Hekkeien:默認,倒數計時開始

-美元計價債券違約逼近-

-中國房地產業正陷入停滯-

我們為您帶來勝俁恆的世界觀摘要。

China Real Estate: Biguiyuan

Unable to pay interest this month:

In September of this month, the company was unable to pay interest on two dollar-denominated bonds by the original deadline.

The grace period has been extended to October 18th and 27th, respectively.

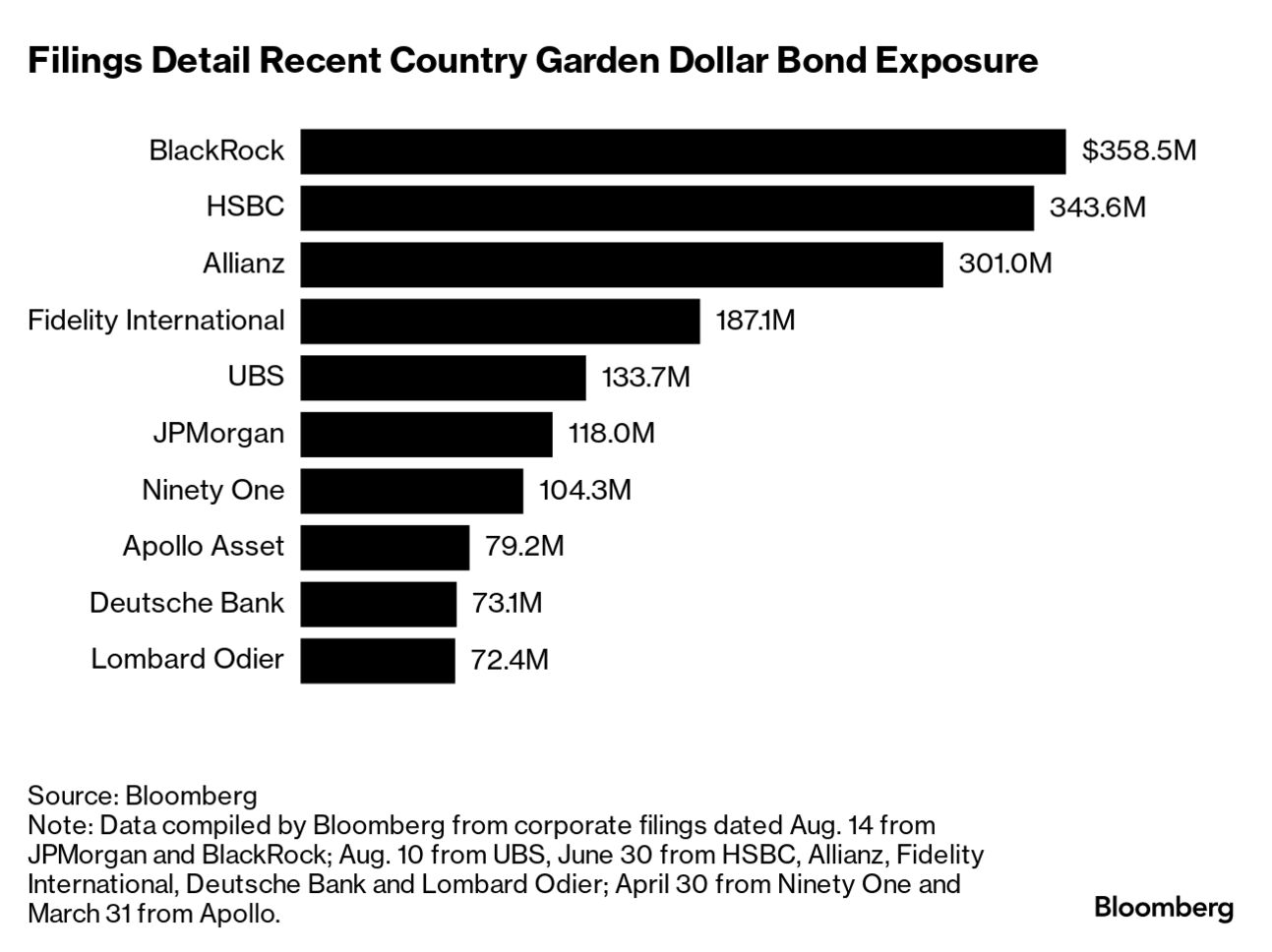

Outstanding dollar-denominated bonds outstanding:

According to a Bloomberg survey, the outstanding amount of offshore bonds issued is 11 billion US dollars (1.63 trillion yen).

It has become virtually impossible to pay such huge debts.

If the government defaults, China’s real estate development industry will come to a standstill.

Chinese real estate developer: Jindi Group (Gemdale)

On the 17th, Chairman Lingke suddenly resigned.

Two onshore bonds of Jinji Group plunged and trading was suspended.

Bonds due in 2024 fell more than 25%.

Bonds due in 2026 also fell by more than 20%.

Chinese media: “First Finance and Economics”

Mr. Ling’s resignation from Jinji Group is a normal transfer of management responsibility.

However, due to the timing, it feels like it’s ”telling a sudden change.”

“Bloomberg” (October 17)

We published an article titled ”China Biguiyuan’s Dollar-Denominated Bonds Approaching Default.”

Testimony from USD bondholders:

Two holders of Biguien’s US dollar-denominated bonds due in 2025.

On October 17th, it was revealed that the interest payment had not yet been received.

The original payment deadline was last month. It has already entered its grace period, which will end soon.

Biguien’s US dollar-denominated bonds are nearing default.

Trading price for USD-denominated bonds:

The company’s U.S. dollar-denominated bonds trade at around 4 to 6 U.S. cents per dollar par value.

Reflecting the low expectations of investors, it would not be surprising if the company eventually defaulted.

Biguien’s history of interest payment default:

Byekeiyuan failed to pay interest payments of US$15.4 million (2.3 billion yen) by the original deadline in September.

The dollar-denominated bond has a 30-day grace period.

However, this period ends on October 17th-18th.

Beyond that a default can be declared.

Default possibilities:

There is a strong possibility of default almost 100%.

Hekkeien’s problem is that it has a large number of unfinished properties.

It is certain that this will lead to even more people leaving their homes. China’s economy is losing its grip on recovery.

Xi Jinping’s stance:

Although the Xi administration is aware of this situation, there is “no sign of it taking any steps to provide relief.”

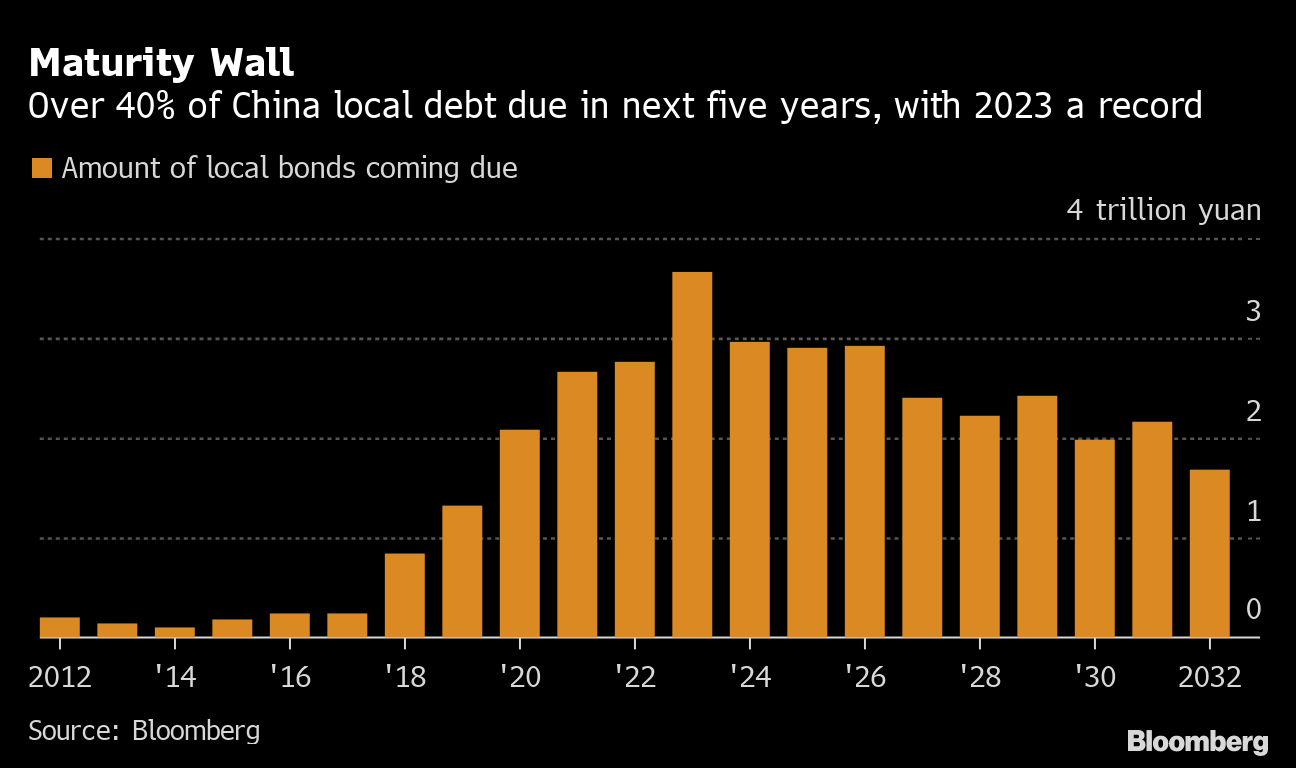

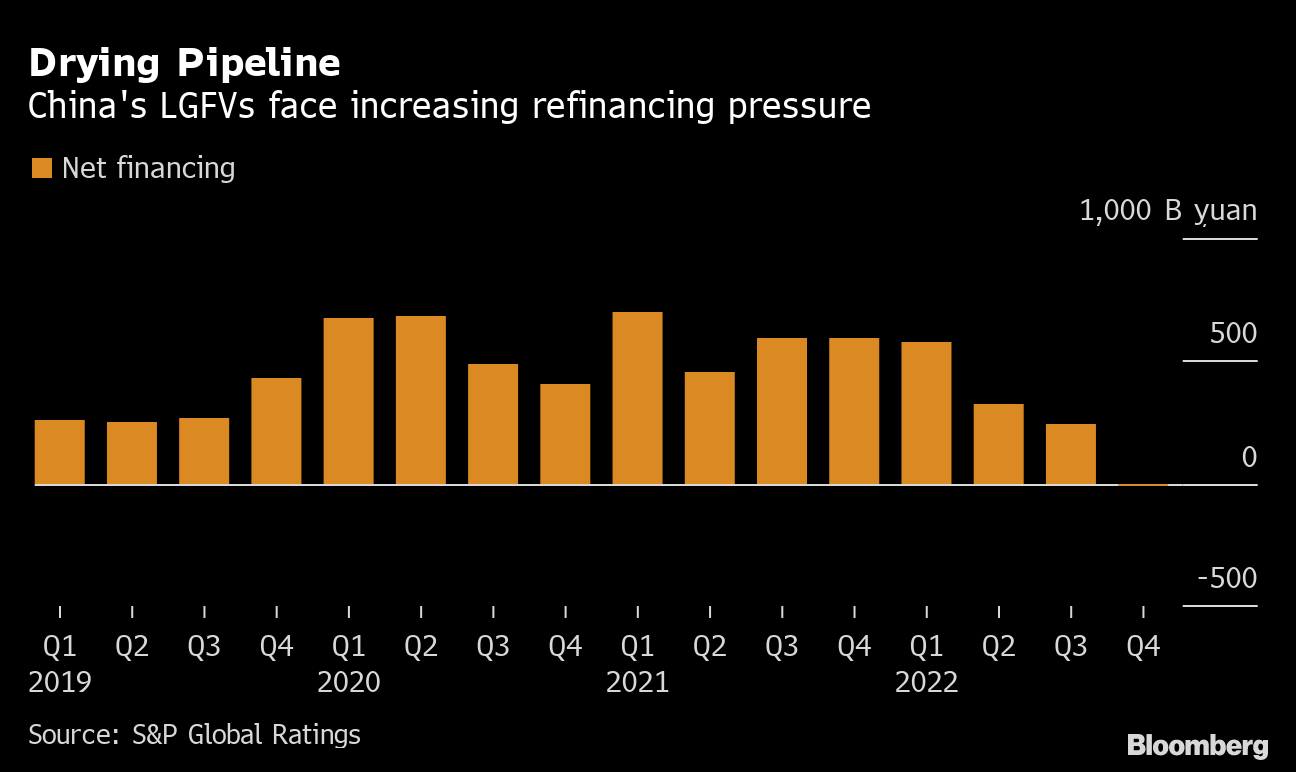

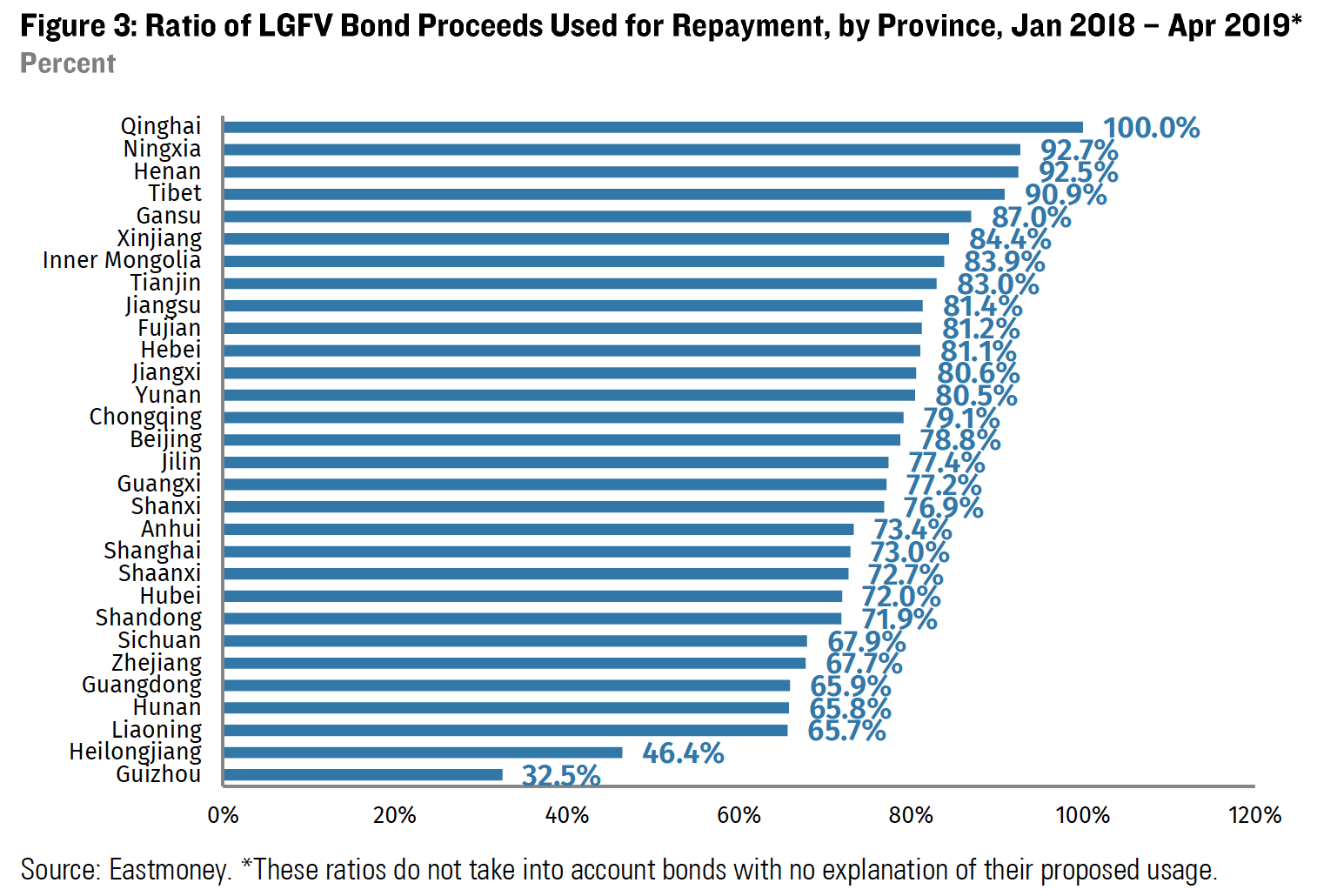

That’s because the government is currently “doing its utmost to rescue local governments with excessive debt.”

Instructions from Chinese authorities:

Issued instructions to state-owned banks to change their loans to local governments to low-interest, long-term loans.

We will begin “initiatives to curb local government debt risk.”

“Reuters” (October 17)

The People’s Bank of China ordered major state-owned financial institutions to do so last week.

Local government infrastructure investment company:

It ordered “extension of loan period, revision of repayment plan, and reduction of interest rate”.

Central bank guidance:

For “loans that are due for repayment before 2024 (non-performing loans)”

”Even if a loan is in arrears, it is not a non-performing loan (ordinary loan).”

This will be classified as a normal loan and will not be reflected in bank performance evaluations.

Bank debt restructuring:

At the same time, a system was introduced to prevent banks from incurring large losses through debt restructuring.

The “refinance interest rate” must not be lower than the interest rate on Chinese government bonds.

The “loan term” must not exceed 10 years.

Biguien announces outlook:

On October 10th, regarding offshore debt,

It announced that it would not be possible to meet all payment obligations by the deadline.

She strongly suggested that “she is headed for default and restructuring.”

China’s largest debt restructuring:

The outstanding amount of US dollar-denominated bonds is 9.9 billion US dollars (1.485 trillion yen).

Total debt as of June 30th:

The total debt as of June 30 was “a huge debt of 187 billion US dollars.”

The tsunami of the bursting of the Chinese real estate bubble has come so close.

https://hisayoshi-katsumata-worldview.com/archives/33539681.html