中國崩潰:破產數量創歷史新高!

・中國企業破產最新調查結果公佈

・中國企業破產與日本企業比較分析

我們為您帶來一篇刊登在《風險怪獸》(Risk Monster)上的文章摘要。

Risk Monster’s survey results:

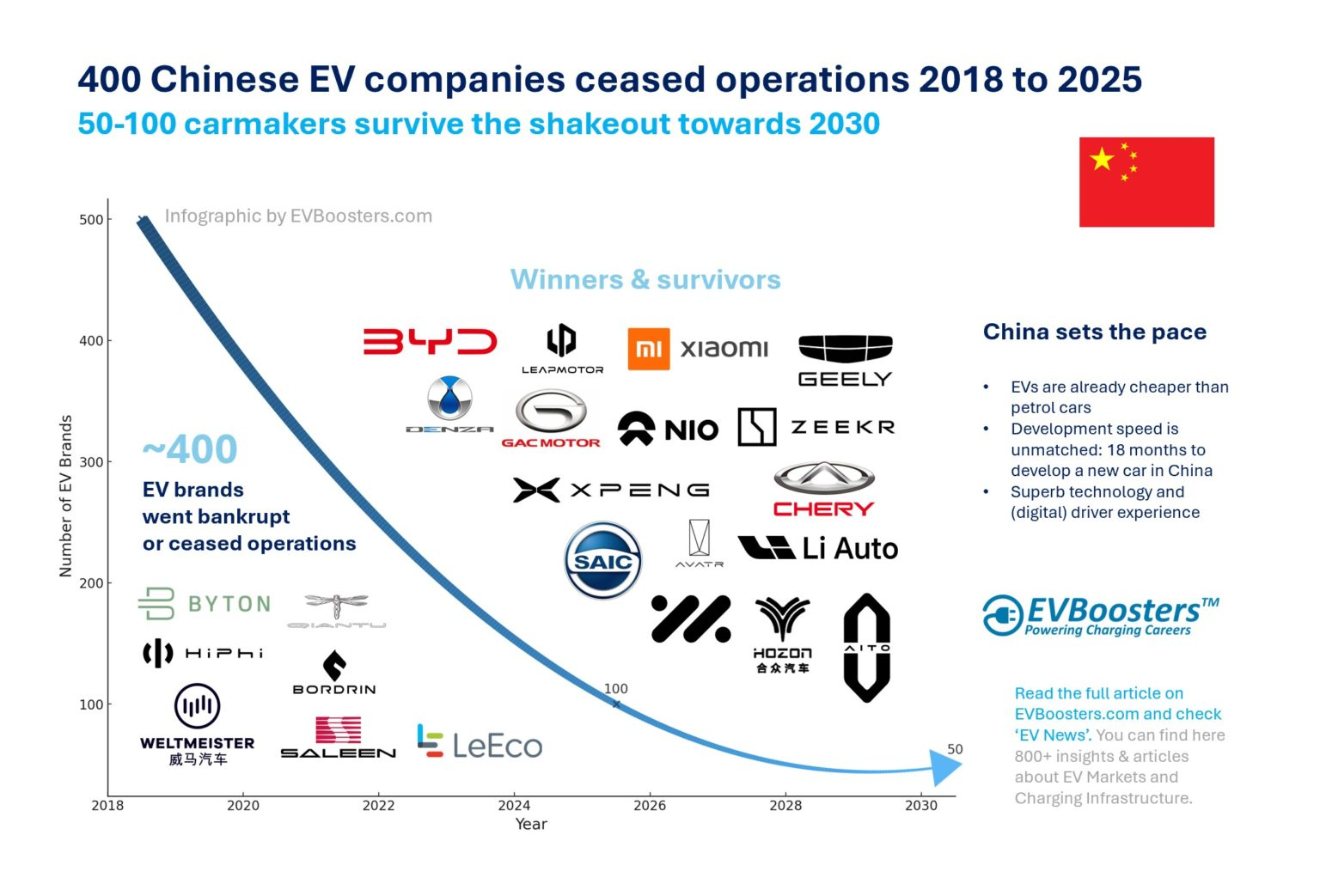

The number of Chinese corporate bankruptcies is rapidly increasing.

As of November 2024:

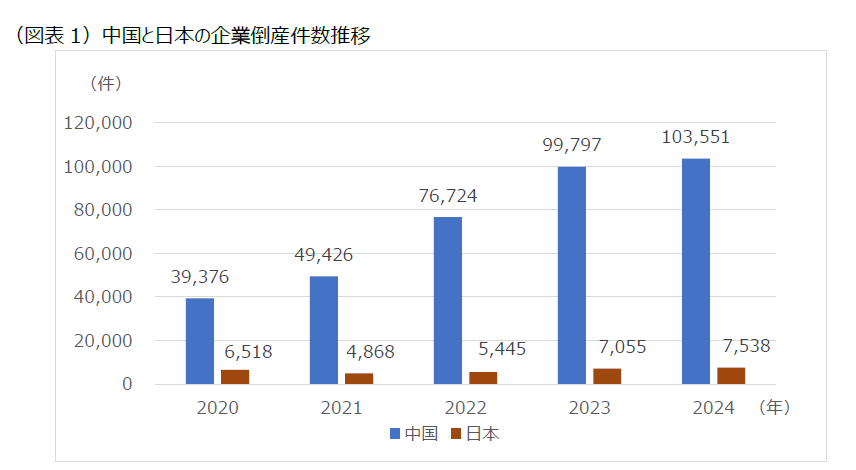

Number of Chinese companies: China has 60.867 million companies (up 5.4% from the previous year), 11 times the number of Japanese companies (5.542 million).

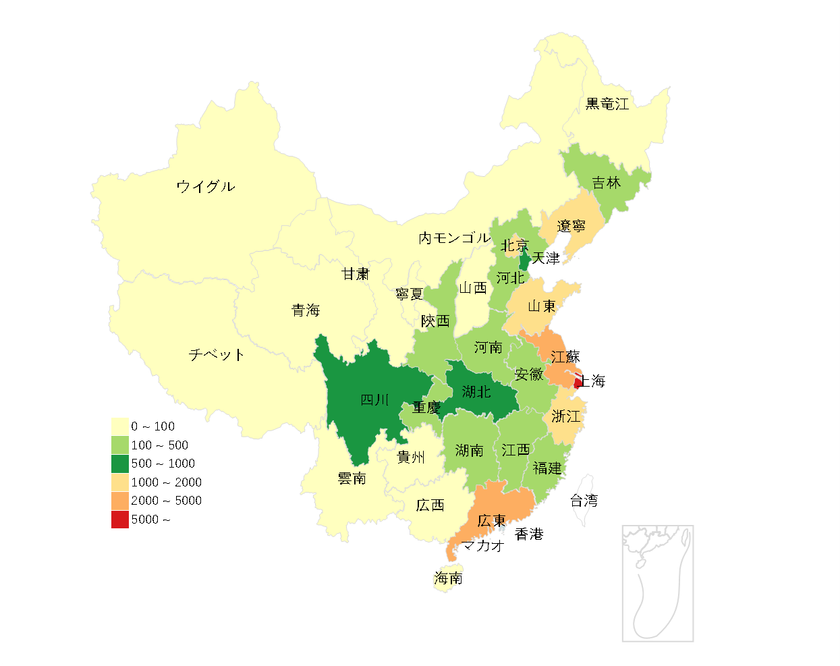

1. Number of Chinese corporate bankruptcies: 2024 was the highest ever, recording 103,551 cases.

2. The number of Chinese companies is 11 times that of Japan, but the number of bankruptcies is 13.7 times that of Japan (103,551 cases in China and 7,538 cases in Japan).

Risk Monster’s survey: Japanese companies fleeing China

Due to the worsening economic environment in China, the number of Japanese companies fleeing China is rapidly increasing.

What should Japanese companies pay attention to in the future?

1. This report focuses on the fluctuations in the number of corporate bankruptcies and legal procedures in China and Japan.

2. We have summarized the points to be aware of when withdrawing from China.

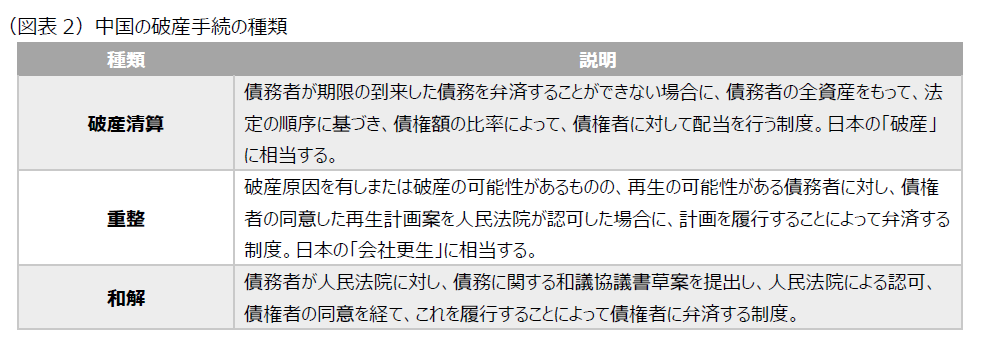

Differences in rules between Japan and China:

When a Chinese company goes bankrupt, it is difficult to collect debts through legal procedures.

In China, more than 90% of cases are handled as “bankruptcy liquidation.”

In Japan:

1. In Japan, bankruptcy procedures are generally completed within a year.

2. Although the dividend rate is less than 10%, a certain level is maintained.

In China:

3. In China, the average dividend rate for general debt is only 0.8%.

4. It is extremely difficult to collect debts through legal procedures in China.

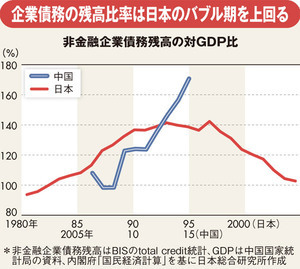

Increasing risk of uncollected debts: Chinese corporate debts are rapidly increasing:

1. Approximately half of Japanese companies have actually experienced “collection abnormalities.”

2. 86% predict that “bankruptcy risk will continue to increase in the future.”

Survey of Japanese companies in China:

1. Half of Japanese companies in China have experienced delayed collection or bad debts in the past three years.

2. 86.0% responded that “bankruptcies will continue to increase in the future.”

Bankruptcies in China are increasing rapidly, and the risk of uncollected debts will increase further in the future.

Case of Japan: Japan Judicial Statistics Annual Report:

Of the 5,936 bankruptcy cases in 2023, 86.5% had a trial period of less than one year.

1. In addition, only 24.4% of cases resulted in dividends being paid to creditors.

2. Even in cases where dividends were paid, 70.7% had a dividend rate of 10% or less (※2).

Case of China: Public data from the Shanghai Bankruptcy Court

The Shanghai Bankruptcy Court in China has released its 2023 data.

1. The average review period for bankruptcy liquidation cases is 291 days.

2. The average dividend rate for general claims is only 0.8%.

https://www.riskmonster.co.jp/pressrelease/post-19259/