全球最大基金:不包括華人和華人選票的外部投資聯盟

・美國兩大退休金計畫避免投資中國股票

・中概股風險上升,中概股報酬率下降

我們將為您提供在彭博社發表的文章摘要。

How to view Dharma Capital:

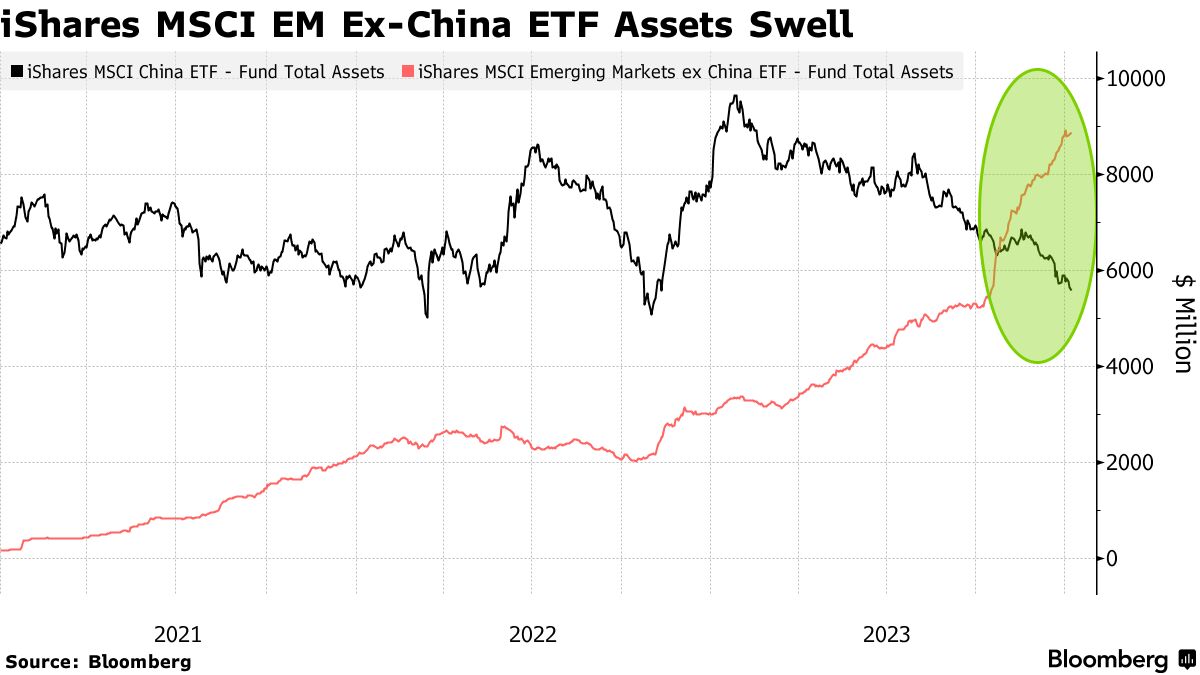

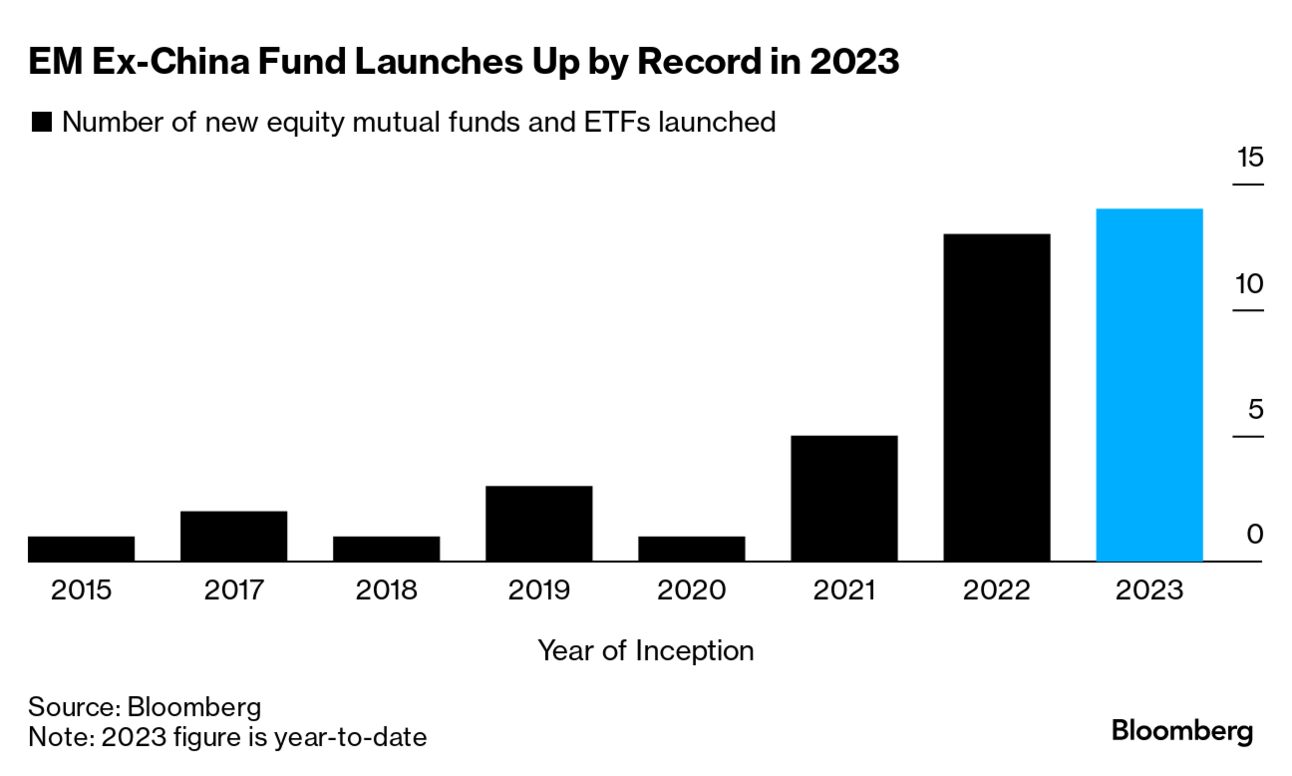

-There is a noticeable movement to diversify stock investment beyond Chinese stocks-

The position of Chinese stocks in global investment portfolios has declined significantly.

Chinese stocks continue to trend downward, and risks are only increasing.

Investment stance of the world’s largest fund:

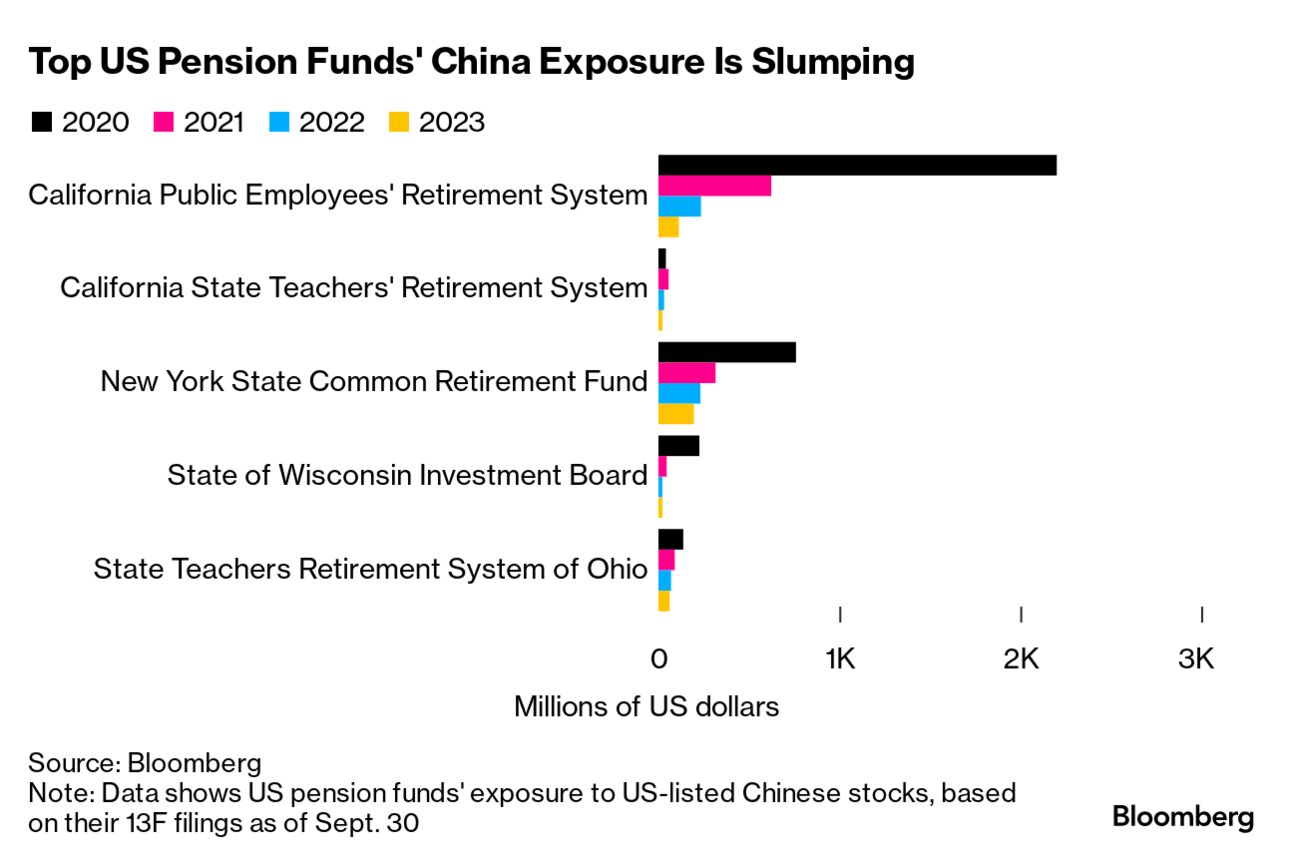

~Analysis of documents submitted by US pension funds~

14 US pension funds invest in Chinese stocks.

Analyzing SEC filings:

It turns out that most funds have reduced their holdings in Chinese stocks since 2020.

Chinese investment declines for third consecutive year:

The largest California Public Employees Retirement Fund (Calpers) and New York State Joint Retirement Fund.

Both funds reduced their China exposure for the third consecutive year.

The shift away from Chinese stocks continues:

1. Doubts about the Chinese government’s economic policies and the protracted real estate crisis.

2. Negative factors such as strategic competition with the United States increased.

3. We no longer hesitate to exclude China from investment targets.

4. The US-Australian pension system has abandoned China, which is in complete decline.

London think tank: Official Monetary Financial Institutions Forum (OMFIF)

2023 Institutional Investor Survey:

Conducted for 100 pension and sovereign wealth funds (SWFs).

1. No funds have a positive outlook on China.

2. None of the funds viewed China as offering high relative returns.

https://www.bloomberg.co.jp/news/articles/2024-01-11/S737YHT0G1KW00

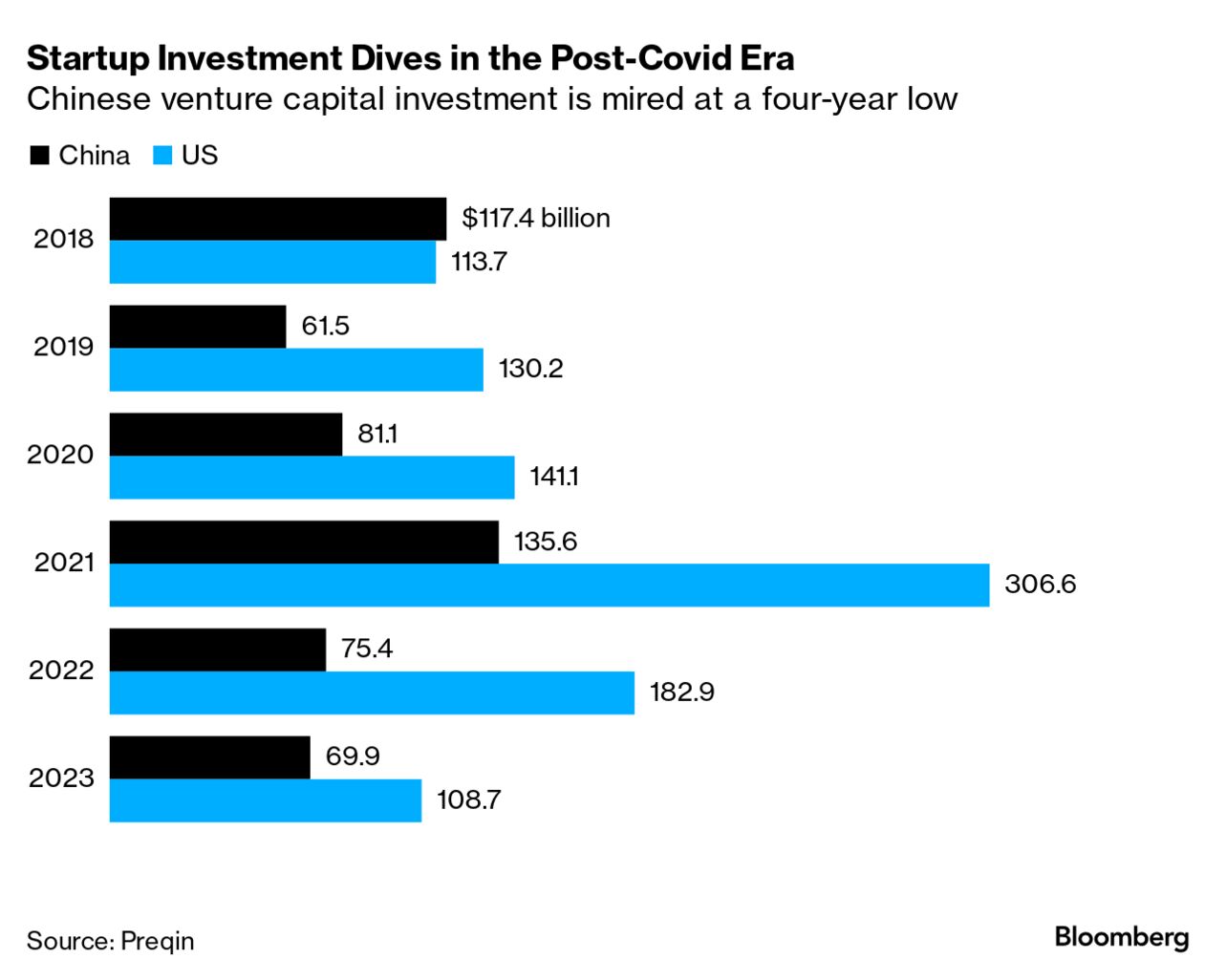

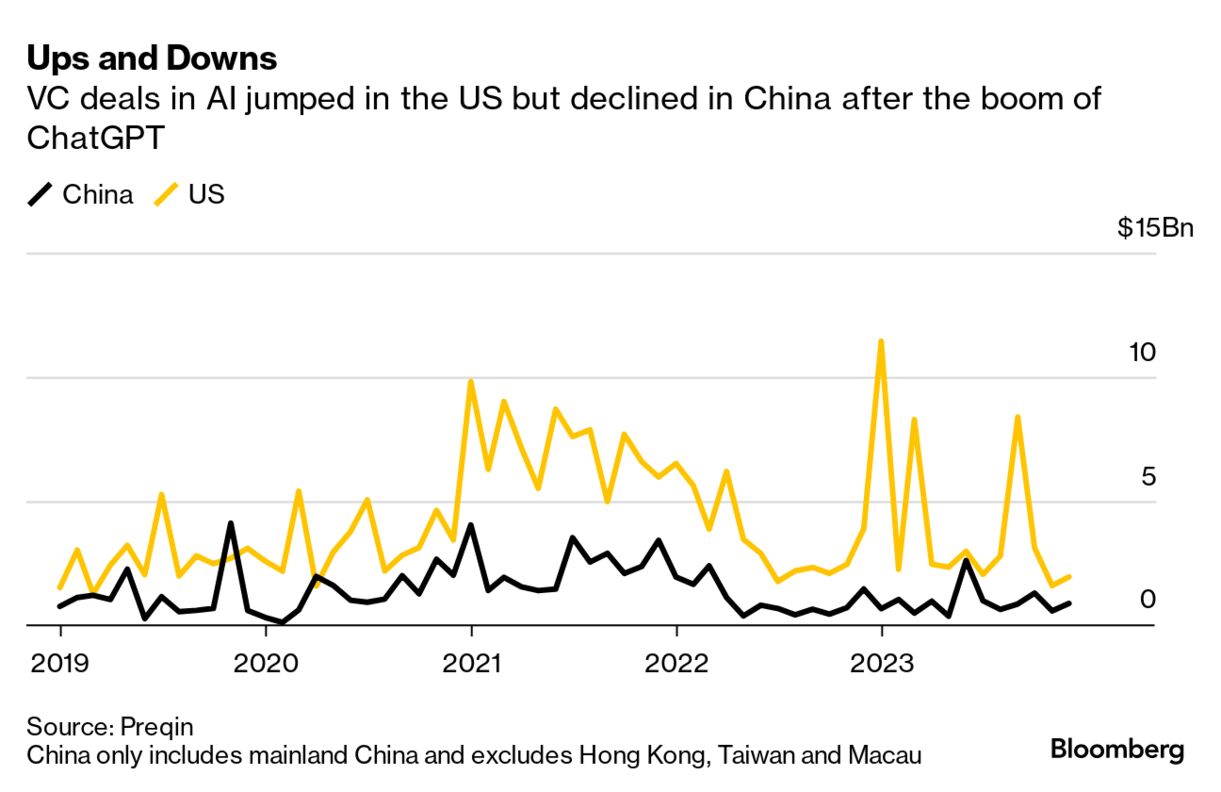

Chinese VC investment: Lowest level in 4 years in 2023

We will provide you with a summary of articles published on Bloomberg.

Preqin data:

Preqin has compiled the amount of venture capital investment.

According to the data, the investment amount was approximately 4,200 projects totaling 69.9 billion dollars (10.12 trillion yen).

1. In 2023, Chinese VC investment will decrease by more than 7%. This follows a 44% decline in 2022.

2. There was a large semiconductor project. However, it is the lowest level in four years.

Tensions between the US and China have increased, and funding has dried up, especially from foreign investors.

Top 10 Chinese VC deals:

~10 major transactions based on the data compiled by Preqin~

Semiconductors: Four companies are on the line, including Changxin Cunchu Technology and Shanghai Stacking Tower Semiconductor (GTA Semiconductor).

Retail: SHEIN is listed after raising $2 billion.

AI startups: Hyakukawa Chino and Beijing Moonshot AI are planning to raise funds this year.

https://www.bloomberg.co.jp/news/articles/2024-01-11/S71IEGT1UM0W00

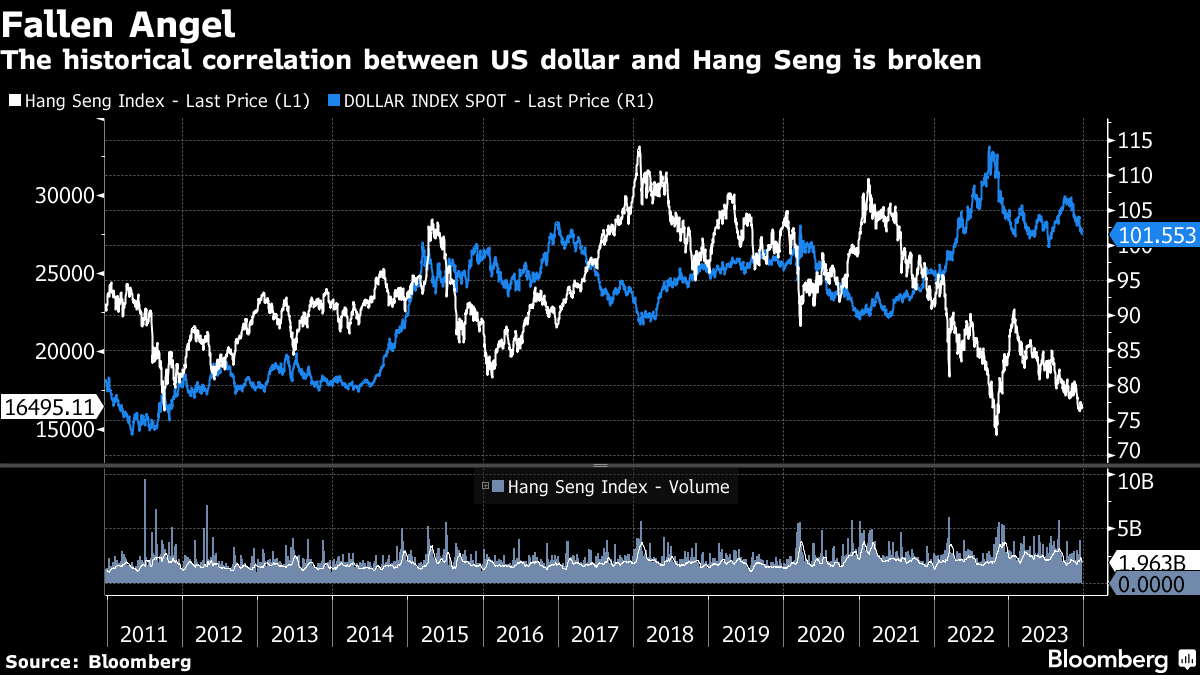

Chinese stock market: China’s decline shows signs of end

・Hang Seng Index fell 19%, 46 stocks delisted

・Japanese stocks rose 29%, smooth sailing

We bring you a summary of Hisashi Katsumata’s World View article.

China’s Ministry of State Security:

There is no trace of the old days in China’s economy.

China’s Ministry of State Security has threatened to “detain those who promote the theory of China’s economic decline.”

China’s economic slump:

The slump in China’s economy is reflected in the decline in stock prices.

1. The Hang Seng Index fell by 19% in 2023.

2. The number of stocks to be delisted reached 46, indicating poor performance.

Chosun Ilbo (December 29)

We published an article titled “46 companies delisted in China, Japan has the highest dividend amount”.

Korean stock exchange:

China’s Shanghai Composite Index has fallen 6% since the beginning of the year, and Hong Kong’s Hang Seng Index has fallen 19%.

1. A real estate crisis arrives, including the default of Country Garden.

2. Exports are slowing due to US-China trade friction, and sluggish domestic demand is also having a negative impact on investment sentiment.

China Securities Times:

As of December 25th, the number of companies delisted this year is 43, the highest ever.

Real estate-related stocks led the list with eight stocks, followed by computer-related stocks with seven stocks.

1. Financial issues were the main reason for delisting.

2. The number of stocks that have fallen below the standard stock price and are discontinued is increasing.

China’s real estate crisis: Oxford Economics

The analysis shows that it will take at least four to six years for China’s housing oversupply problem to be resolved.

State Administration of Foreign Exchange of China:

~Away from foreign investors: Foreigners are in a hurry to leave China~

As of the end of October, investment in Chinese stocks and bonds had fallen by $31 billion.

This is the largest decline since China joined the WTO in 2001.

US PE investment in China also sharply declines:

Wall Street PE funds’ investment in China has plummeted to 5% in previous years.

https://hisayoshi-katsumata-worldview.com/archives/34521233.html