中國的困境:不得不出售海外房地產

・因現金短缺而從海外房地產撤資

・碧桂園進入緊急狀態,死亡慘叫聲不斷

我們為您帶來勝俁恆的世界觀文章摘要。

Withdrawal from overseas real estate:

Chinese creditors have begun selling real estate assets around the world.

As the real estate crisis in China worsens, the company is cutting its losses despite the fact that the market price will fall.

Commercial offices worldwide:

China’s real estate industry is being forced to dispose of properties under adverse conditions.

1. Due to the pandemic, working from home became popular and demand fell.

2. Coupled with the unfavorable conditions of high interest rates, the global real estate industry is at its worst.

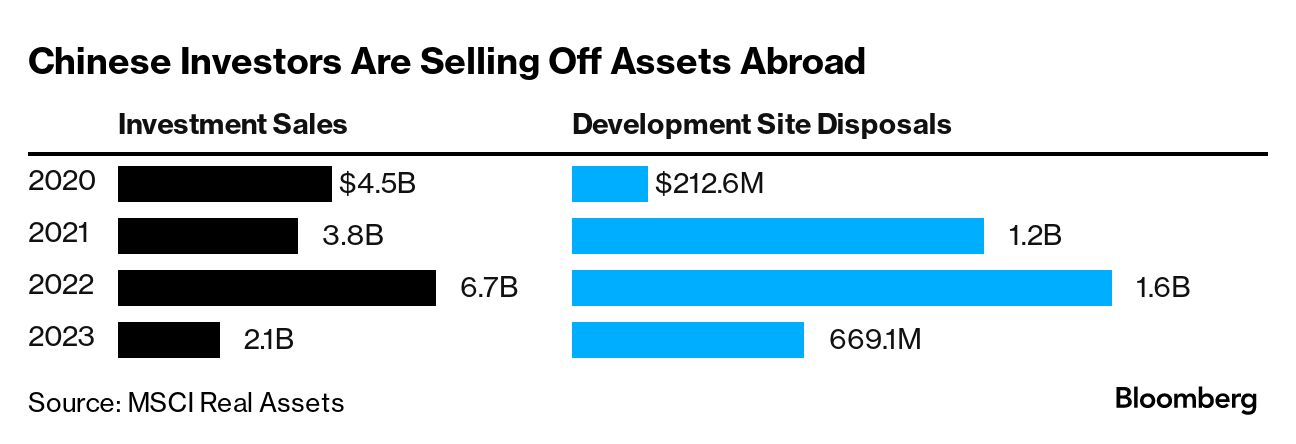

Bloomberg (February 9)

An article titled ”Chinese companies begin selling non-performing assets” was published.

The scale of this is clear if you look at the amount of money Chinese companies have sold overseas assets.

Starwood Capital Group: Barry Sternlicht CEO

During the recent global recession, office real estate lost $1 trillion (149 trillion yen) in value.

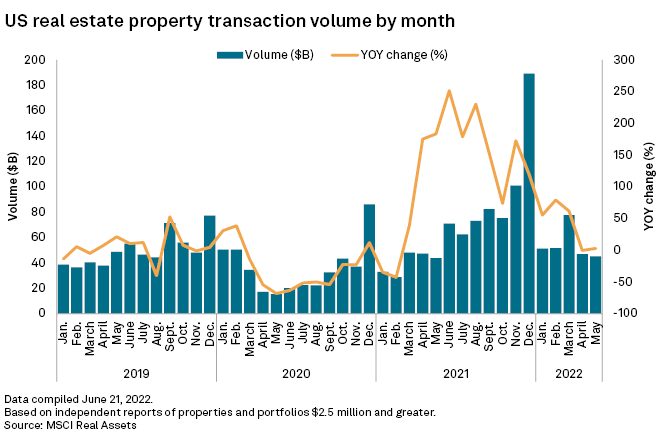

Global commercial real estate: Number of deals closed in 2023

The number of commercial real estate deals is at its lowest level in 10 years.

1. The global real estate industry is in dire straits due to high interest rates and declining demand.

2. Even if you put a property on the market, you won’t be able to close it right away.

Plight of China’s real estate industry:

The Chinese real estate industry is struggling to dispose of overseas properties.

1. Landlords and developers are struggling to repay debts from domestic businesses.

2. Even if you cut your losses, you immediately decide that you need cash.

China Ouyuan Group: Toronto plot sale

Altus Canada sold the Toronto lot late last year for a 5% discount on the purchase price.

1. China’s Ouyuan Group is under pressure to reorganize its domestic business.

2. Generating cash through the disposal of overseas properties is essential for debt repayment.

Semo Group: Sale of London office building

Semo Group sold an office building in London last year.

It was agreed that the sale would take place in 2022. However, in reality, it remained unsold.

The sale price was a 15% discount from the purchase price.

The number of Chinese real estate sales in Europe is starting to increase.

Fu Li Chisan: Sale of London’s Market Towers

Fu Li Chisan will sell its holding company for the London skyscraper Market Towers.

The buyer is London One, an SPV of CC Land, a Hong Kong real estate company.

1. Fu Li Chisan will pay Fu Li Chisan HK$1 as a nominal fee.

2. In exchange, it will assume $800 million in dollar-denominated debt.

A property valued at £1.34 billion was put up for sale on the condition that $800 million in debt be assumed.

Selling non-performing assets outside Europe:

The sale of non-performing assets is accelerating outside Europe, including Australia.

Australian real estate market:

Chinese real estate companies have also been buying up properties in Australia.

1. The company has now stopped making acquisitions and is focusing on selling projects.

2. They are being forced to turn it into cash in order to maintain their cash flow.

Country Garden’s Risland: Melbourne land sale’

Risland is a symbol of China’s heavily indebted real estate crisis.

3. Risland sells land on the outskirts of Melbourne for A$250 million (¥24.2 billion).

4. Risland also sold development assets in Sydney for A$240 million.

https://hisayoshi-katsumata-worldview.com/archives/35006402.html

China’s Country Garden: Asset sales at will

・Real estate worth over 79 billion yen to be auctioned in Guangzhou

・Selling real estate in Australia

We bring you a summary of articles published on Toyo Keizai Online.

Guangzhou Property Exchange: Country Garden sale information

On January 19th, information on the sale of Country Garden was made public at the Guangzhou Property Exchange.

Country Garden has 5 properties up for auction:

1. Fenghuangcheng Hotel (Hotel) in Zengcheng District, Guangzhou City;

2. Country Garden center A-class copying tower (office building),

3. Country Garden Phoenix City Yongwang Commercial Products (Shopping Mall),

4. Biguiyuan Clanhuangfu Bengonglou (office building) located in Panyu District,

5. Renhegongjirou (apartment) located in Baiyun District

The planned sale price is 3.818 billion yuan (79.4 billion yen).

What is Guangzhou Industrial Rights Exchange?

A public market that specializes in trading property rights.

It is installed in various parts of China and is used for corporate bankruptcy processing, asset restructuring, and transfer of unlisted stocks.

When selling the assets of a real estate company that is experiencing financial difficulties, there are many cases where the relationship between credits and debts is complicated.

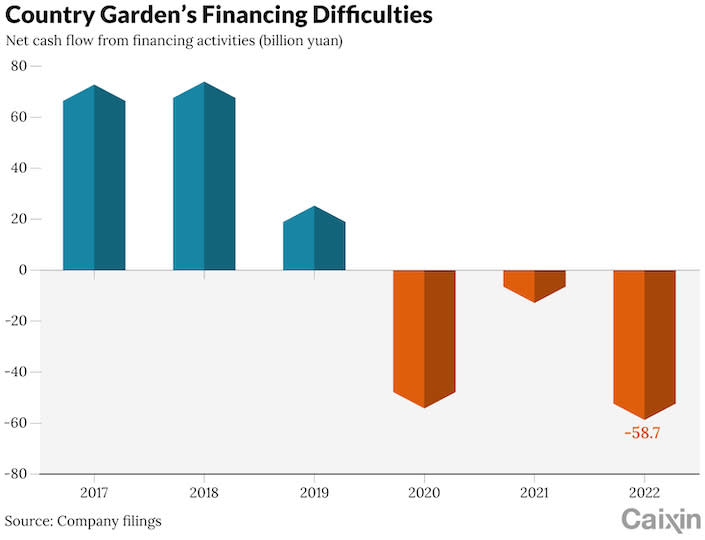

Country Garden’s financial situation worsens:

In August 2023, Country Garden was unable to pay interest on its bonds by the due date. Tight cash flow has surfaced.

It has total assets of 1.62 trillion yuan (34 trillion yen) and total liabilities of 1.44 trillion yuan (30 trillion yen).

Real estate sales income decreased significantly:

Real estate sales income, which is Country Garden’s lifeblood, has decreased significantly.

1. In 2022, interest sales (=revenue from reservation sales of unfinished properties) will reach an average of 29.8 billion yuan (619.5 billion yen) per month.

2. In August 2023, interest sales decreased sharply to an average of 7.98 billion yuan (165.9 billion yen) per month.

3. Country Garden requires at least 22 billion yuan (457.4 billion yen) per month.