恆大集團:造假會計與擴張計畫的慘痛!

・對門面手段與債務細節進行徹底分析

・習近平政策失敗將導致泡沫破滅

我們將為您提供總統在線發表的文章摘要。

Causes of China’s real estate crisis:

Journalist Kota Takaguchi points out the causes of China’s real estate crisis.

1. This is due to the ‘new urbanization policy’ implemented by Xi Jinping.

2. Because of this policy, private companies were unable to respond appropriately.

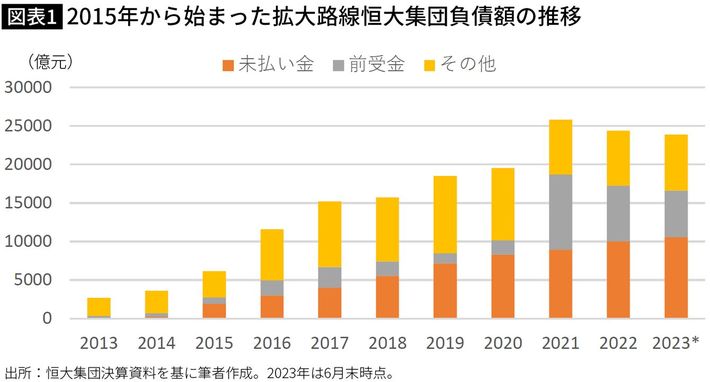

[Chart] Expansion path started in 2015: Changes in Evergrande collective debt amount

Details of Evergrande Group’s fraudulent financial statements:

We analyzed Evergrande’s fraudulent financial statements.

1. Inflated sales by 213.9 billion yuan (approximately 4.49 trillion yen) in 2019

2. Inflated sales by 350.1 billion yuan (approximately 7.35 trillion yen) in 2020

The total amount was 11.74 trillion yen, the largest falsified settlement in world history.

Evergrande Group’s total debt:

Evergrande Group’s debt crisis emerged at the end of 2021.

More than two years have passed this year. But there is no sign that he will recover.

– Total debt is 2,388.2 billion yuan (50 trillion yen, as of the end of June 2023) –

It has decreased by about 190 billion yuan (400 billion yen) from the end of 2021. However, it is “water on a hot stone”.

Total amount of subcontractor/accounts payable, contractor/advance payment:

1. Accounts payable to subcontractors (Orange) is 1,056.6 billion yuan (22 trillion yen)

2. Advance payments (gray) from policyholders amounted to 603.9 billion yuan (12.7 trillion yen)

Evergrande Group received the advance payment. Therefore, there is an obligation to build.

These two items alone account for 80% of the debt.

Chinese government solution:

The Chinese government wants to resolve these two debts first.

1. If these two debts are left unchecked, the people may go wild.

2. Even though I paid my mortgage, I was unable to move in.

However, repayments to investors and banks will be prioritized later.

Minister of Housing, Urban and Rural Construction:

Minister Nihong spoke at the National People’s Congress (National People’s Congress).

1. Actions that harm the interests of the public will be dealt with in accordance with the law.

2. We will “punish unscrupulous real estate companies” for their actions.

Minister Nihong has no intention of seriously addressing the real estate crisis.

Xi Jinping has also not shown any leadership in the real estate crisis.

Xi Jinping implements new urbanization policy:

The origin of this local real estate bubble was in 2015.

Xi Jinping encouraged the development of regional cities in order to curb concentration in large cities.

Promoting the remodeling of local old urban areas:

1. Previously, the rule was to provide alternative housing to evicted residents.

2. Starting in 2015, there will be a rule that allows people to freely purchase housing using eviction fees.

These new rules have created a huge demand for housing in regional cities.

Evergrande Group’s sales soar:

Evergrande Group’s sales have increased sevenfold in seven years.

In 2012, it was 65.3 billion yuan, but in 2018 it rapidly grew to 466.2 billion yuan.

Evergrande Group’s debt amount has also increased rapidly:

On the other hand, if you look at the trends in the amount of debt, you can clearly see the expansion path.

Total debt has quadrupled, or increased by 24 trillion yen in just three years.

It increased from 362.1 billion yuan (7.6 trillion yen) in 2014 to 1.5195 trillion yuan (32 trillion yen) in 2017.

Evergrande Group’s accounts payable (unpaid) are considered problematic:

As of 2014, unpaid amounts were 22.6 billion yuan (475 billion yen), 6% of total debt.

As of 2017, the amount owed was 399.5 billion yuan (8.39 trillion yen), a sharp increase of 26%.

Chinese government suspends new urbanization policy:

1. The central government viewed the excessive development of local governments as dangerous.

2. Xi Jinping has suddenly put the brakes on new urbanization policies.

The Chinese government stopped paying eviction fees in 2017. .

The beginning of Evergrande Group’s troubles:

Since 2018, the pace of Evergrande Group’s debt expansion has sharply decreased.

1. The system of “high debt, high leverage, and high turnover” is a pyramid scheme.

2. It is impossible to continue with a shortened model without continuing to expand the scale.

Biguiyuan/Consortium China also face debt crisis:

Biguiyuan/Consortium China also fell into debt crisis.

They also uses the same shortened model as Evergrande Group.

They are also suspected of falsifying their accounts:

Both companies said that their past financial results showed that their business performance continued to be strong until 2021.

However, suspicions of window-dressing were directed at Biguiyuan/Consortium China.

。

Solving two major problems:

1. The rise and fall of Evergrande Group was the result of fraudulent financial statements.

2. China’s real estate crisis was caused by Xi Jinping’s policies.

The Chinese government is acting on the spot:

There are two major issues: ”completion of real estate under construction” and ”payment of outstanding amounts.”

1. The problem cannot be resolved without drastic measures such as the injection of public funds.

2. If public funding is delayed, the damage will be even greater.

https://news.yahoo.co.jp/articles/c906f44ce1be49559b8c790971f3074ed44ecfbf