Chinese Manufacturing: June PMI below 50 for 3 months!

ーLack of demand is the biggest factor “The same fate as Japan”ー

– China is in a quagmire, there is no way to deal with the collapse of the bubble –

We will deliver a summary from the latest article of hisayoshi-katsumata-worldview.

Chinese economy in recession:

China’s economy is in a quagmire.

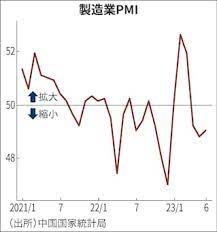

The June manufacturing PMI dipped below the boom-bust junction of 50.

3 months in a row.China already has a huge debt overhang.

It is impossible to take economic stimulus measures with more debt.

There is no way to beat it.

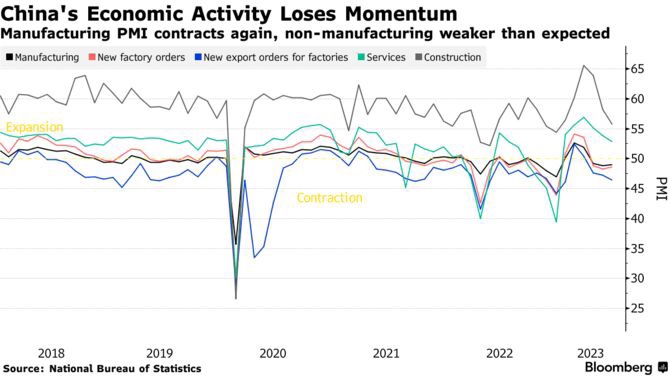

“Bloomberg” (June 30):

It published an article titled “China’s economic momentum slows down further.”

The manufacturing PMI contracted again,

prompting calls for stronger policy support.

National Bureau of Statistics of China:

The June manufacturing PMI announced on June 30

remained at 49, the worst condition.

It improved slightly from 48.8 in the previous month.

However, it remained below 50.

June Manufacturing PMI:

It has been below 50 for three consecutive months.

A lack of demand, including a slump in exports, is a major factor.

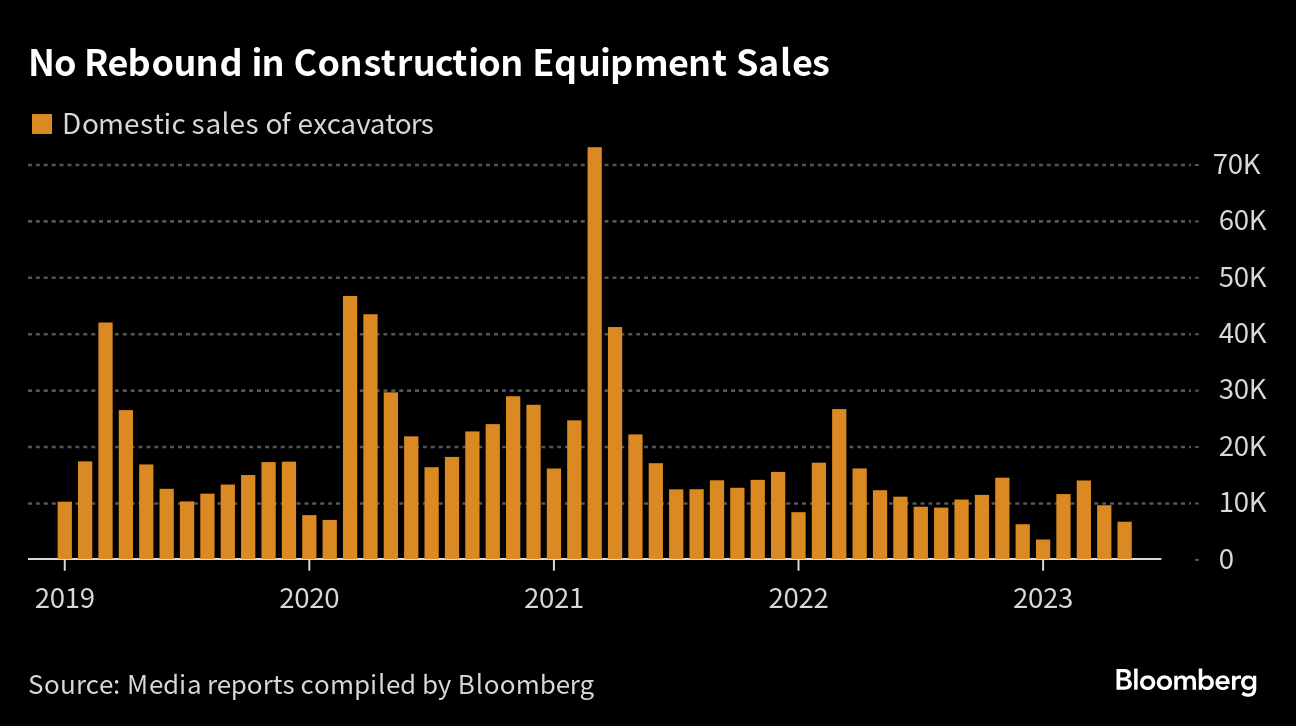

A slowdown in manufacturing is weighing on the Chinese economy.

ANZ Chief Economist: Mr. Yang Yuchu

The question is not whether the Chinese government will take stimulus measures.

The question to ask is “the quality of the Chinese government’s stimulus package.”

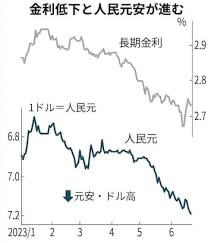

The dire situation for the Chinese economy:

A large-scale economic boost is becoming impossible.

There is a high risk that the rate cut will lead to a depreciation of the yuan.

Even if interest rates are cut,

there is no prospect of an increase in demand for new funds.

This is evidence that they are moving toward reducing the interest burden

by repaying loans rather than taking new loans.

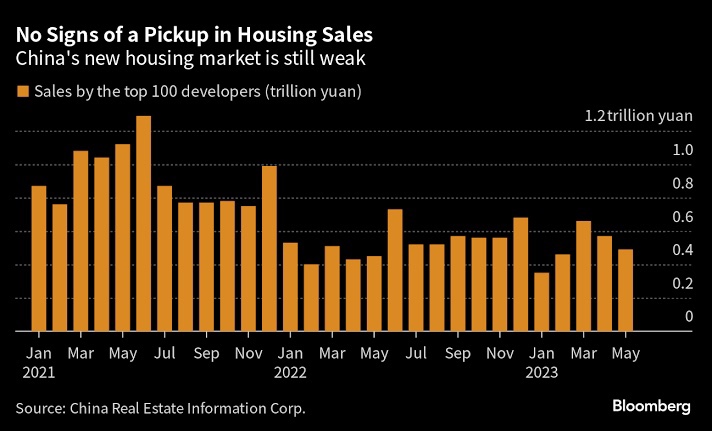

The epic feast of the real estate bubble:

A huge amount of debt remains at hand,

putting pressure on the management of China as a whole.

“China is in a long-term quagmire after the bursting of the bubble” should begin.

“Bloomberg” (June 30):

A People’s Bank of China (PBOC) survey

predicted that housing prices will fall in the next three months.

Revenues for the period from April to June

have decreased compared to the previous period.

The main reason is the deteriorating employment environment.

Residential construction is an important sector:

Prices and construction have slumped,

and it has fallen into crisis in the last two years.

China’s real estate bubble is over.

Loans for home purchases were also sluggish

from January to May this year, dropping by 13 percent.

https://hisayoshi-katsumata-worldview.com/archives/32690103.html