中國惡夢:房屋庫存超5000萬套!

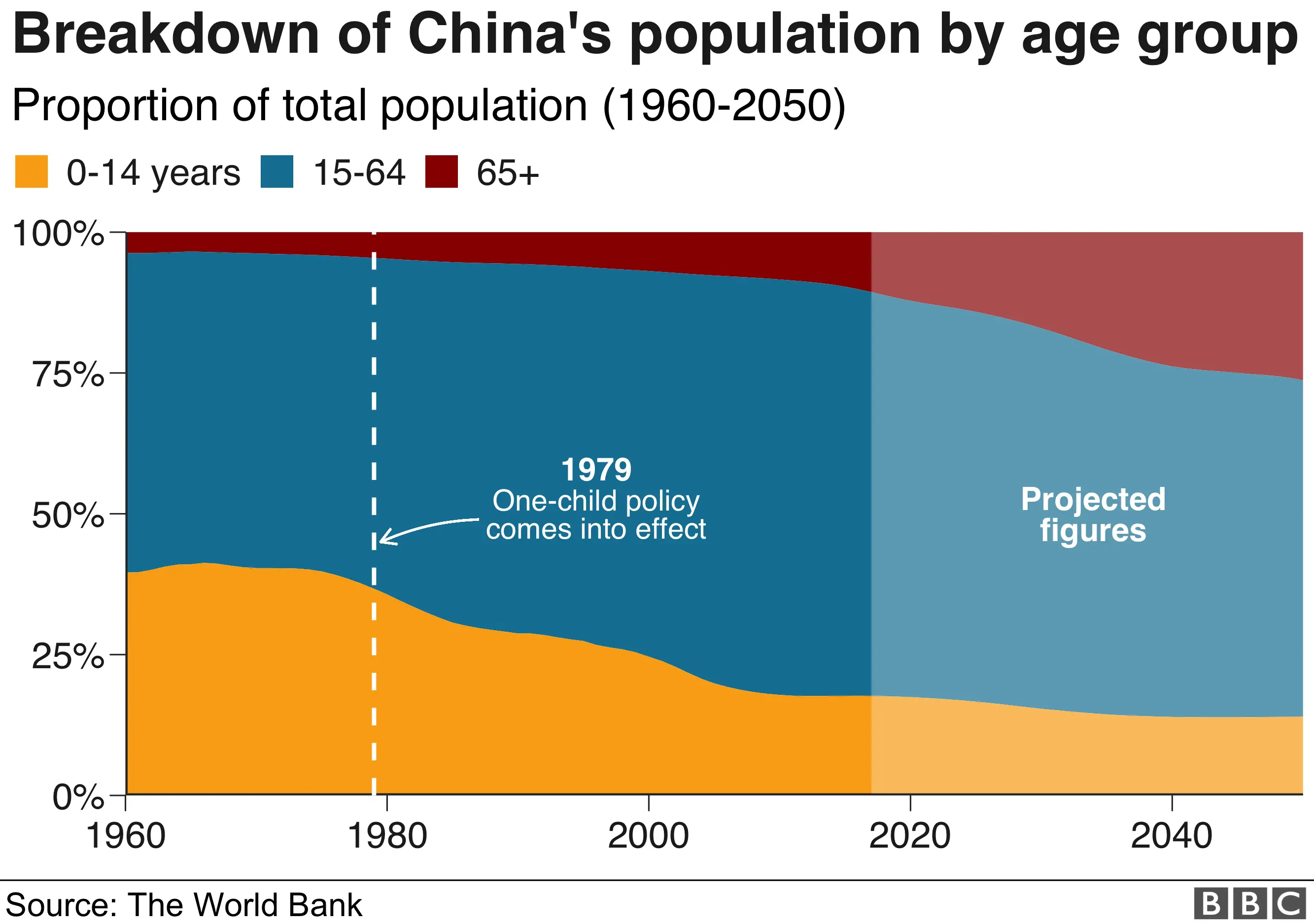

・受獨生子女政策影響,房屋購買停滯

・以低價出口彌補生產過剩

我們為您帶來勝俁恆的世界觀文章摘要。

Housing inventory in China:

Currently, China’s housing inventory has reached 50 million units.

1. If three people live in one house, it is equivalent to housing for 150 million people.

2. It was calculated that it would take 60 months to sell this huge inventory.

However, the most important home-buying demographic is people in their 30s.

However, the number is decreasing due to the one-child policy.

Nikkei Shimbun, electronic version (January 27)

We published an article titled 50 million units of surplus inventory.

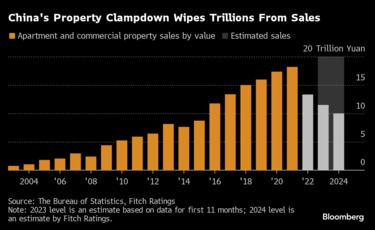

China’s housing bubble burst:

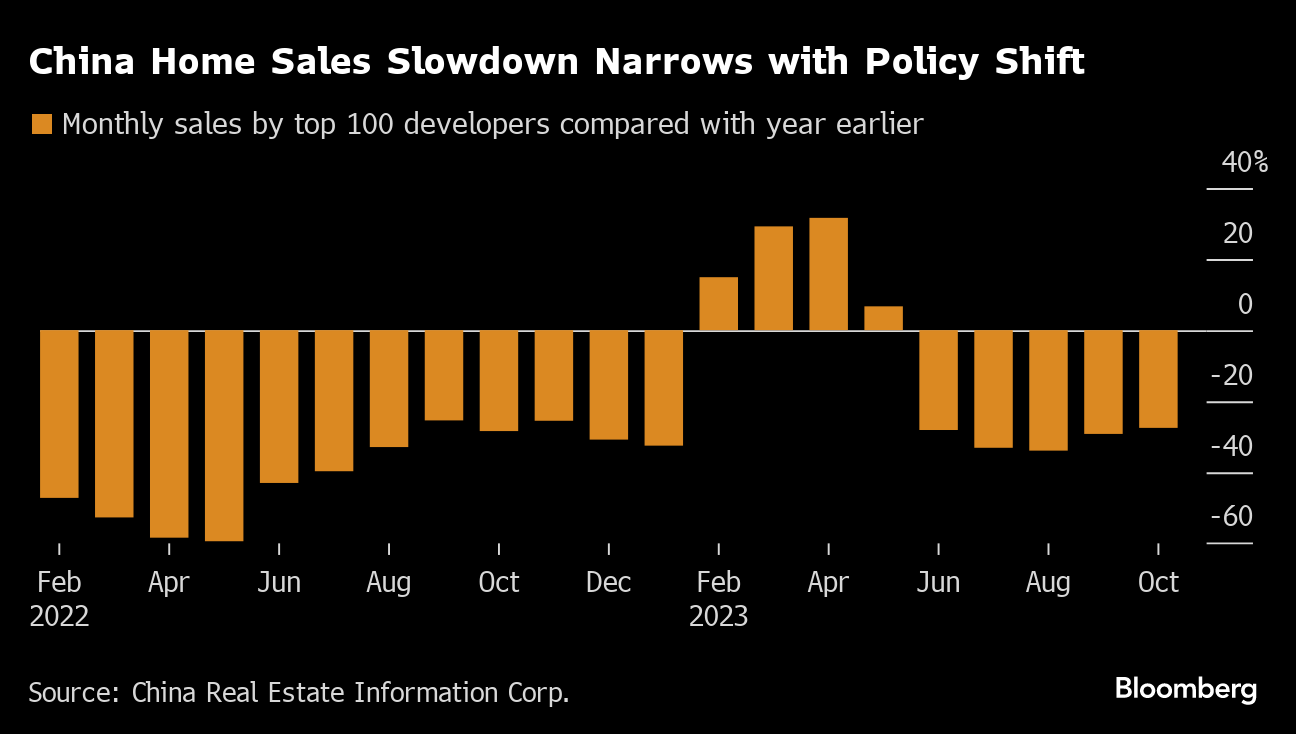

China is struggling with the aftermath of the bursting of the housing bubble.

Accumulating inventory and sluggish sales coincide.

A simple calculation shows that the number of months required to sell the product is over 60 months.

Coupled with the declining population, actual demand is on the decline.

Estimating China’s housing stock:

We have calculated the “housing inventory” at the end of 2023.

The sales area is subtracted from the construction area of the house.

1.Assuming the area per unit to be 100 m2,

Assuming that 2.3 people live there, there will be 50 million units.

It is estimated that China has enough stock for 150 million people.

Country Garden

Selling inventory properties for cash:

Country Garden, which is in financial trouble, is selling its inventory for cash.

In Nanchong, Sichuan:

110㎡ is on sale for 620,000 yuan (12.7 million yen), a 22% discount.

In Shenyang, Liaoning Province:

It is on sale at a huge discount at 8,300 yuan, a decrease of 3,000 yuan per square meter.

Impact of slump in new home sales:

When looking at the breakdown of household assets in China, housing accounts for 70%.

In urban areas, 97% of people own multiple rental homes.

In particular, the impact of “decrease in assets among the middle class” is large.

The general public in China has been forced to cut back on their consumption.

Reasons why housing stock is not decreasing:

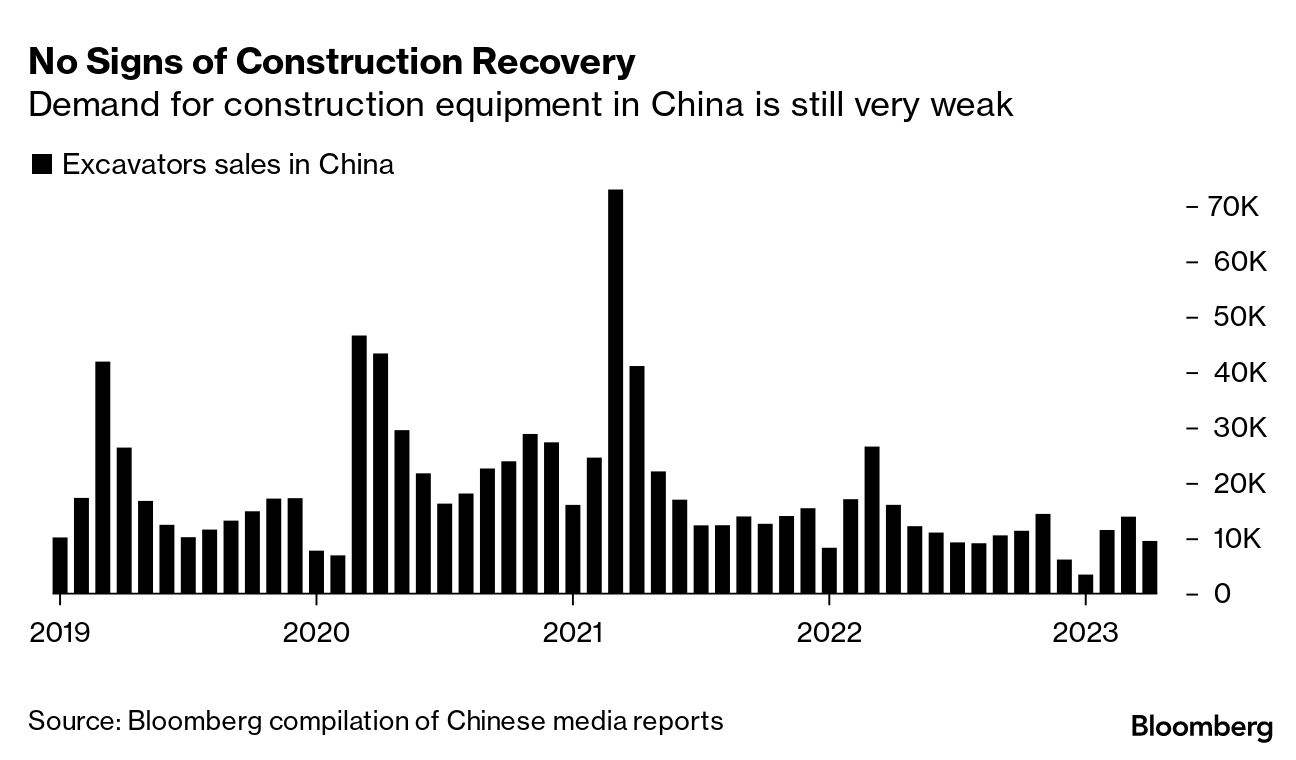

The construction boom subsided with stricter regulations in 2020.

However, the reason housing stock has not decreased is due to sluggish sales.

1. The sales area in 2023 has drastically decreased to 940 million square meters.

2.40% decrease compared to the 2021 peak (1.56 billion m2).

Due to the sharp decline in housing demand, the time for resolving the housing problem will become even more distant.

Chinese authorities’ major blunder exposed:

The housing inventory of 50 million units is too large.

1. It is a huge blunder for the Chinese authorities to not notice the excessive construction in advance.

2. This is also the result of overestimating urbanization population projections.

Responsibility for the decline in the population of people in their 30s:

Due to the negative effects of the ‘one child policy’, the population of people in their 30s is decreasing.

Number of people in their 30s who own a home:

In 2020, the number of people in their 30s exceeded 220 million. :

In 2035, the number of people in their 30s will fall below 160 million.

Professor at Harvard University: Kenneth Rogoff

The population of people who acquire first-time housing will decrease from now on.

From now on, housing construction will shrink at an annual rate of 3% until 2035.

Responsibilities of Chinese leadership:

The Chinese leadership must be held accountable.

Thanks to the land ownership system, local finances have been enriched.

However, that estimate was off. Now it’s the Chinese leadership’s turn to suffer.

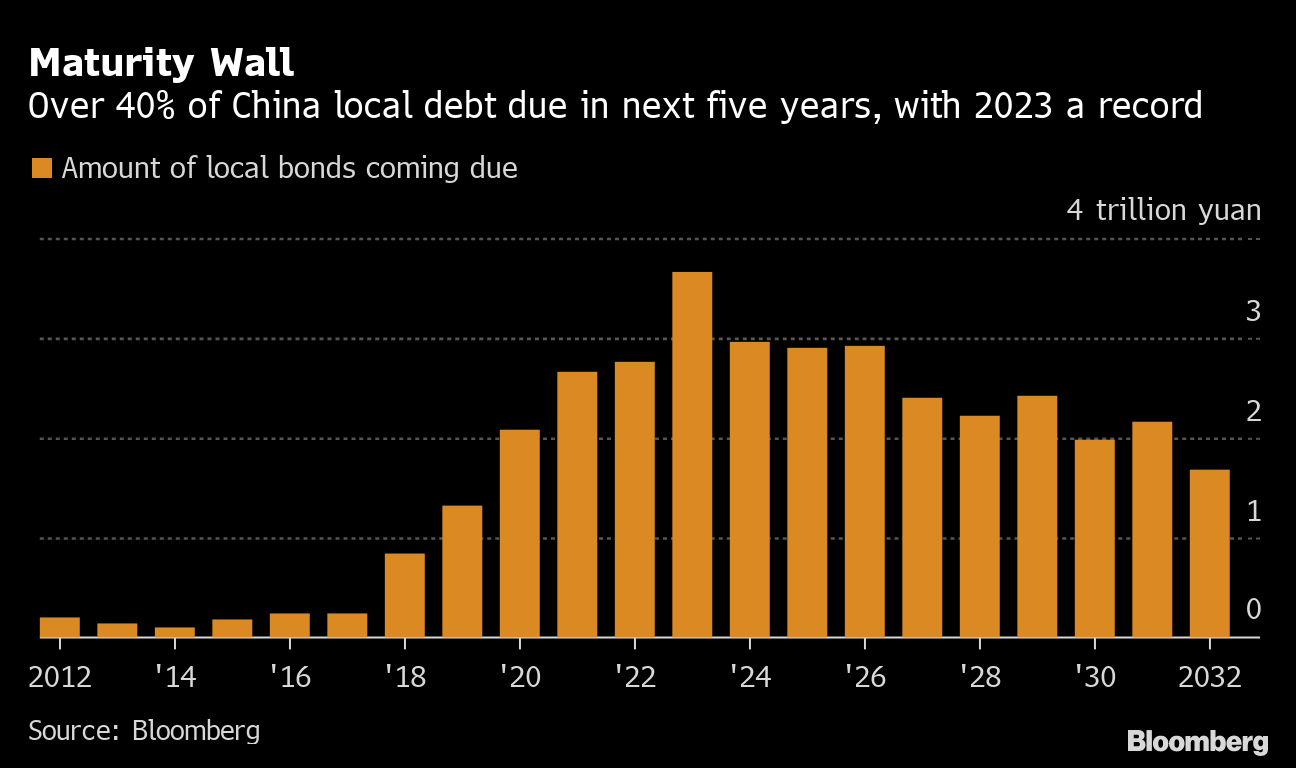

Housing recession hits local economy directly:

Bidding for local government land use rights continues to be unsuccessful.

Real estate companies with excess inventory no longer participate in bidding at all.

Excess debt of “loan flat”:

Local governments that have lost their main source of income suffer from excessive debt due to a “loan plateau”.

The “hidden debt” of the loan base is huge.

This repayment alone will shake the foundation of China’s economy.

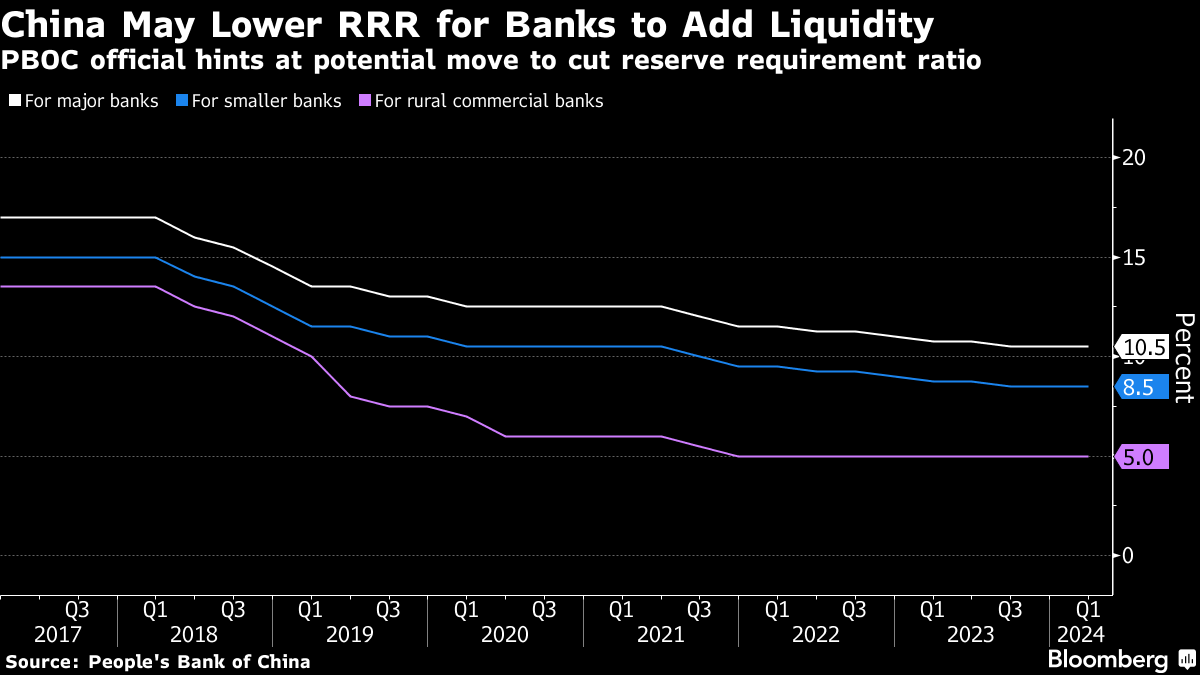

People’s Bank of China:

Although it is belated, the government has decided to implement additional monetary easing.

However, it is absolutely impossible to discover demand for housing.

China’s low-priced export offensive continues:

The housing surplus put downward pressure on international commodity prices.

The world is wary of “cheap exports of surplus building materials from China.”

China’s housing recession has affected steel and copper futures prices.

Chinese steel companies are in the red: 45 listed steel companies in China

In the first half of 2023, nearly 80% of the companies will be in the red.

China is looking to exports as an outlet for its overproduction.

China Steel Industry Association:

Steel exports in 2023 will be 90 million tons. This was an increase of 20 million tons from the previous year.

“Export growth has alleviated the oversupply,” Vice Chairman Tan Seong-hyuk commented.

To prevent China’s low-priced exports:

Mexico has raised tariffs on steel and related products with China in mind.

The influx of cheap Chinese products could take away the competitiveness of domestic industries.

The “runaway” Chinese economy will cause trouble all over the world.

The world is bracing for new friction due to China’s “low-priced exports.”

https://hisayoshi-katsumata-worldview.com/archives/34903592.html