美國鋼鐵公司:工廠關閉/搬遷迫在眉睫

・因拜登決定拒絕收購,美國海軍無法重建

・如果收購失敗,美國就會被中國打敗。

我們為您帶來了勝俁恆在 World View 上發表的文章摘要。

Biden administration blocks acquisition:

On January 3, the Biden administration decided to block Nippon Steel’s acquisition of US Steel.

This will likely make it difficult for US Steel to restructure its business.

US stock market on January 3:

US Steel’s stock price temporarily fell by 8%.

1. With the acquisition not going through, US Steel’s steelworks closure and headquarters relocation will become a reality.

2. President Biden’s misjudgment will soon come into focus.

Nikkei Newspaper: January 4

US Steel’s steelworks closure and headquarters relocation have become a reality.

Both companies said, “We will take all measures to protect our legal rights.”

US Steel issues joint statement with Nippon Steel:

On the 3rd, when it was decided to block the acquisition by Nippon Steel, US Steel issued a joint statement with Nippon Steel.

US Steel has been cooperating with Nippon Steel and has consistently advocated for the legitimacy of the acquisition.

US Steel employees hold protest rallies:

Employees who support the acquisition have held frequent rallies at the headquarters and factories.

1. If the acquisition does not go through, there will be no additional investment, which will have a huge impact on the local economy and employment.

2. They strongly stated that if the acquisition fails, the United States will not be able to counter the threat from China and “will be defeated.”

US Steel’s worsening financial results:

There is limited room for US Steel to rebuild on its own.

1. On December 19th, the company announced that it expects its net profit for the October-December period to be in the red for the first time in four quarters.

2. In addition to the sluggish demand for steel for automobiles and falling prices, the cost of starting up an electric furnace plant is a heavy burden.

David Britt: (CEO)

If the acquisition does not go through, the closure of the Mon Valley Steel Works in Pennsylvania and the relocation of the headquarters will be inevitable.

1. Even if they decide to sue the US government, it will take time for a decision to be reached.

2. For US Steel, merging with Nippon Steel was the only remedy.

President Biden made a wrong decision without knowing these circumstances.

Cleveland-Cliffs’ ambitions:

US Steel lost the bid for US Steel to Nippon Steel, but it wants to acquire US Steel.

In the case of a Cliffs-US Steel merger:

It will have a nearly 100% share of the US blast furnace and automotive steel production, and is unlikely to be realized from the perspective of competition law.

1. Cleveland-Cliffs decided to acquire a major Canadian steel company in 2024.

2. Cliffs has little investment capacity, and posted a final deficit of $242 million in the July-September period of 2024.

US Steel is on the decline:

In 2023, US Steel’s crude steel production will be 15 million tons, one-third of Nippon Steel’s.

US Steel’s world ranking has dropped to 24th in 2023 from 13th ten years ago.

1. The US government protects jobs and production with protectionist policies such as tariffs.

2. US Steel is already a company that lives only on its past reputation.

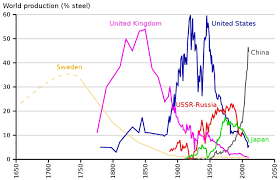

China’s crude steel production is the largest in the world:

In 2023, the US’s crude steel production will be 81.4 million tons, ranking third in the world.

1. Since 1980, the US has been overtaken by Japan in crude steel production by country, and by China in the 1990s.

2. Since 2000, China has been in the lead, accounting for 50% of the world’s production.

Nippon Steel’s acquisition proposal is to counter this threat from China.

US Steel CEO Britt:

On January 3, he issued a statement saying, “Blocking the acquisition will only please China’s Communist Party leadership.”

1. US Steel has emphasized that “cooperation with other countries is essential in terms of security.”

2. The decline of the US steel industry is the result of neglecting rationalization investments due to government protectionist policies.

President Biden’s “blocking the merger” is nothing but the “final blow” to bankrupt the US steel industry.

The future of the “Big River” electric furnace project:

The focus going forward will be on the “Big River” electric furnace project of a US Steel subsidiary.

It will produce electrical steel sheets with low carbon dioxide emissions in the southern state of Arkansas.

1. Nippon Steel may “consider the possibility of acquiring only the electric furnaces alone.”

2. US Steel’s electric furnace plants are not unionized, so there is little opposition.

Nippon Steel has shown a desire to invest in electric furnaces, which have a low environmental impact, in order to expand its business in the United States.

https://hisayoshi-katsumata-worldview.com/archives/37617797.html#google_vignette