been forced to sell the largest asset ever to raise cash.

The withdrawal plan was revealed in Norway’s 2020 supplementary budget.

This time, the scale is more than four times that of 2016, which is the largest number so far.

The double crisis of the new coronavirus infectious disease (COVID19) and the plunge in crude oil prices has resulted.

(Bloomberg)

https://news.yahoo.co.jp/articles/cdb01940dd17d87fc653527823bd3a435bc94256

World’s Biggest Wealth Fund Faces Record $37 Billion Withdrawal

In 2020, everything changed.

The government

now expects to spend a record 420 billion kroner of oil money on crisis packages to prop up its economy,

with the collapse in petroleum revenue compounding the shock.

The government predicts its net cash flow from petroleum activities will drop by 62% to 98 billion kroner, the lowest since 1999.

‘Financial Muscles’

Norway has a self-imposed fiscal rule stating it should use no more than 3% of the fund’s value each year to plug budget holes (which represents the long-term real-return expectation for the fund).

But it’s allowed to stray from that limit to help the economy during downturns.

At 4.2% this year, spending will exceed the cap for the first time since the financial crisis in 2009.