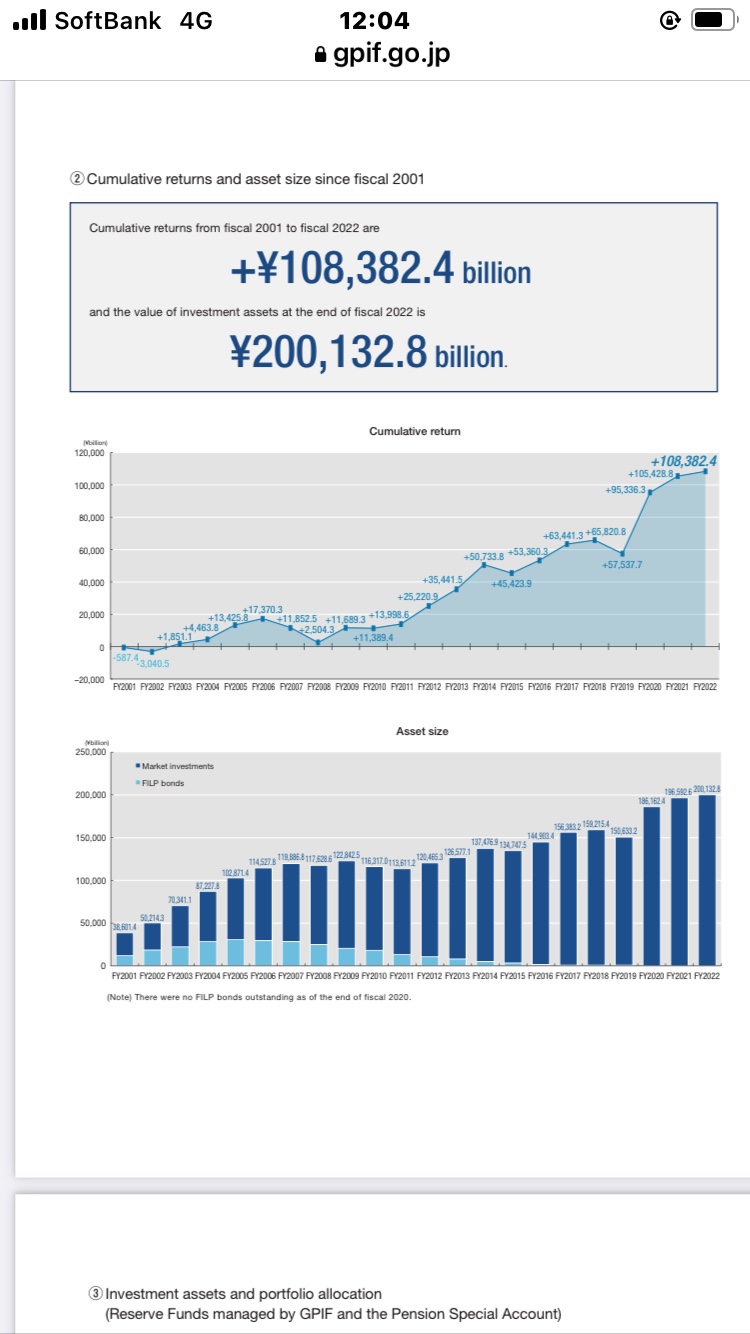

Japanese pension fund: GPIF surplus for first time in five quarters!

– Investment income of 10 trillion yen in January-March quarter –

ーAssets under management at the end of March reached a record high of 200 trillion yenー

From GPIF disclosure information, we will deliver a summary report.

GPIF investment income:

Japan’s GPIF is the world’s largest pension fund managing nearly 200 trillion yen.

Market participants’ attention to GPIF’s investment performance is very high.

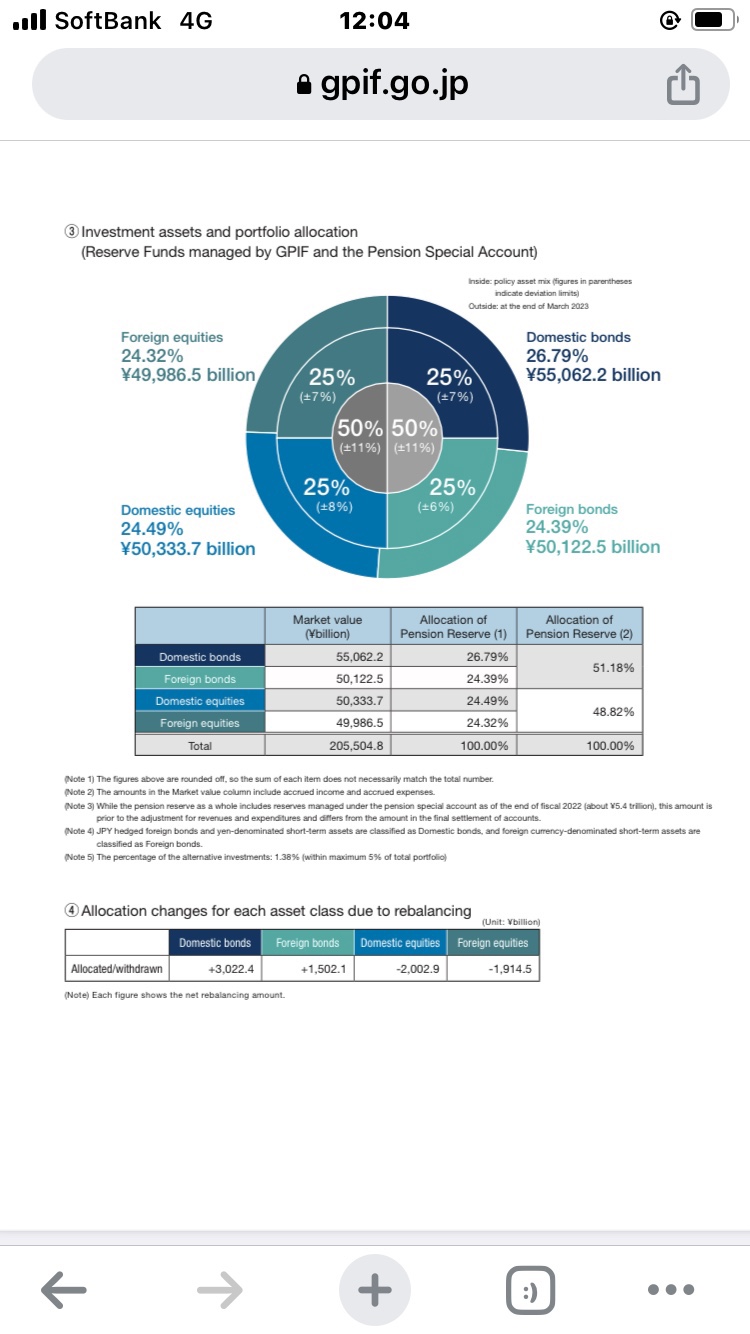

The amount of assets under management as of the end of March reached a record high of 200.1328 trillion yen.

Domestic and foreign stocks and bonds, all assets are positively managed.

Government Pension Investment Fund (GPIF):

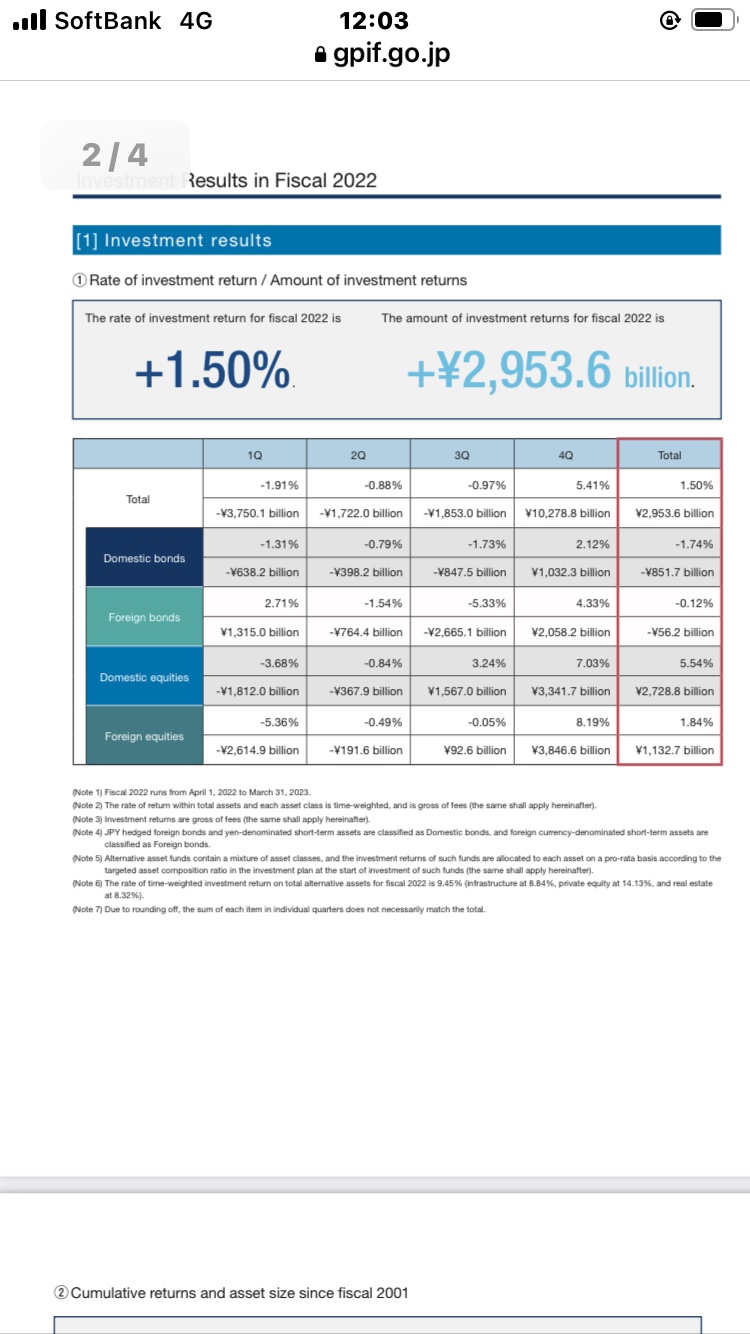

Investment income for January to March reached 10,278.8 billion yen, an increase of 5.41%.

It was the first profitable operation in five quarters.

Rise in domestic and foreign stock prices contributed to the increase.

Record AUM:

As of the end of March, the amount of assets under management reached a record high of 200.1328 trillion yen.

This is an increase from 189.9362 trillion yen as of the end of December last year.

Changes in the world stock index:

The MSCI index, which consists of developed and emerging market stocks, rose 6.8% in the first three months.

The US S&P 500 stock index rose 7%.

TOPIX increased by 5.9%.

The yen fell 1% against the dollar and 3% against the euro.

Quarterly return by asset:

Domestic bonds +2.12%,

Foreign bonds increased by 4.33%,

Domestic stocks increased by 7.03%,

Foreign equities were up 8.19%.

Securing profitability for three consecutive years:

Investment income for the full year of FY2022 is 2,953.6 billion yen, an increase of 1.50%.

The cumulative rate of return since fiscal 2001 is +3.59%, and the cumulative profit amount is 108.3824 trillion yen.

Press conference by Chairman Masataka Miyazono:

FY2022 was a volatile market environment.

The fact that we were able to secure investment performance in such an environment

is also a result of the diversified investment effect being demonstrated.

ESG (Environment, Society, Governance)

ESG index-linked stock management is 12.5 trillion yen.

It increased from 12.1 trillion yen in the previous fiscal year.

Points to pay attention to in the future

Miyazono said he would closely monitor trends in inflation in the United States

and Europe, as well as economic recovery in China.

https://www.bloomberg.co.jp/news/articles/2023-07-07/RX1ZO5T0G1KW01