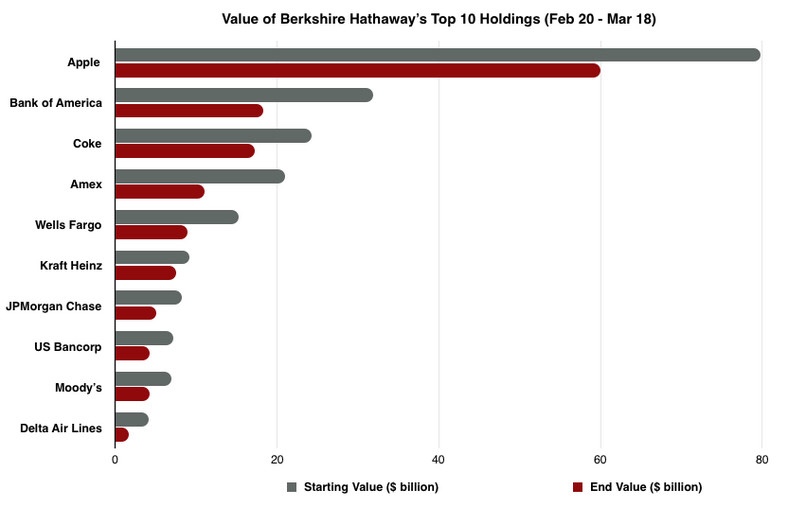

沃伦·巴菲特(Warren Buffett)的伯克希尔哈撒韦公司(Berkshire Hathaway)在其10大投资中可能遭受了700亿美元的冠状病毒损失

在冠状病毒驱动的市场抛售期间,沃伦·巴菲特(Warren Buffett)旗下的伯克希尔·哈撒韦公司(Berkshire Hathaway)可能损失了700亿美元,这是该公司持有的十大股票所致。

在2月20日至3月10日期间,伯克希尔在苹果,美国银行和其他蓝筹股中的持股价值平均下降了37%。

伯克希尔哈撒韦公司因苹果股价下跌而遭受了200亿美元的损失,而美国银行则遭受了140亿美元的损失。

表现最差的是达美航空,下跌58%,而卡夫亨氏的股票仅下跌14%。

Warren Buffett’s Berkshire Hathaway :

probably recorded about $70 billion in losses on its 10 biggest equity investments in the past month.

The coronavirus-fueled market sell-off decimated the value of its shares in Apple, Coca-Cola, Delta Air Lines, and other blue-chip companies.

The famed investor’s conglomerate saw its top 10 holdings suffer an average drop in share price of 37% between February 20 and the close of trading on March 18.

These figures assume Berkshire hasn’t tweaked its portfolio since disclosing it for the end of December.

Apple’s stock price:

tumbled about 23% in less than four weeks, slashing the value of Berkshire’s 5.6% stake in the iPhone maker by around $19 billion.

Bank of America’s :

stock plummeted 43% over the same period, wiping close to $14 billion off Berkshire’s investment in the lender.

Markets Insider