China and Russia Buy Up More Physical Gold

The worst fears of the Federal Reserve may be coming true.

The barbarous relic is once again offering some resistance to Fed policy as it maintains its uptrend from mid-November, and is being snapped up from central banks worldwide.

Former Fed chairman Paul Volcker shared the central bank view that “Gold was the enemy.” If so, the enemy is gaining ground.

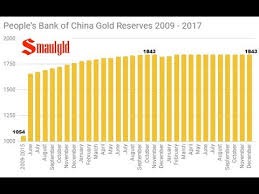

China’s gold reserves

quietly grew from December 2018 to February 2019.

The People’s Bank of China

disclosed in February 2019 that it increased its gold reserves by 10 tonnes that month,

following purchases of

11.8 tonnes in January 2019,

9.95 tonnes in December 2018.

Goldman Sachs has listed central bank purchasing as the reason for the uptrend.

Goldman Sachs expects to see gold at US$ 1,400 over the next six months, which would lift it well above its long-held resistance at US$ 1,350.

China’s gold holdings are now US$ 79.5 billion.

China, which is emphasizing diversification from the U.S. dollar, has been a fan of precious metals for years, and it has been encouraging its citizens to purchase gold and silver for a decade, when previous controls on precious metals were done away with.

Now anyone in China can trade gold internationally with the swipe of a card.

SWFI – Sovereign Wealth Fund Institute

https://www.swfinstitute.org/swf-news/china-and-russia-buy-up-more-physical-gold/