WhaleWisdom Institutions Dumping Boeing Amid Uncertain Future

Boeing Co.’s (BA) stock

has fallen by 21% since peaking in early March. The sharp decline has come following two crashes of its 737 MAX jets and the grounding of the fleet around the world.

The recent developments have hampered the stock as investors have lost visibility into the future of the company.

Institutional

hedge fund investors

went from accumulating the stock in the fourth quarter of 2018 to dumping it in the first quarter of 2019.

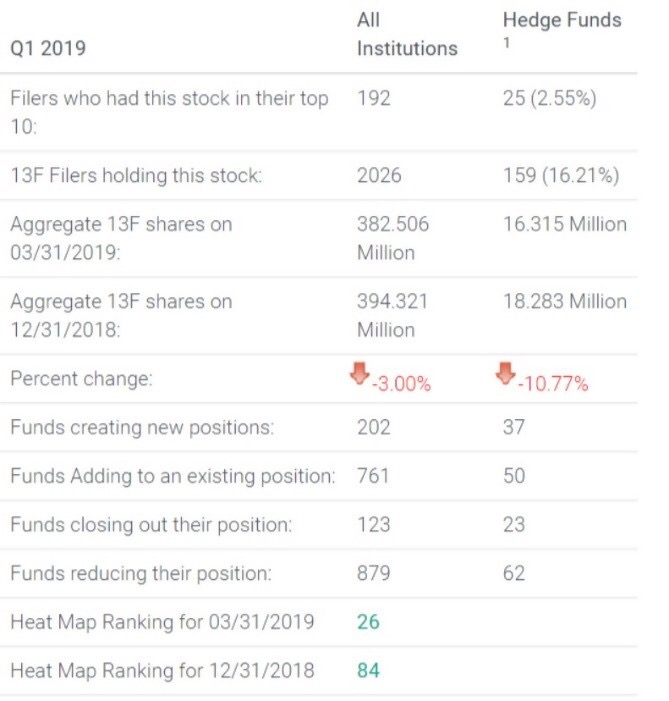

Still, the stock managed to land on the WhaleWisdom Heatmap at 26, up from 84.

The stock may have had an even higher ranking if not for the developments at the end of the first quarter.

The high ranking is likely to fall further as second quarter filing results start to come in, given that the stock continued to decline since the end of the first quarter.

Turning Bearish

During the first quarter, the number of aggregate institutional 13F shares fell by 3% to 382.5 million from 394.3 million.

That included a decline of more than 10% among hedge funds, which saw the total number of 13F shares fall to 16.3 million from 18.3 million.

In total, 202 institutions created new positions, while 761 added to existing ones.

Additionally, 123 institutions closed out their positions, while 879 reduced their holdings.

WhaleWisdom

https://whalewisdom.com/articles/institutions-dumping-boeing-amid-uncertainfuture/