Marubeni:Earnings forecast revised down / impairment loss: Crude oil / natural gas, resource prices falling

Marubeni: Consolidated results at the end of the current term

As a result of reviewing the value of assets held in each business, temporary losses such as impairment losses are expected to occur.

Following this, it was announced on February 5, 2020.

We need to revise our consolidated business forecast for the fiscal year ending March 2020.

<Breakdown of reasons for correction>

Oil and gas development business:

Impairment loss in the US Gulf of Mexico oil and gas development business: ¥ 80 billion

Impairment loss and reversal of deferred tax assets in the oil and gas development business in the British North Sea: ¥ 65 billion

US grain business:

Gavilon grain business impairment loss: ¥ 80 billion

Impairment loss of US West Coast grain export business: ¥ 20 billion

Impairment loss in Chile copper business: ¥ 60 billion

Impairment loss in overseas power and infrastructure related businesses: ¥ 40 billion

Other: ¥ 25 billion

Deterioration due to one-time loss: ¥ 370 billion

Decrease in net income due to worsening market conditions: ¥ 20 billion

Total: ¥ 390 billion

https://www.marubeni.com/jp/news/2020/release/data/202003251J-1.pdf

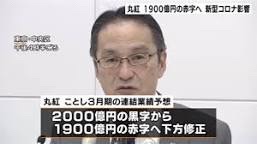

Marubeni has a final deficit of 190 billion yen

Due to falling resource prices in the fiscal year ending March 2008

Marubeni announced on March 25 that the consolidated net loss for the fiscal year ending March 2020 will be a deficit of 190 billion yen.

This is a downward revision of 390 billion yen from the previous forecast.

Record impairment losses due to falling prices of resources such as crude oil and natural gas.

The US grain business will also record a loss of about 100 billion yen.

Nihon Keizai Shimbun

https://r.nikkei.com/article/DGXMZO57205680V20C20A3I00000?n_cid=BMSR2P001_202003251519&s=5