對華投資發出黃色訊號:外資明顯迴避

-蓋洛普和先鋒集團退出中國

– 摩根大通和太平洋投資管理公司重新考慮他們的策略

我們為您帶來勝俁恆的世界觀摘要。

Yellow light for China’s economy:

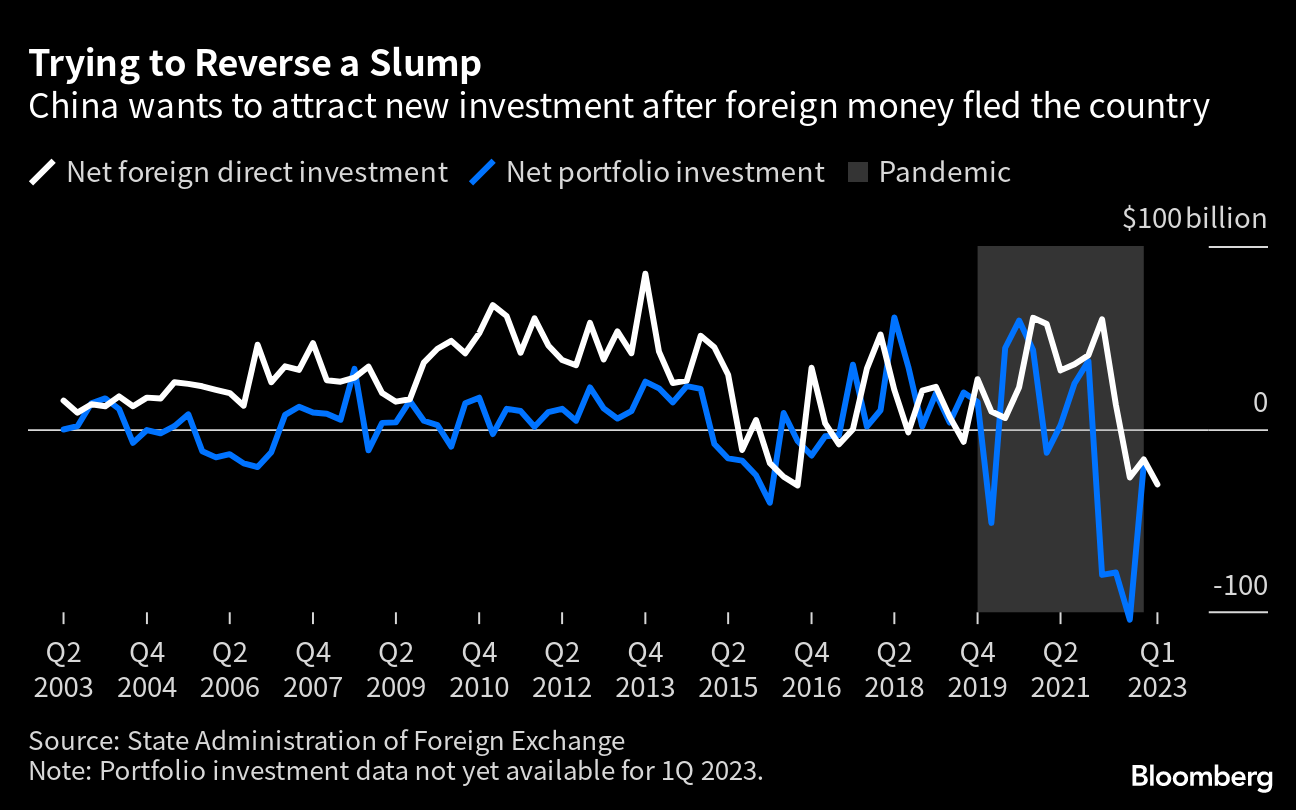

An unwelcome situation has occurred in the Chinese economy.

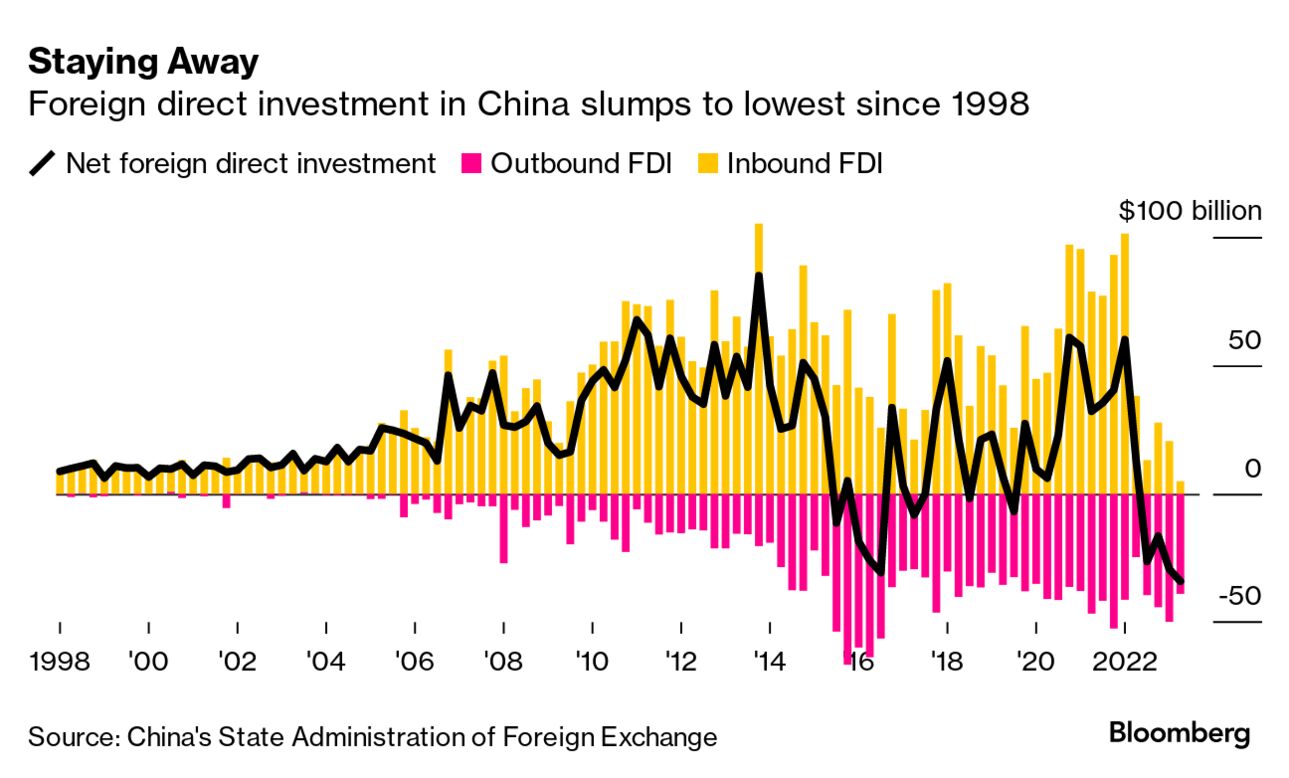

From July to September, FDI in China fell into the abyss.

Foreign direct investment (FDI) from July to September plummeted to minus $11.8 billion for the first time.

The Chinese economy has lost its attractiveness as an investment destination for foreign capital.

Trends in Chinese FDI in 2023:

January-March period 21 billion dollars

April-June period $6.7 billion

July-September period: -11.8 billion dollars

Disclosure of FDI for August:

The Chinese government suspended the publication of dollar-denominated FDI in August.

The reason is that FDI is rapidly decreasing.

Lowest recorded FDI since 2000:

6.7 billion dollars for the April-June period of this year. This was a sharp decline from $21 billion in the January-March period.

1. In 2022, FDI will reach an annual record of $189 billion.

2. In 2023, the situation will be “dropping the bottle.”

Announcement by the spokesperson of the Ministry of Commerce of China (Xinhua News Agency)

At a press conference on November 2nd, he made a bullish statement, saying, “In the long term, FDI will improve.”

1. Restrictions on foreign capital participation in the manufacturing industry will be completely abolished.

2. Expanding the entry of foreign capital into China’s service industry.

3. Efforts will be made to eliminate hidden barriers to foreign investment.

4. Treat foreign companies equally in areas other than the negative list.

To put it bluntly, the question is, “What are you making excuses for now?”

China risks are rapidly expanding:

Foreign capital is investing in the future potential of the Chinese market.

In addition, even though there were many barrier clauses for inward direct investment, they were patient.

https://hisayoshi-katsumata-worldview.com/archives/33684407.html

‘Long winter’ coming to China: Foreign companies predict economic stagnation and plan to sell Chinese stocks

We bring you a summary from Hisashi Katsumata’s World View.

Financial Times (November 4)

Gallup, a pollster, announced last week that it was withdrawing from China.

Public opinion poll Gallup:

The company expanded into China in 1993 and opened offices in Beijing, Shanghai, and Shenzhen.

He has provided consulting in areas such as marketing and organizational design.

Gallup targeted by Chinese authorities:

For institutional investors, economic information is essential for making investment decisions.

1. But earlier this year, it became a target of Chinese authorities.

2. Gathering information on China has become extremely difficult.

Not being able to obtain satisfactory data on China is fatal.

“Bloomberg” (November 2nd)

It was reported that “Vanguard is closing its China office and completely withdrawing from China.”

The person spoke on condition of anonymity because the decision is confidential.

Vanguard China Office Closing:

The size of the Chinese investment trust market is 29 trillion yuan (600 trillion yen)

Vanguard has agreed to terms of retirement with 10 Shanghai staff members.

The team will leave the company early next year and the office will close.

Bloomberg (November 6th)

An article titled “JP Morgan and Pimco reconsider their China strategy” was published.

China’s economy in a quagmire:

The real estate crisis has spread to the economy, and recovery as post-coronavirus activities resume has stalled.

The slump in Chinese stocks is clear:

Foreign investors are withdrawing money from China at a rapid pace.

1. There are no measures to shore up the chaotic real estate market.

2. In fact, I am despairing that I have left it alone.

3. The renminbi is at its lowest level in 16 years.

JPMorgan Chase: Global Analysis Joyce Chan

Withdrawal of funds from China

The withdrawal from China is not simply based on market sentiment. The harsh view is that the stock is subject to structural selling.

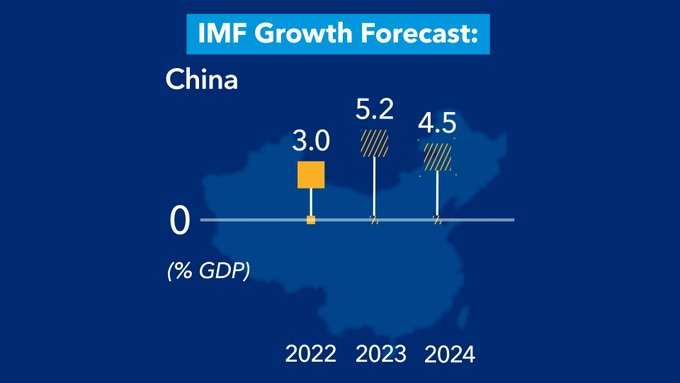

According to IMF forecasts, China’s GDP growth rate will decline sharply from now on.

https://hisayoshi-katsumata-worldview.com/archives/33690954.html